Beijer Ref AB (publ)'s (STO:BEIJ B) dividend will be increasing from last year's payment of the same period to SEK0.65 on 30th of April. Despite this raise, the dividend yield of 0.9% is only a modest boost to shareholder returns.

See our latest analysis for Beijer Ref

Beijer Ref's Earnings Easily Cover The Distributions

It would be nice for the yield to be higher, but we should also check if higher levels of dividend payment would be sustainable. However, prior to this announcement, Beijer Ref's dividend was comfortably covered by both cash flow and earnings. This means that most of what the business earns is being used to help it grow.

The next year is set to see EPS grow by 18.5%. If the dividend continues on this path, the payout ratio could be 22% by next year, which we think can be pretty sustainable going forward.

Dividend Volatility

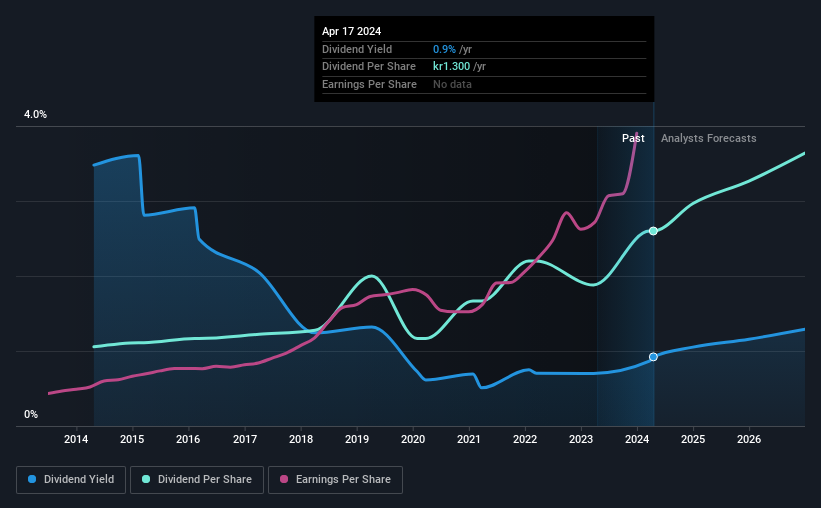

While the company has been paying a dividend for a long time, it has cut the dividend at least once in the last 10 years. The dividend has gone from an annual total of SEK0.528 in 2014 to the most recent total annual payment of SEK1.30. This means that it has been growing its distributions at 9.4% per annum over that time. A reasonable rate of dividend growth is good to see, but we're wary that the dividend history is not as solid as we'd like, having been cut at least once.

The Dividend Looks Likely To Grow

Growing earnings per share could be a mitigating factor when considering the past fluctuations in the dividend. Beijer Ref has impressed us by growing EPS at 18% per year over the past five years. Beijer Ref definitely has the potential to grow its dividend in the future with earnings on an uptrend and a low payout ratio.

Beijer Ref Looks Like A Great Dividend Stock

Overall, a dividend increase is always good, and we think that Beijer Ref is a strong income stock thanks to its track record and growing earnings. Distributions are quite easily covered by earnings, which are also being converted to cash flows. Taking this all into consideration, this looks like it could be a good dividend opportunity.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. Companies that are growing earnings tend to be the best dividend stocks over the long term. See what the 5 analysts we track are forecasting for Beijer Ref for free with public analyst estimates for the company. Is Beijer Ref not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

Valuation is complex, but we're here to simplify it.

Discover if Beijer Ref might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:BEIJ B

Beijer Ref

Provides refrigeration, air conditioning, and heating solutions worldwide.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives