It's only natural that many investors, especially those who are new to the game, prefer to buy shares in 'sexy' stocks with a good story, even if those businesses lose money. Unfortunately, high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson.

In contrast to all that, I prefer to spend time on companies like BE Group (STO:BEGR), which has not only revenues, but also profits. Even if the shares are fully valued today, most capitalists would recognize its profits as the demonstration of steady value generation. Loss-making companies are always racing against time to reach financial sustainability, but time is often a friend of the profitable company, especially if it is growing.

View our latest analysis for BE Group

How Quickly Is BE Group Increasing Earnings Per Share?

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS). That makes EPS growth an attractive quality for any company. Who among us would not applaud BE Group's stratospheric annual EPS growth of 57%, compound, over the last three years? While that sort of growth rate isn't sustainable for long, it certainly catches my attention; like a crow with a sparkly stone.

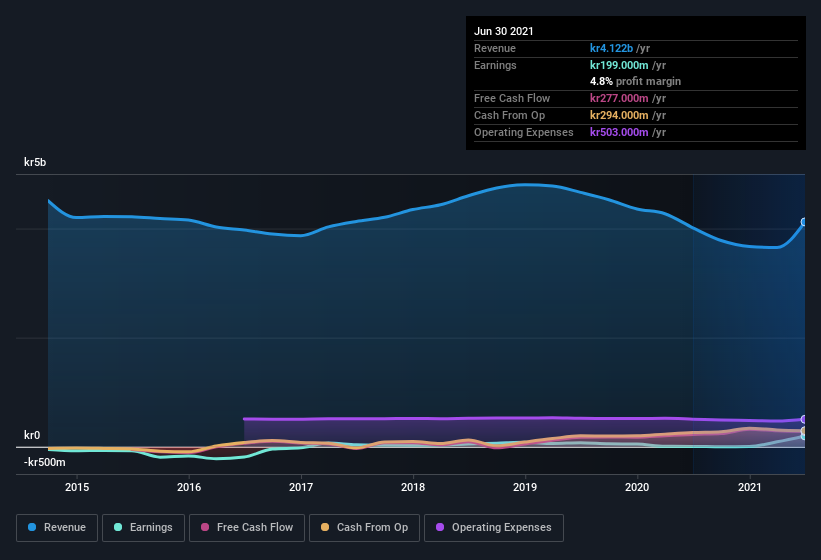

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. BE Group maintained stable EBIT margins over the last year, all while growing revenue 2.7% to kr4.1b. That's progress.

In the chart below, you can see how the company has grown earnings, and revenue, over time. For finer detail, click on the image.

Since BE Group is no giant, with a market capitalization of kr1.0b, so you should definitely check its cash and debt before getting too excited about its prospects.

Are BE Group Insiders Aligned With All Shareholders?

Like that fresh smell in the air when the rains are coming, insider buying fills me with optimistic anticipation. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

In the last twelve months BE Group insiders spent kr137k on stock; good news for shareholders. This might not be a huge sum, but it's well worth noting anyway, given the complete lack of selling.

On top of the insider buying, it's good to see that BE Group insiders have a valuable investment in the business. Indeed, they hold kr256m worth of its stock. That shows significant buy-in, and may indicate conviction in the business strategy. That amounts to 25% of the company, demonstrating a degree of high-level alignment with shareholders.

Does BE Group Deserve A Spot On Your Watchlist?

BE Group's earnings per share growth have been levitating higher, like a mountain goat scaling the Alps. What's more insiders own a significant stake in the company and have been buying more shares. This quick rundown suggests that the business may be of good quality, and also at an inflection point, so maybe BE Group deserves timely attention. Still, you should learn about the 2 warning signs we've spotted with BE Group .

As a growth investor I do like to see insider buying. But BE Group isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you’re looking to trade BE Group, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

If you're looking to trade BE Group, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if BE Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About OM:BEGR

BE Group

Operates as a trading and service company in steel, stainless steel, and aluminum products in Sweden, Poland, Finland, and Baltics.

Adequate balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives