- Sweden

- /

- Trade Distributors

- /

- OM:BUFAB

What Bufab (OM:BUFAB)'s Digital Procurement Deal With Babcock Means For Shareholders

Reviewed by Sasha Jovanovic

- Bufab recently announced it signed a framework agreement to supply fasteners and associated C-parts to Babcock International Group, giving Babcock access to Bufab’s digital procurement solutions aimed at streamlining operations.

- This collaboration highlights Bufab’s growing role in supplying critical components to the defence, aerospace, and security sector, supporting operational efficiency through digital innovation.

- We’ll explore how Bufab’s partnership with Babcock and its emphasis on digital integration could influence the company’s investment prospects.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 32 best rare earth metal stocks of the very few that mine this essential strategic resource.

Bufab Investment Narrative Recap

To be a shareholder in Bufab, one needs to believe in its ability to drive sustained growth via operational efficiency, digital integration, and expansion in high-value sectors like defence and aerospace. The new Babcock partnership boosts Bufab’s position in these sectors and supports its digital push, but does not materially alter the most important short-term catalyst: growth in Asia Pacific and ongoing margin improvements. The biggest risk remains sensitivity to regional market conditions, particularly in Europe and the Americas, where uncertainty and weak demand persist.

Of recent announcements, the appointment of Marcus Söderberg as Chief Financial Officer, effective March 2026, stands out. While this change is not directly linked to the Babcock agreement, effective financial leadership is vital as Bufab consolidates new partnerships and seeks to capitalize on efficiency gains in the fast-evolving industrial distribution market.

Yet in contrast, investors should still keep a close watch on how ongoing volatility in key markets could...

Read the full narrative on Bufab (it's free!)

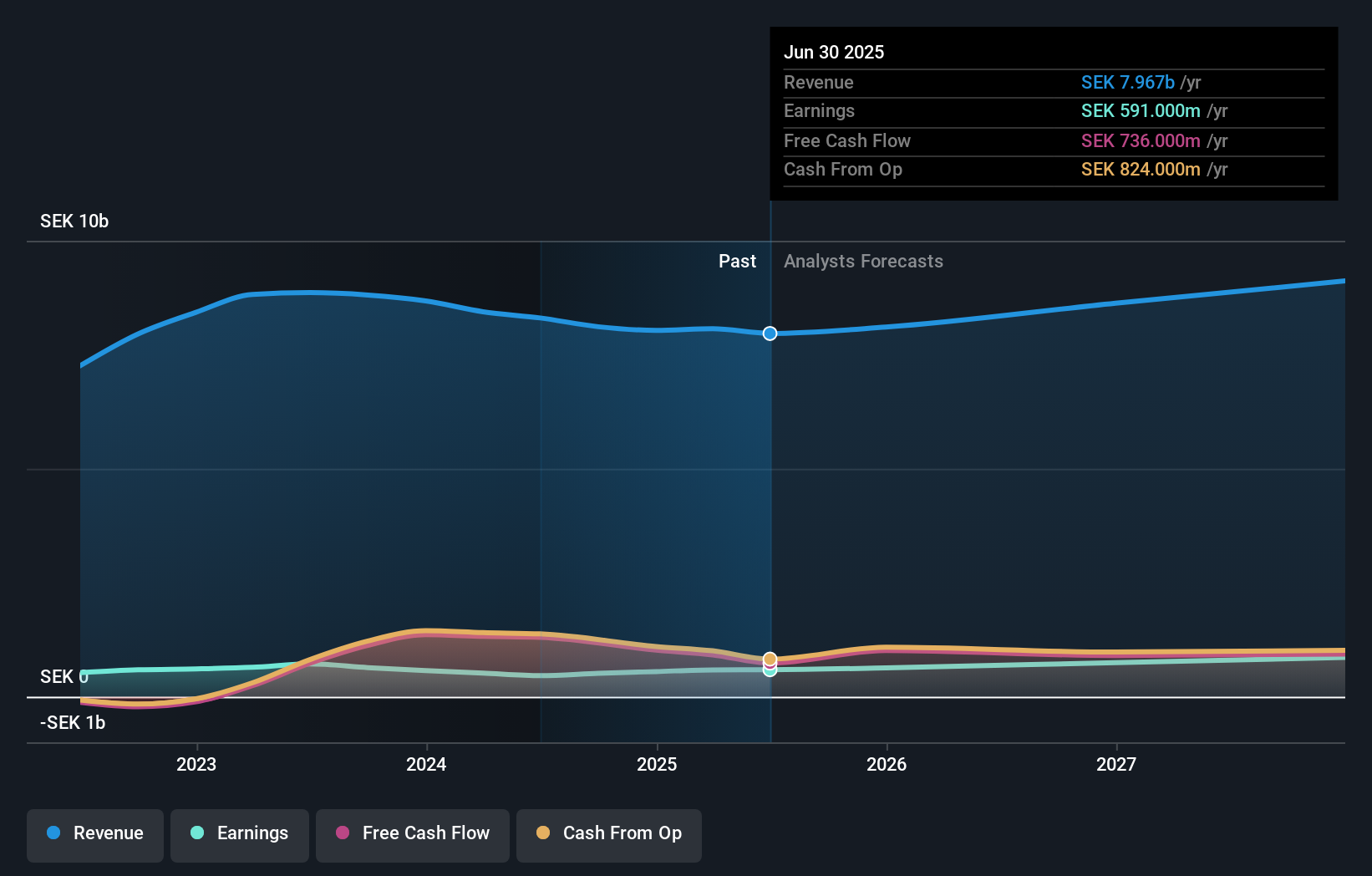

Bufab's narrative projects SEK 9.4 billion revenue and SEK 928.2 million earnings by 2028. This requires 5.8% yearly revenue growth and a SEK 337.2 million earnings increase from SEK 591.0 million today.

Uncover how Bufab's forecasts yield a SEK104.50 fair value, a 16% upside to its current price.

Exploring Other Perspectives

Two Simply Wall St Community valuations place Bufab’s fair value between SEK104.50 and SEK531.11. While optimism about digital growth is gathering interest, regional market risk remains a key theme you should consider.

Explore 2 other fair value estimates on Bufab - why the stock might be worth just SEK104.50!

Build Your Own Bufab Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Bufab research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Bufab research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Bufab's overall financial health at a glance.

Searching For A Fresh Perspective?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bufab might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:BUFAB

Bufab

A trading company, provides solutions for procurement, quality assurance, and logistics for c-parts and technical components in Sweden, Denmark, the United States, the United Kingdom, and internationally.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives