- Poland

- /

- Consumer Durables

- /

- WSE:ARH

European Stocks Estimated Below Fair Value In March 2025

Reviewed by Simply Wall St

As of late February 2025, the European stock market has shown resilience, with the pan-European STOXX Europe 600 Index marking its longest streak of weekly gains since August 2012. This positive momentum is supported by encouraging company results and gains in defense stocks, even amidst uncertainties surrounding U.S. trade policies and mixed inflation data across major European economies. In such an environment, identifying undervalued stocks can present opportunities for investors seeking to capitalize on potential discrepancies between current market prices and intrinsic values.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Micro Systemation (OM:MSAB B) | SEK55.40 | SEK108.15 | 48.8% |

| Laboratorios Farmaceuticos Rovi (BME:ROVI) | €54.60 | €107.22 | 49.1% |

| Vimi Fasteners (BIT:VIM) | €0.96 | €1.91 | 49.8% |

| Net Insight (OM:NETI B) | SEK4.82 | SEK9.39 | 48.6% |

| CD Projekt (WSE:CDR) | PLN221.00 | PLN441.00 | 49.9% |

| Tinexta (BIT:TNXT) | €7.83 | €15.45 | 49.3% |

| Storytel (OM:STORY B) | SEK92.60 | SEK179.62 | 48.4% |

| Canatu Oyj (HLSE:CANATU) | €12.40 | €24.73 | 49.9% |

| IONOS Group (XTRA:IOS) | €24.70 | €48.78 | 49.4% |

| Nordic Semiconductor (OB:NOD) | NOK137.55 | NOK266.28 | 48.3% |

Here's a peek at a few of the choices from the screener.

Absolent Air Care Group (OM:ABSO)

Overview: Absolent Air Care Group AB (publ) specializes in designing, developing, selling, installing, and maintaining air filtration units and has a market cap of SEK3.19 billion.

Operations: The company's revenue is primarily derived from its Industrial segment, which accounts for SEK1157.16 million, and its Commercial Kitchen segment, contributing SEK243.11 million.

Estimated Discount To Fair Value: 46%

Absolent Air Care Group is trading at SEK282, significantly below its estimated fair value of SEK521.83, indicating it may be undervalued based on cash flows. Despite modest past earnings growth of 2.6%, future earnings are expected to grow significantly at 23.24% annually, outpacing the Swedish market's forecasted growth rate of 9.5%. Recent financial results show stable sales and net income figures, while leadership transitions are underway with an interim CEO appointed until June 2025.

- Our comprehensive growth report raises the possibility that Absolent Air Care Group is poised for substantial financial growth.

- Click to explore a detailed breakdown of our findings in Absolent Air Care Group's balance sheet health report.

CTT Systems (OM:CTT)

Overview: CTT Systems AB (publ) designs, manufactures, and sells humidity control systems for aircraft in Sweden, Denmark, France, the United States, and internationally with a market cap of SEK2.92 billion.

Operations: The company generates revenue of SEK302.30 million from its Aerospace & Defense segment, focusing on humidity control systems for aircraft across various regions.

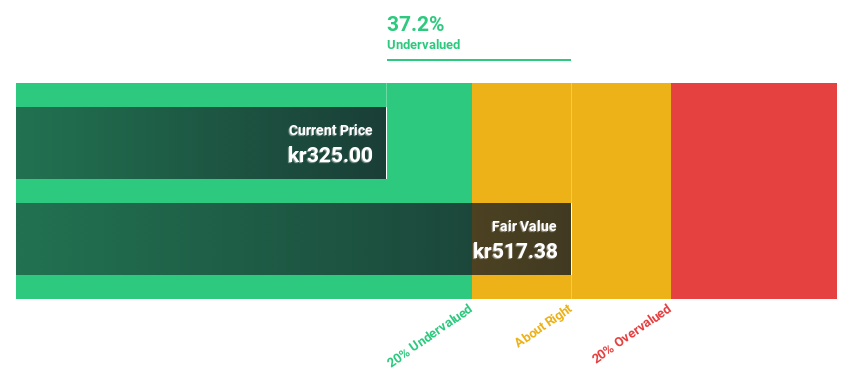

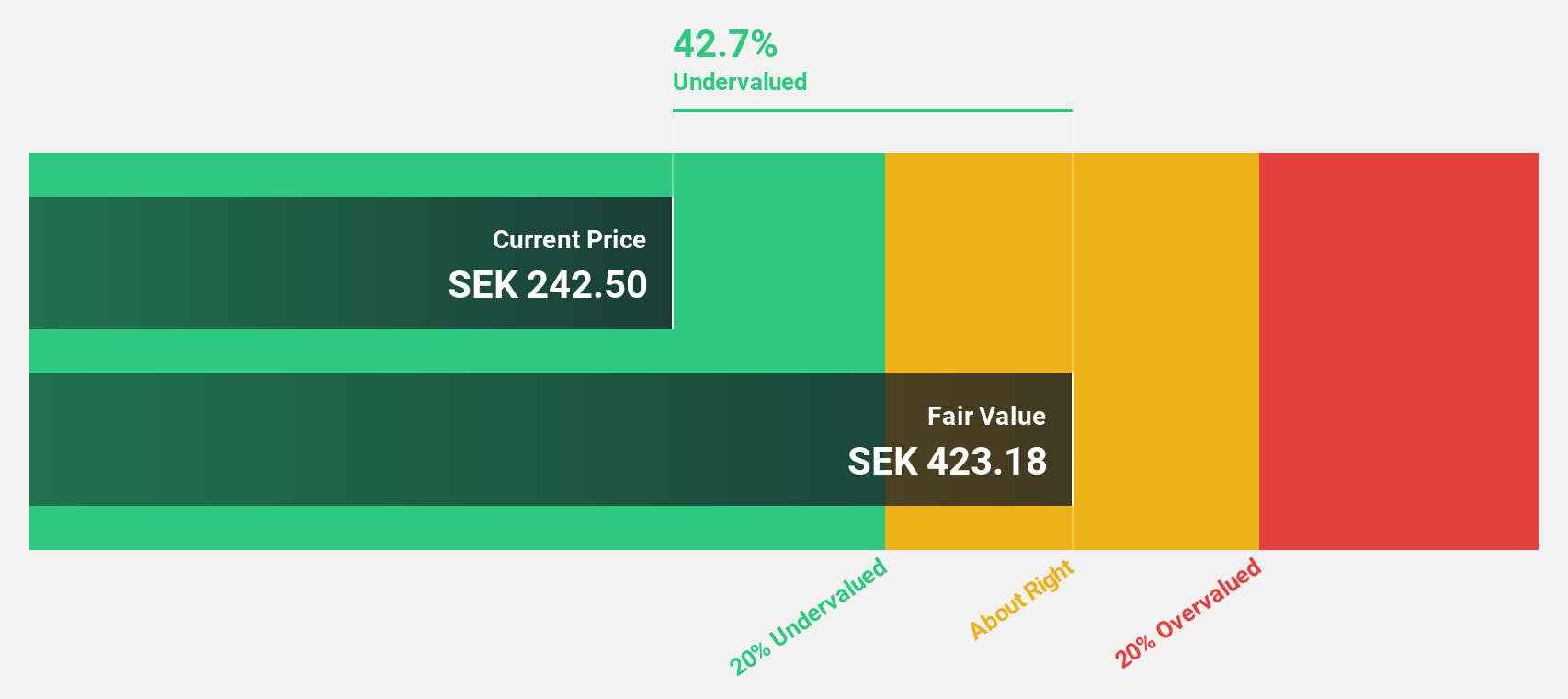

Estimated Discount To Fair Value: 45.7%

CTT Systems is trading at SEK233, significantly below its estimated fair value of SEK428.91, highlighting potential undervaluation based on cash flows. Despite a slight dip in recent net income to SEK 24.1 million, earnings are projected to grow at 25.9% annually over the next three years, surpassing Swedish market expectations. A recent order for anti-condensation systems valued at approximately SEK 120 million underscores future revenue potential despite current dividends being inadequately covered by free cash flows.

- The growth report we've compiled suggests that CTT Systems' future prospects could be on the up.

- Navigate through the intricacies of CTT Systems with our comprehensive financial health report here.

Archicom (WSE:ARH)

Overview: Archicom S.A. operates in the real estate sector in Poland, with a market capitalization of PLN2.12 billion.

Operations: Archicom S.A. generates its revenue from real estate activities in Poland.

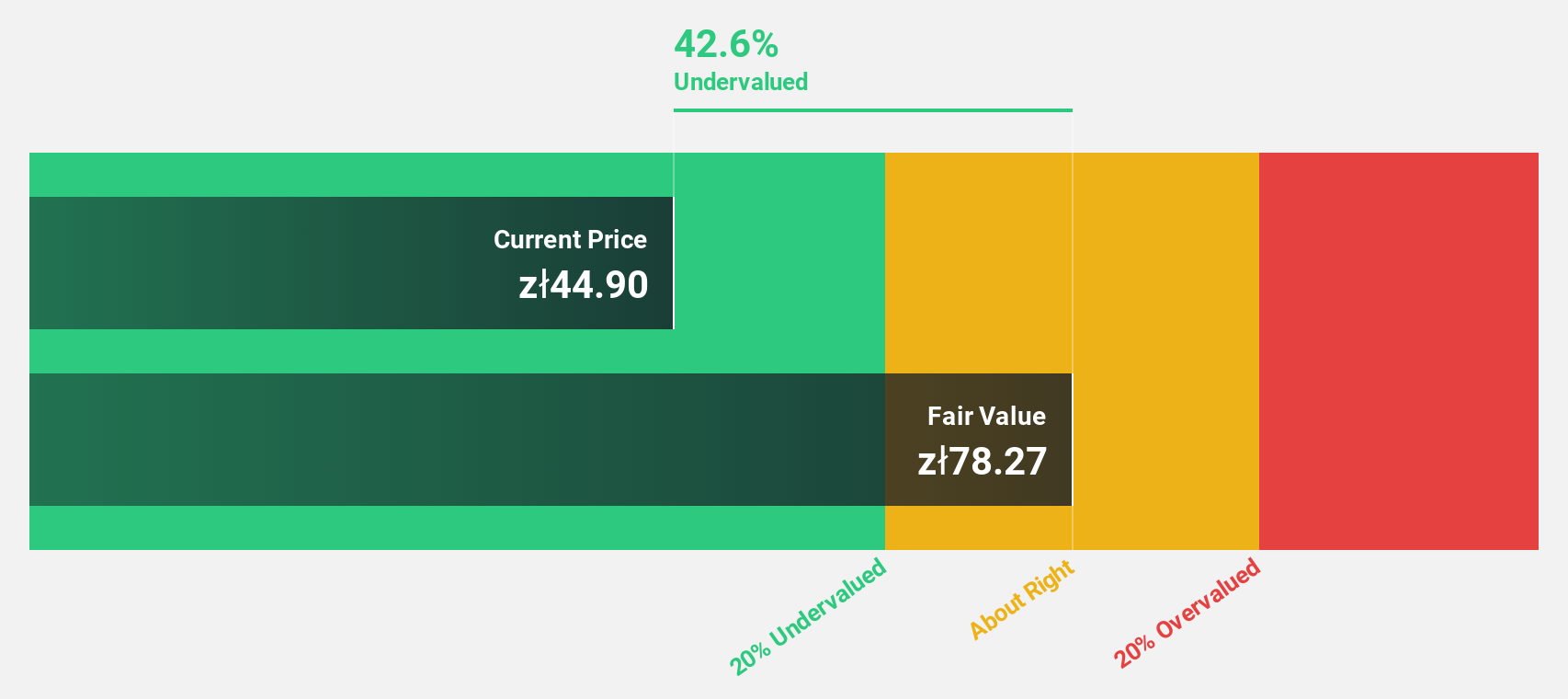

Estimated Discount To Fair Value: 30.7%

Archicom is trading at PLN36.2, well below its estimated fair value of PLN52.23, suggesting undervaluation based on cash flows. Despite earnings growing by 175.8% last year and a forecasted annual growth rate of 26.3%, debt coverage by operating cash flow remains inadequate. The dividend yield of 5.66% isn't supported by free cash flows, though the company's return on equity is expected to be high in three years at 25%.

- Upon reviewing our latest growth report, Archicom's projected financial performance appears quite optimistic.

- Click here to discover the nuances of Archicom with our detailed financial health report.

Seize The Opportunity

- Dive into all 205 of the Undervalued European Stocks Based On Cash Flows we have identified here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About WSE:ARH

High growth potential and good value.

Market Insights

Community Narratives