- Switzerland

- /

- Biotech

- /

- SWX:KURN

European Growth Companies With High Insider Ownership

Reviewed by Simply Wall St

As the pan-European STOXX Europe 600 Index and major single-country stock indexes continue to rise, investors are keeping a close eye on inflation trends that suggest eurozone inflation could remain near the European Central Bank's target. In this environment, growth companies with high insider ownership may capture attention due to their potential for aligning management interests with shareholder value, making them an intriguing focus for those navigating Europe's evolving market landscape.

Top 10 Growth Companies With High Insider Ownership In Europe

| Name | Insider Ownership | Earnings Growth |

| Pharma Mar (BME:PHM) | 12% | 41.5% |

| MilDef Group (OM:MILDEF) | 13.7% | 83% |

| MedinCell (ENXTPA:MEDCL) | 12.5% | 96.3% |

| KebNi (OM:KEBNI B) | 36.3% | 61.2% |

| Elliptic Laboratories (OB:ELABS) | 22.5% | 109.1% |

| DNO (OB:DNO) | 13.5% | 97.5% |

| CTT Systems (OM:CTT) | 17.5% | 52% |

| Circus (XTRA:CA1) | 24.1% | 65.8% |

| CD Projekt (WSE:CDR) | 29.7% | 52.1% |

| Bonesupport Holding (OM:BONEX) | 10.4% | 49.7% |

Let's dive into some prime choices out of the screener.

CTT Systems (OM:CTT)

Simply Wall St Growth Rating: ★★★★★★

Overview: CTT Systems AB (publ) specializes in providing humidity control systems for aircraft across Sweden, Denmark, France, the United States, and other international markets, with a market cap of SEK2.39 billion.

Operations: The company's revenue is primarily generated from its Aerospace & Defense segment, amounting to SEK291.20 million.

Insider Ownership: 17.5%

Return On Equity Forecast: 45% (2028 estimate)

CTT Systems demonstrates strong growth potential with its earnings forecast to grow significantly at 52% annually, outpacing the Swedish market. Revenue is also expected to increase by 25.2% per year, surpassing market averages. Despite a recent decline in net profit margins and a dividend not well covered by earnings, CTT trades at a substantial discount to its estimated fair value. Recent earnings show improved quarterly performance but decreased nine-month results compared to the previous year.

- Click here to discover the nuances of CTT Systems with our detailed analytical future growth report.

- Our valuation report here indicates CTT Systems may be overvalued.

Medicover (OM:MCOV B)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Medicover AB (publ) is a company that offers healthcare and diagnostic services in Poland, Sweden, and internationally, with a market cap of approximately SEK35.20 billion.

Operations: The company's revenue is primarily derived from Healthcare Services, generating €1.62 billion, and Diagnostic Services, contributing €732.10 million.

Insider Ownership: 11.2%

Return On Equity Forecast: 24% (2028 estimate)

Medicover exhibits strong growth prospects with earnings anticipated to grow significantly at 26.9% annually, outpacing the Swedish market. Revenue growth is also expected to surpass market averages. Recent earnings reports show substantial improvement, with third-quarter sales reaching €591.6 million and net income of €19.5 million, compared to a net loss last year. Insider activity remains positive with more shares bought than sold recently, although interest payments are not well covered by earnings.

- Navigate through the intricacies of Medicover with our comprehensive analyst estimates report here.

- Insights from our recent valuation report point to the potential overvaluation of Medicover shares in the market.

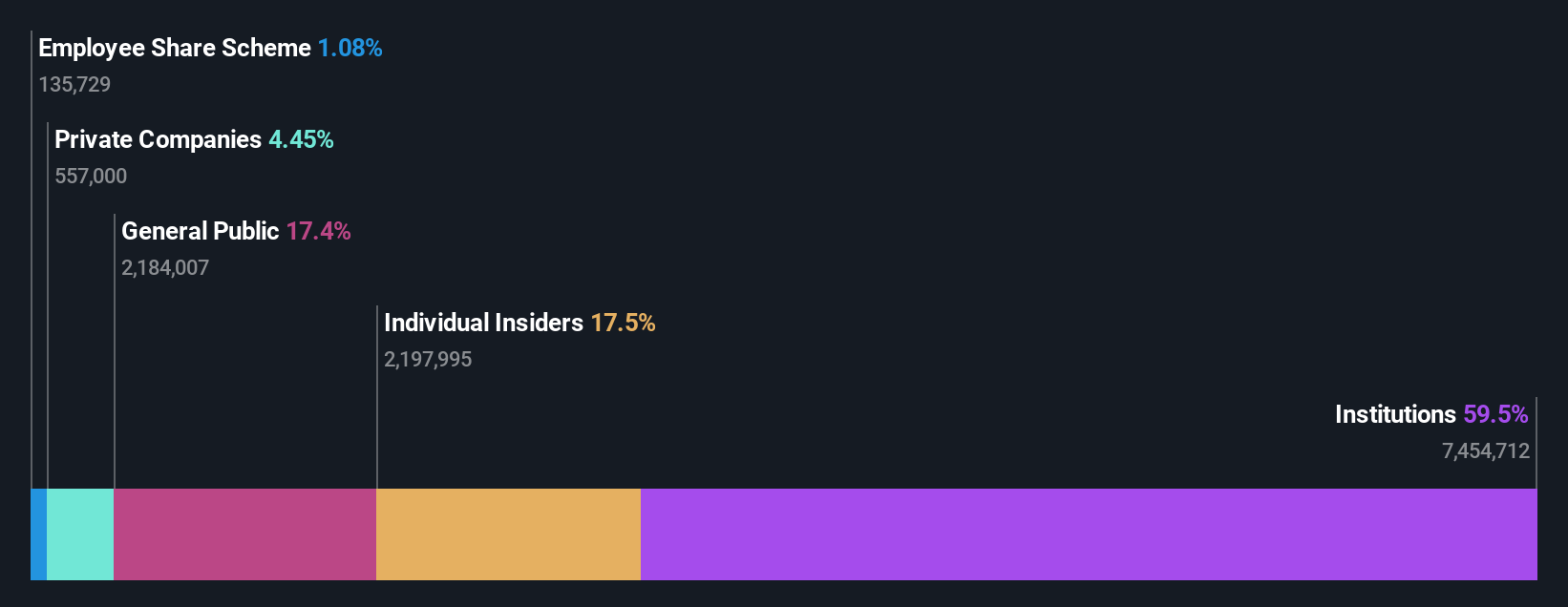

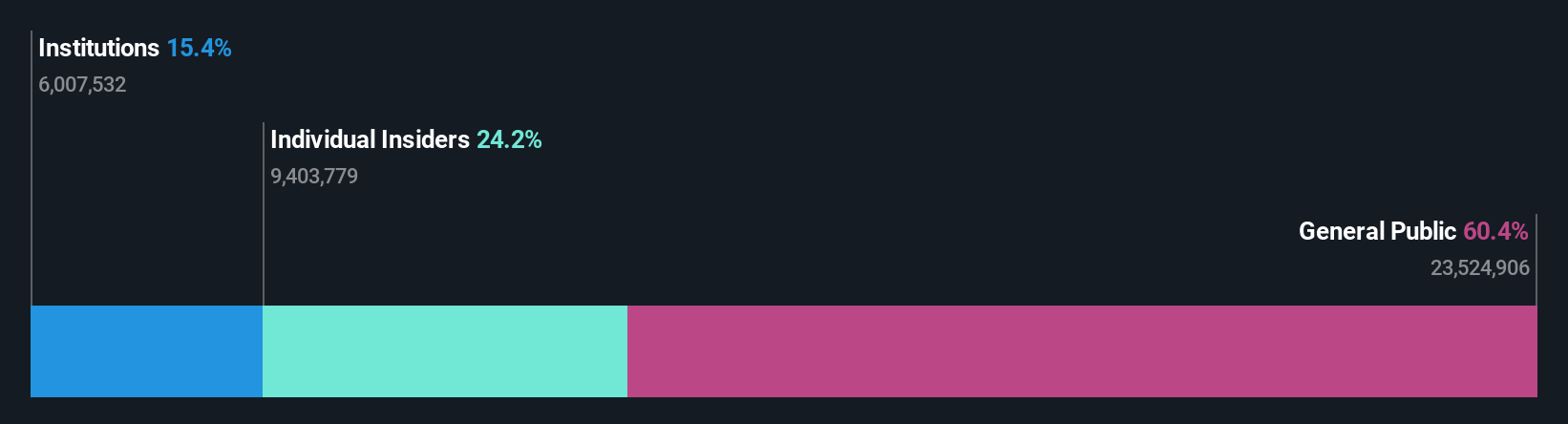

Kuros Biosciences (SWX:KURN)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Kuros Biosciences AG focuses on the commercialization and development of biologic technologies for musculoskeletal care across the United States, European Union, and other international markets, with a market cap of CHF1.22 billion.

Operations: The company's revenue is primarily derived from its Medical Devices segment, which generated CHF103.35 million.

Insider Ownership: 24%

Return On Equity Forecast: N/A (2028 estimate)

Kuros Biosciences is poised for significant growth, with revenue expected to increase by 24.5% annually, outpacing the Swiss market. The company recently raised its earnings guidance for 2025, anticipating at least 70% sales growth. Despite a highly volatile share price and no recent insider trading activity, Kuros is projected to become profitable within three years. Trading significantly below estimated fair value enhances its appeal as a potential investment opportunity in the biotech sector.

- Unlock comprehensive insights into our analysis of Kuros Biosciences stock in this growth report.

- In light of our recent valuation report, it seems possible that Kuros Biosciences is trading beyond its estimated value.

Turning Ideas Into Actions

- Navigate through the entire inventory of 205 Fast Growing European Companies With High Insider Ownership here.

- Want To Explore Some Alternatives? This technology could replace computers: discover the 27 stocks are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Kuros Biosciences might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:KURN

Kuros Biosciences

Engages in the commercialization and development of biologic technologies for musculoskeletal care in the United States of America, the European Union, and internationally.

High growth potential with excellent balance sheet.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026