We can readily understand why investors are attracted to unprofitable companies. For example, although Amazon.com made losses for many years after listing, if you had bought and held the shares since 1999, you would have made a fortune. But while the successes are well known, investors should not ignore the very many unprofitable companies that simply burn through all their cash and collapse.

So should Climeon (STO:CLIME B) shareholders be worried about its cash burn? For the purposes of this article, cash burn is the annual rate at which an unprofitable company spends cash to fund its growth; its negative free cash flow. The first step is to compare its cash burn with its cash reserves, to give us its 'cash runway'.

See our latest analysis for Climeon

Does Climeon Have A Long Cash Runway?

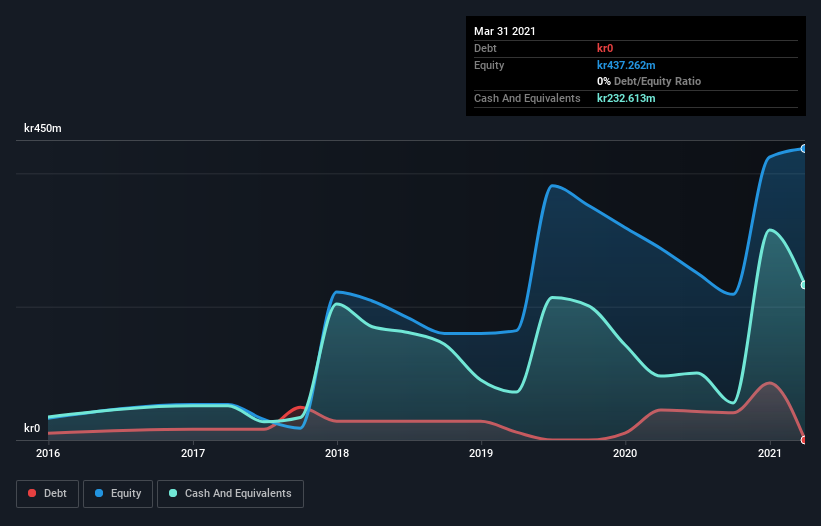

You can calculate a company's cash runway by dividing the amount of cash it has by the rate at which it is spending that cash. Climeon has such a small amount of debt that we'll set it aside, and focus on the kr233m in cash it held at March 2021. Importantly, its cash burn was kr167m over the trailing twelve months. Therefore, from March 2021 it had roughly 17 months of cash runway. Importantly, the one analyst we see covering the stock thinks that Climeon will reach cashflow breakeven in around 19 months. That means it doesn't have a great deal of breathing room, but it shouldn't really need more cash, considering that cash burn should be continually reducing. The image below shows how its cash balance has been changing over the last few years.

How Well Is Climeon Growing?

It was fairly positive to see that Climeon reduced its cash burn by 21% during the last year. But the revenue dip of 46% in the same period was a bit concerning. Considering both these metrics, we're a little concerned about how the company is developing. Clearly, however, the crucial factor is whether the company will grow its business going forward. For that reason, it makes a lot of sense to take a look at our analyst forecasts for the company.

How Hard Would It Be For Climeon To Raise More Cash For Growth?

Climeon seems to be in a fairly good position, in terms of cash burn, but we still think it's worthwhile considering how easily it could raise more money if it wanted to. Generally speaking, a listed business can raise new cash through issuing shares or taking on debt. Commonly, a business will sell new shares in itself to raise cash and drive growth. We can compare a company's cash burn to its market capitalisation to get a sense for how many new shares a company would have to issue to fund one year's operations.

Since it has a market capitalisation of kr2.1b, Climeon's kr167m in cash burn equates to about 8.1% of its market value. Given that is a rather small percentage, it would probably be really easy for the company to fund another year's growth by issuing some new shares to investors, or even by taking out a loan.

So, Should We Worry About Climeon's Cash Burn?

As you can probably tell by now, we're not too worried about Climeon's cash burn. For example, we think its cash burn relative to its market cap suggests that the company is on a good path. While we must concede that its falling revenue is a bit worrying, the other factors mentioned in this article provide great comfort when it comes to the cash burn. There's no doubt that shareholders can take a lot of heart from the fact that at least one analyst is forecasting it will reach breakeven before too long. Based on the factors mentioned in this article, we think its cash burn situation warrants some attention from shareholders, but we don't think they should be worried. Its important for readers to be cognizant of the risks that can affect the company's operations, and we've picked out 2 warning signs for Climeon that investors should know when investing in the stock.

Of course Climeon may not be the best stock to buy. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

When trading Climeon or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

If you're looking to trade Climeon, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About OM:CLIME B

Moderate with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives