- Sweden

- /

- Trade Distributors

- /

- OM:BUFAB

Bufab AB (publ)'s (STO:BUFAB) 26% Price Boost Is Out Of Tune With Earnings

Bufab AB (publ) (STO:BUFAB) shareholders are no doubt pleased to see that the share price has bounced 26% in the last month, although it is still struggling to make up recently lost ground. Taking a wider view, although not as strong as the last month, the full year gain of 17% is also fairly reasonable.

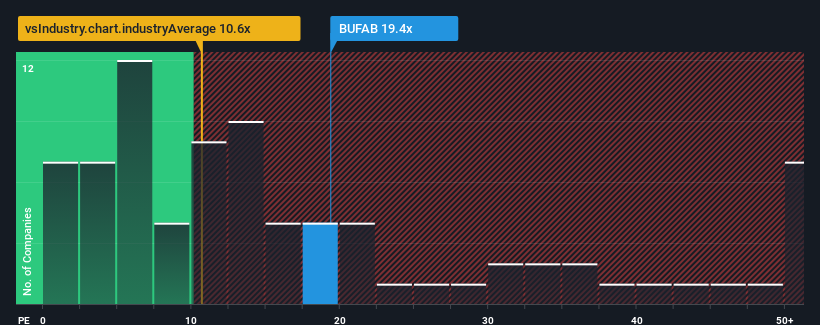

After such a large jump in price, Bufab may be sending bearish signals at the moment with its price-to-earnings (or "P/E") ratio of 27.5x, since almost half of all companies in Sweden have P/E ratios under 22x and even P/E's lower than 14x are not unusual. However, the P/E might be high for a reason and it requires further investigation to determine if it's justified.

Our free stock report includes 2 warning signs investors should be aware of before investing in Bufab. Read for free now.Bufab certainly has been doing a good job lately as it's been growing earnings more than most other companies. The P/E is probably high because investors think this strong earnings performance will continue. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Check out our latest analysis for Bufab

How Is Bufab's Growth Trending?

The only time you'd be truly comfortable seeing a P/E as high as Bufab's is when the company's growth is on track to outshine the market.

Retrospectively, the last year delivered a decent 13% gain to the company's bottom line. The latest three year period has also seen a 12% overall rise in EPS, aided somewhat by its short-term performance. So we can start by confirming that the company has actually done a good job of growing earnings over that time.

Turning to the outlook, the next three years should generate growth of 13% each year as estimated by the three analysts watching the company. That's shaping up to be materially lower than the 20% per annum growth forecast for the broader market.

In light of this, it's alarming that Bufab's P/E sits above the majority of other companies. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. There's a good chance these shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with the growth outlook.

The Final Word

Bufab shares have received a push in the right direction, but its P/E is elevated too. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Bufab currently trades on a much higher than expected P/E since its forecast growth is lower than the wider market. When we see a weak earnings outlook with slower than market growth, we suspect the share price is at risk of declining, sending the high P/E lower. Unless these conditions improve markedly, it's very challenging to accept these prices as being reasonable.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Bufab, and understanding them should be part of your investment process.

If you're unsure about the strength of Bufab's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Bufab might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:BUFAB

Bufab

A trading company, provides solutions for procurement, quality assurance, and logistics for c-parts and technical components in Sweden, Denmark, the United States, the United Kingdom, and internationally.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives