- Sweden

- /

- Trade Distributors

- /

- OM:BUFAB

Undervalued Small Caps With Insider Activity To Watch In November 2024

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by mixed earnings reports and economic uncertainties, small-cap stocks have shown resilience, holding up better than their large-cap counterparts amid recent market fluctuations. With the S&P 600 SmallCap Index reflecting this trend, investors are increasingly focused on identifying opportunities within this segment that might be poised for growth. In such an environment, evaluating stocks with notable insider activity can provide valuable insights into potential undervaluation and future performance prospects.

Top 10 Undervalued Small Caps With Insider Buying

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Paradeep Phosphates | 25.4x | 0.8x | 25.28% | ★★★★★☆ |

| Maharashtra Seamless | 10.0x | 1.7x | 35.07% | ★★★★★☆ |

| Genus | 159.7x | 1.9x | 18.80% | ★★★★★☆ |

| NCL Industries | 12.7x | 0.5x | -38.26% | ★★★☆☆☆ |

| Douglas Dynamics | 10.9x | 1.1x | -18.03% | ★★★☆☆☆ |

| Semen Indonesia (Persero) | 21.0x | 0.7x | 29.32% | ★★★☆☆☆ |

| L.G. Balakrishnan & Bros | 14.5x | 1.7x | -45.01% | ★★★☆☆☆ |

| Orion Group Holdings | NA | 0.4x | -212.54% | ★★★☆☆☆ |

| Community West Bancshares | 18.7x | 2.9x | 42.25% | ★★★☆☆☆ |

| Bajel Projects | 254.2x | 2.0x | 27.92% | ★★★☆☆☆ |

Let's take a closer look at a couple of our picks from the screened companies.

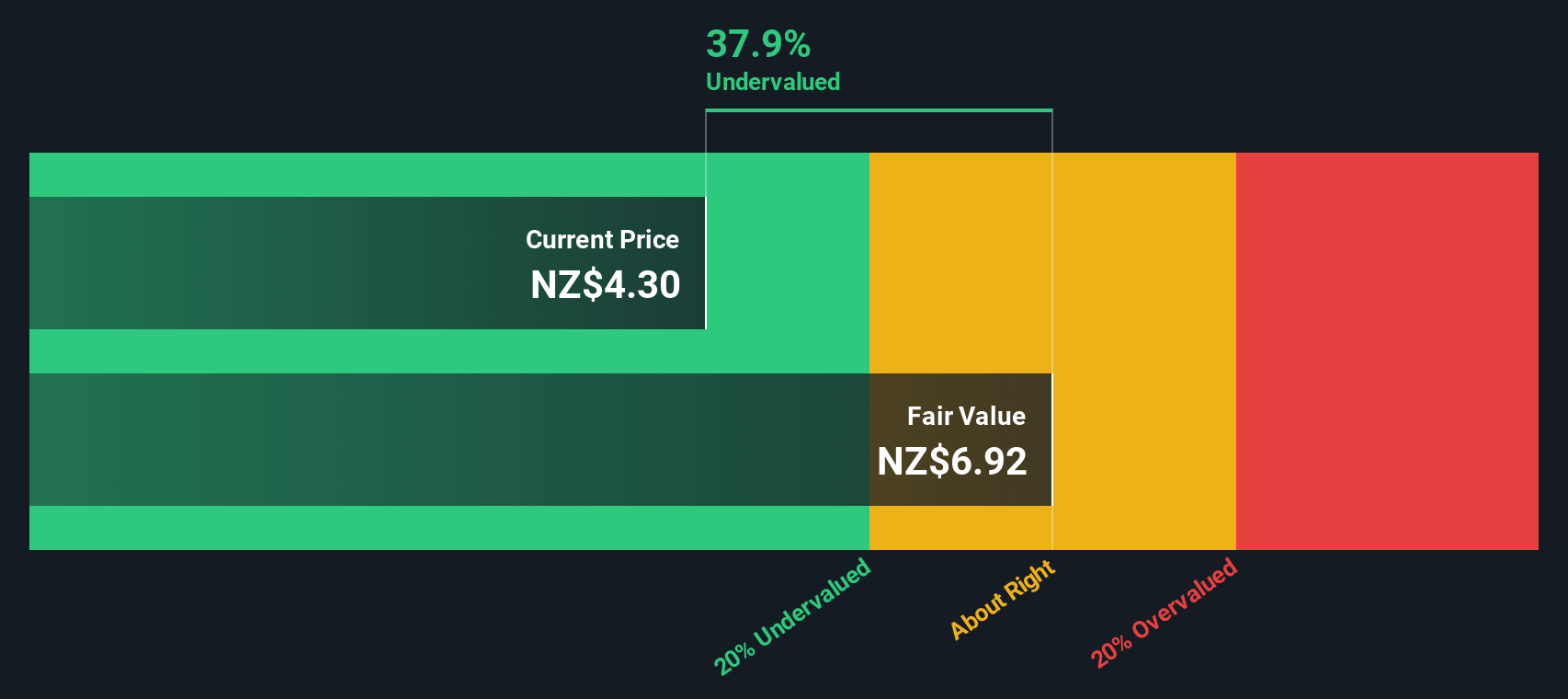

Delegat Group (NZSE:DGL)

Simply Wall St Value Rating: ★★★★★☆

Overview: Delegat Group is a wine production company with operations spanning New Zealand, the USA, Europe, and Australia, and it has a market capitalization of NZ$1.54 billion.

Operations: Delegat Group generates revenue primarily through Delegat Limited, contributing significantly alongside Delegat USA and Delegat Europe. The company has seen a notable decline in its gross profit margin, falling from 57.31% in December 2015 to 39.61% by June 2024. Operating expenses have increased over time, with sales and marketing being a substantial component of these costs.

PE: 16.7x

Delegat Group, a smaller player in the wine industry, recently confirmed a fully imputed dividend of NZ$0.20 per share, maintaining its decade-long dividend streak. Despite facing challenges with net income dropping to NZ$31.38 million from last year's NZ$64.83 million and profit margins narrowing to 8.3%, insider confidence is evident through recent share purchases. The company projects global sales of 3,585,000 cases for 2025 and expects operating net profit after tax between NZ$55 million and NZ$60 million, indicating potential growth amidst financial restructuring efforts.

- Navigate through the intricacies of Delegat Group with our comprehensive valuation report here.

Review our historical performance report to gain insights into Delegat Group's's past performance.

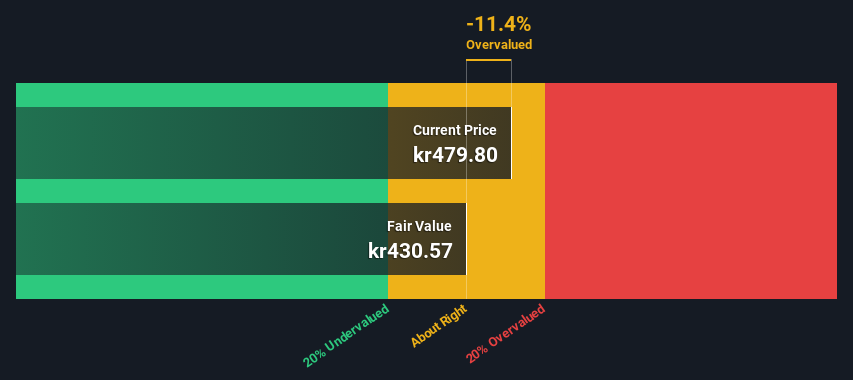

Bufab (OM:BUFAB)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Bufab is a Swedish company that specializes in the supply chain solutions and distribution of components and fasteners, with a market capitalization of approximately SEK 8.75 billion.

Operations: Bufab's revenue streams are primarily driven by its sales, with a gross profit margin reaching 29.66% as of September 30, 2024. The company incurs significant costs in cost of goods sold (COGS) and operating expenses, including sales and marketing and general administrative expenses.

PE: 29.4x

Bufab, a smaller company in the industrial sector, shows potential for investors seeking undervalued opportunities. Despite facing high external debt risks, its earnings are projected to grow by 13.35% annually. Recent insider confidence is evident as Bertil Persson purchased 2,500 shares valued at approximately SEK 1.08 million in October 2024. The latest earnings report highlights a rise in Q3 net income to SEK 146 million from SEK 98 million the previous year, indicating improving profitability despite declining sales figures.

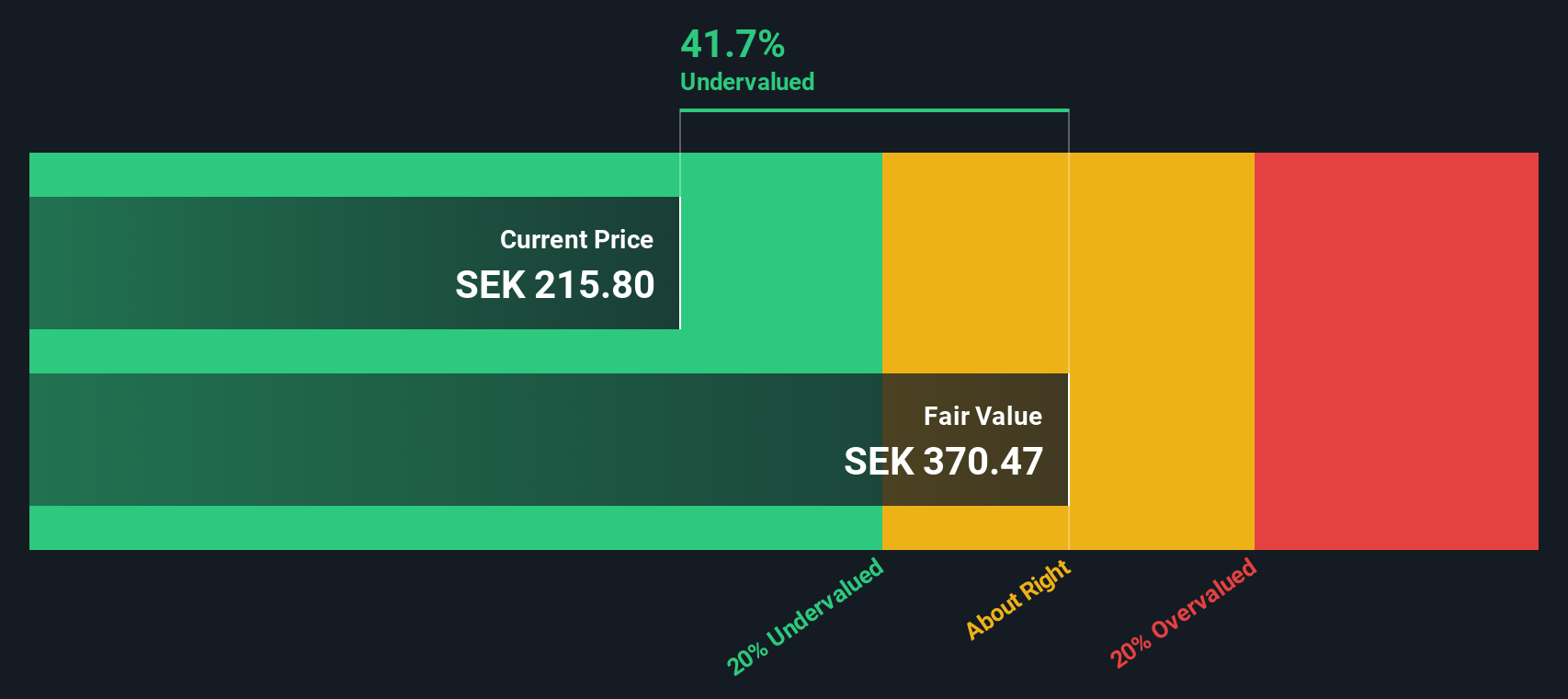

Lindab International (OM:LIAB)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Lindab International is a company specializing in the development, production, and distribution of ventilation and building products, with a market capitalization of SEK 15.23 billion.

Operations: The company generates revenue primarily from its Profile Systems and Ventilation Systems segments, with the latter contributing significantly more. Over recent periods, the gross profit margin has shown fluctuations, reaching 27.81% by September 2024. Operating expenses have been increasing steadily, impacting net income margins which stood at 5.10% in the same period.

PE: 25.8x

Lindab, a company known for its building and ventilation products, is navigating a challenging landscape with strategic moves like closing its Czech Profile Systems operation to boost profitability. Despite a dip in Q3 net income to SEK 158 million from SEK 239 million last year, sales rose slightly. Insider confidence is evident as the Chairman of the Board purchased 7,400 shares worth approximately SEK 1.8 million in October. While reliant on external funding, Lindab's earnings are projected to grow by nearly 30% annually.

- Click here and access our complete valuation analysis report to understand the dynamics of Lindab International.

Assess Lindab International's past performance with our detailed historical performance reports.

Turning Ideas Into Actions

- Click this link to deep-dive into the 173 companies within our Undervalued Small Caps With Insider Buying screener.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bufab might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:BUFAB

Bufab

A trading company, provides solutions for procurement, quality assurance, and logistics for c-parts and technical components in Sweden, Denmark, the United States, the United Kingdom, and internationally.

Excellent balance sheet with proven track record.

Market Insights

Community Narratives