- China

- /

- Medical Equipment

- /

- SZSE:300888

Uncovering 3 Stocks That Might Be Trading Below Fair Value

Reviewed by Simply Wall St

As global markets rally with the S&P 500 reaching record highs and optimism surrounding trade policies, investors are keenly watching for opportunities that might be trading below their intrinsic value. In this environment of heightened enthusiasm, identifying stocks that are potentially undervalued can offer a strategic advantage, especially when growth stocks have recently outperformed value shares.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Sichuan Injet Electric (SZSE:300820) | CN¥50.58 | CN¥100.77 | 49.8% |

| GlobalData (AIM:DATA) | £1.78 | £3.56 | 49.9% |

| Fudo Tetra (TSE:1813) | ¥2199.00 | ¥4346.13 | 49.4% |

| J Trust (TSE:8508) | ¥517.00 | ¥1040.17 | 50.3% |

| Bufab (OM:BUFAB) | SEK464.20 | SEK926.28 | 49.9% |

| Greenworks (Jiangsu) (SZSE:301260) | CN¥13.83 | CN¥27.64 | 50% |

| Allied Blenders and Distillers (NSEI:ABDL) | ₹394.40 | ₹787.12 | 49.9% |

| IDP Education (ASX:IEL) | A$13.34 | A$26.40 | 49.5% |

| Condor Energies (TSX:CDR) | CA$1.83 | CA$3.64 | 49.7% |

| Vista Group International (NZSE:VGL) | NZ$3.24 | NZ$6.16 | 47.4% |

We're going to check out a few of the best picks from our screener tool.

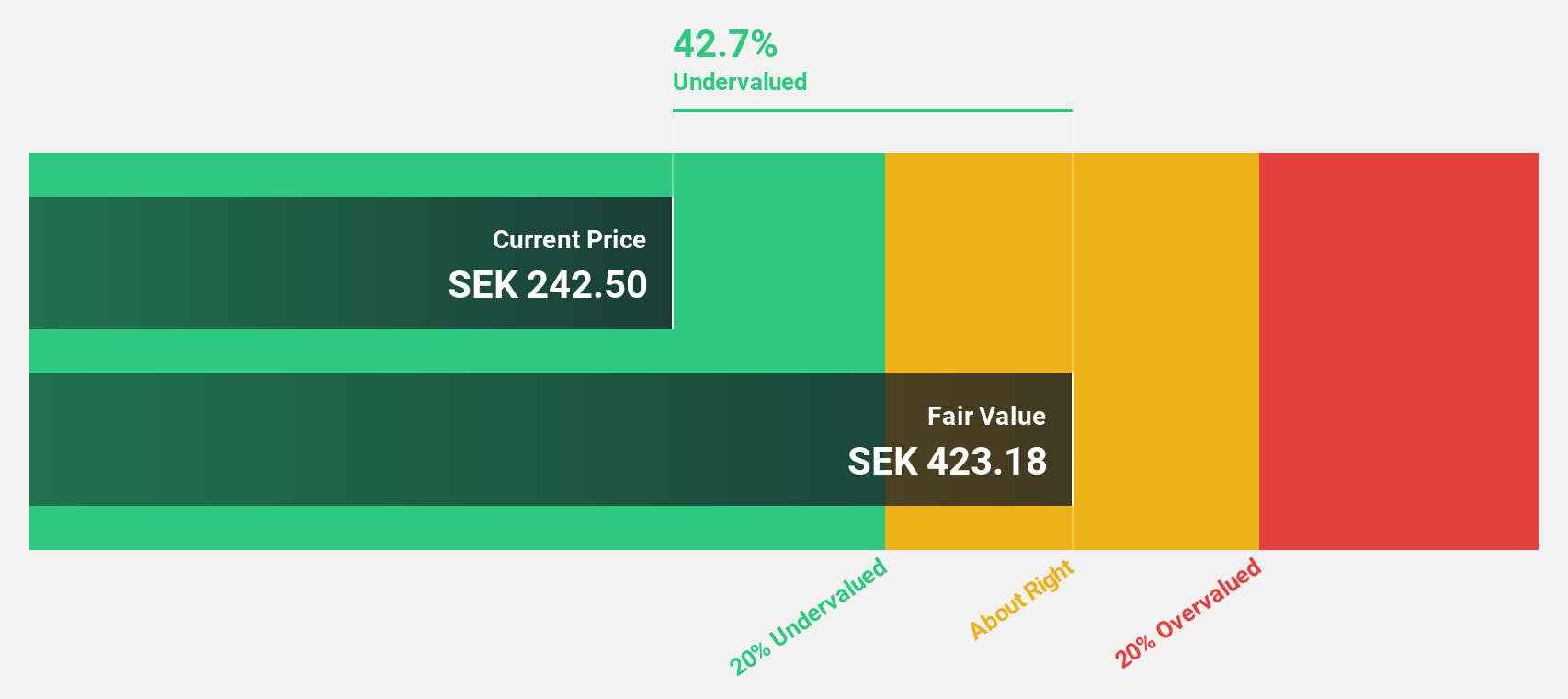

CTT Systems (OM:CTT)

Overview: CTT Systems AB (publ) designs, manufactures, and sells humidity control systems for aircraft across Sweden, Denmark, France, the United States, and internationally with a market cap of SEK3.52 billion.

Operations: The company's revenue is primarily derived from its Aerospace & Defense segment, totaling SEK301.40 million.

Estimated Discount To Fair Value: 15.3%

CTT Systems is trading at SEK284, below its estimated fair value of SEK335.26, reflecting a 15.3% discount. The company is positioned for robust growth with earnings expected to rise 33.3% annually, outpacing the Swedish market's 13.9%. Revenue is also forecast to increase significantly by 24.7% per year over the next three years, surpassing market expectations of 1.1%, indicating strong cash flow potential despite an unstable dividend history.

- The analysis detailed in our CTT Systems growth report hints at robust future financial performance.

- Click here and access our complete balance sheet health report to understand the dynamics of CTT Systems.

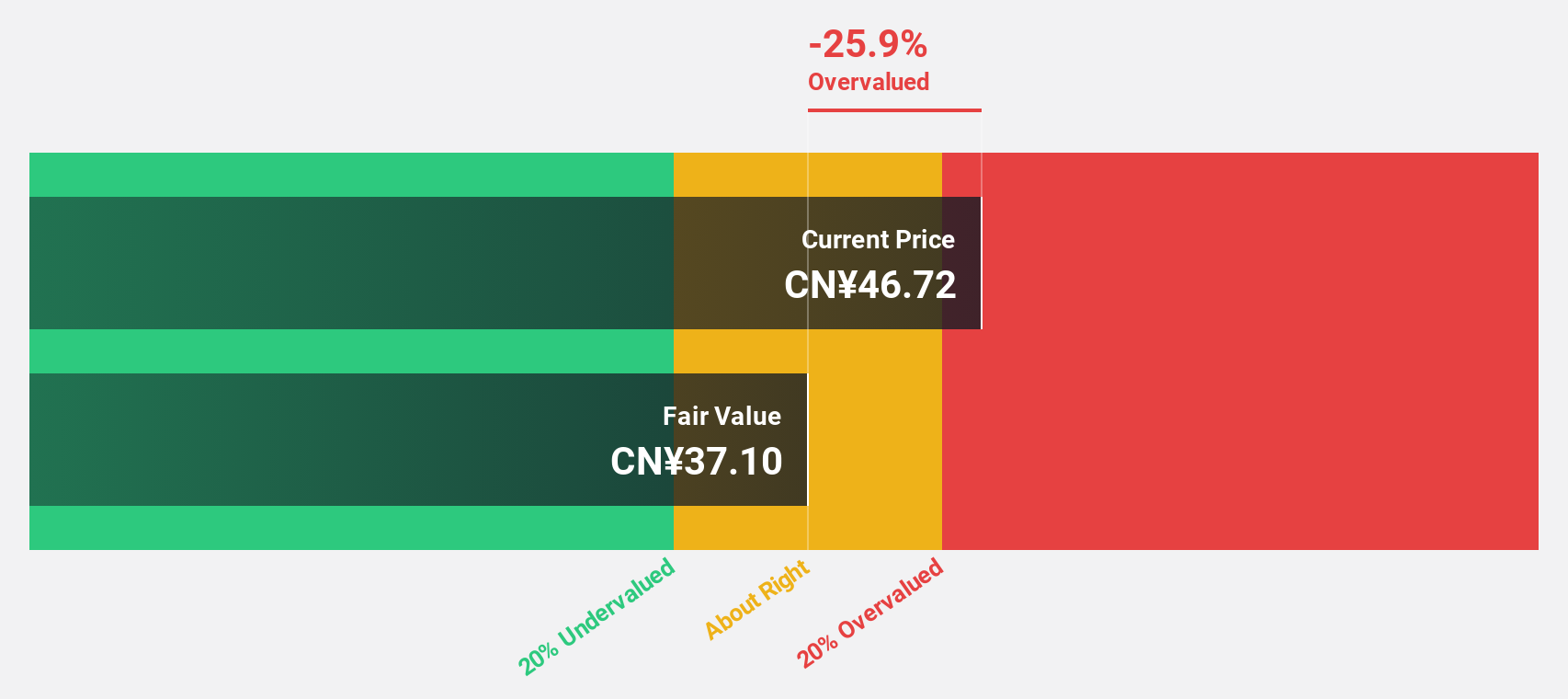

Winner Medical (SZSE:300888)

Overview: Winner Medical Co., Ltd. focuses on the R&D, manufacturing, and marketing of cotton-based medical dressings and disposables in China, with a market cap of CN¥23.59 billion.

Operations: Revenue Segments (in millions of CN¥):

Estimated Discount To Fair Value: 14.6%

Winner Medical, trading at CN¥40.51, is undervalued compared to its fair value of CN¥47.41. Despite a low future return on equity forecast of 8.7%, the company's earnings are expected to grow significantly at 72.55% annually and become profitable within three years, surpassing average market growth rates. Revenue growth is projected at 16.6% per year, outpacing the Chinese market's 13.3%, although its dividend yield of 1.97% lacks sufficient coverage by earnings or cash flows.

- Our earnings growth report unveils the potential for significant increases in Winner Medical's future results.

- Unlock comprehensive insights into our analysis of Winner Medical stock in this financial health report.

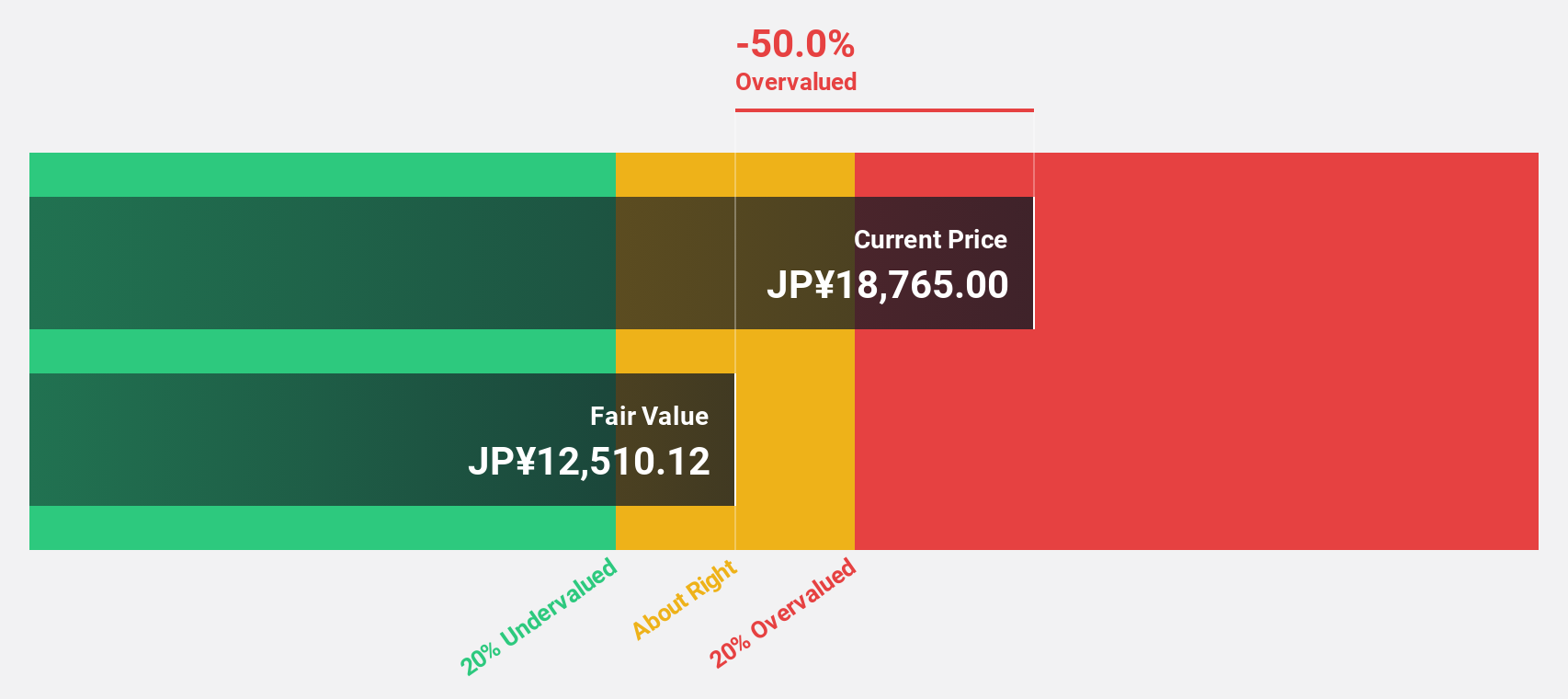

Lasertec (TSE:6920)

Overview: Lasertec Corporation designs, manufactures, and sells inspection and measurement equipment globally, with a market cap of ¥1.36 trillion.

Operations: The company's revenue from inspection and measurement equipment amounts to ¥202.94 billion.

Estimated Discount To Fair Value: 10.1%

Lasertec, currently priced at ¥15,505, trades below its estimated fair value of ¥17,239.6. The company's earnings are projected to grow at 12.38% annually, outpacing the Japanese market's average of 8%. However, its dividend yield of 1.86% is not adequately covered by free cash flows. Despite a volatile share price recently and high non-cash earnings levels, Lasertec's return on equity is expected to reach a robust 32.7% in three years.

- Our growth report here indicates Lasertec may be poised for an improving outlook.

- Dive into the specifics of Lasertec here with our thorough financial health report.

Next Steps

- Delve into our full catalog of 904 Undervalued Stocks Based On Cash Flows here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Winner Medical might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300888

Winner Medical

Engages in the research and development, manufacture, and marketing of cotton-based medical dressings and medical disposables, and consumer products in China.

Excellent balance sheet and good value.

Market Insights

Community Narratives