Atlas Copco (OM:ATCO A) Valuation: Assessing Growth Potential as Saudi Healthcare Investments Accelerate

Reviewed by Kshitija Bhandaru

Atlas Copco (OM:ATCO A) could benefit as Saudi Arabia ramps up investments in healthcare infrastructure under Vision 2030. This move is fueling demand for advanced medical equipment and services across the region.

See our latest analysis for Atlas Copco.

The momentum in Atlas Copco's share price has picked up lately, with a 7% gain over the past month and a positive tone in the last week. However, its total shareholder return remains down 11% for the year. Still, the company’s long-term total returns tell a more resilient story, up roughly 77% over five years. This suggests that recent market caution could offer new opportunity for investors weighing the stock’s broader growth potential.

If you’re interested in what’s driving healthcare innovation and market shifts, take the next step and explore See the full list for free.

With robust long-term gains but shares still trading just below analyst targets, is Atlas Copco a bargain amid its healthcare tailwinds, or has the market already factored in its future growth prospects?

Most Popular Narrative: 0.4% Undervalued

Atlas Copco’s latest fair value estimate sits right above the recent closing price. This reflects optimism around industry innovation, margin strength, and global infrastructure expansion. Investor focus is on whether the company’s current performance narrative can fully justify its premium valuation.

Sustained investments in product innovation, including AI-driven efficiency in compressors and launches like the new GHS pump VSD+, position Atlas Copco to benefit from ongoing shifts toward automation, energy efficiency, and digitalization in industrial and infrastructure markets. This enhances long-term revenue growth and supports premium pricing power.

Want to know the hidden growth engine behind this price tag? The calculations rest on earnings power that could rival Scandinavia’s industrial giants. Find out what big assumptions drive the premium and what needs to click for Atlas Copco to keep earning its spot among top global players.

Result: Fair Value of $171.76 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent currency headwinds and hesitation in large industrial orders could derail Atlas Copco’s growth story if these trends worsen.

Find out about the key risks to this Atlas Copco narrative.

Another View: Market Ratios Send a Mixed Message

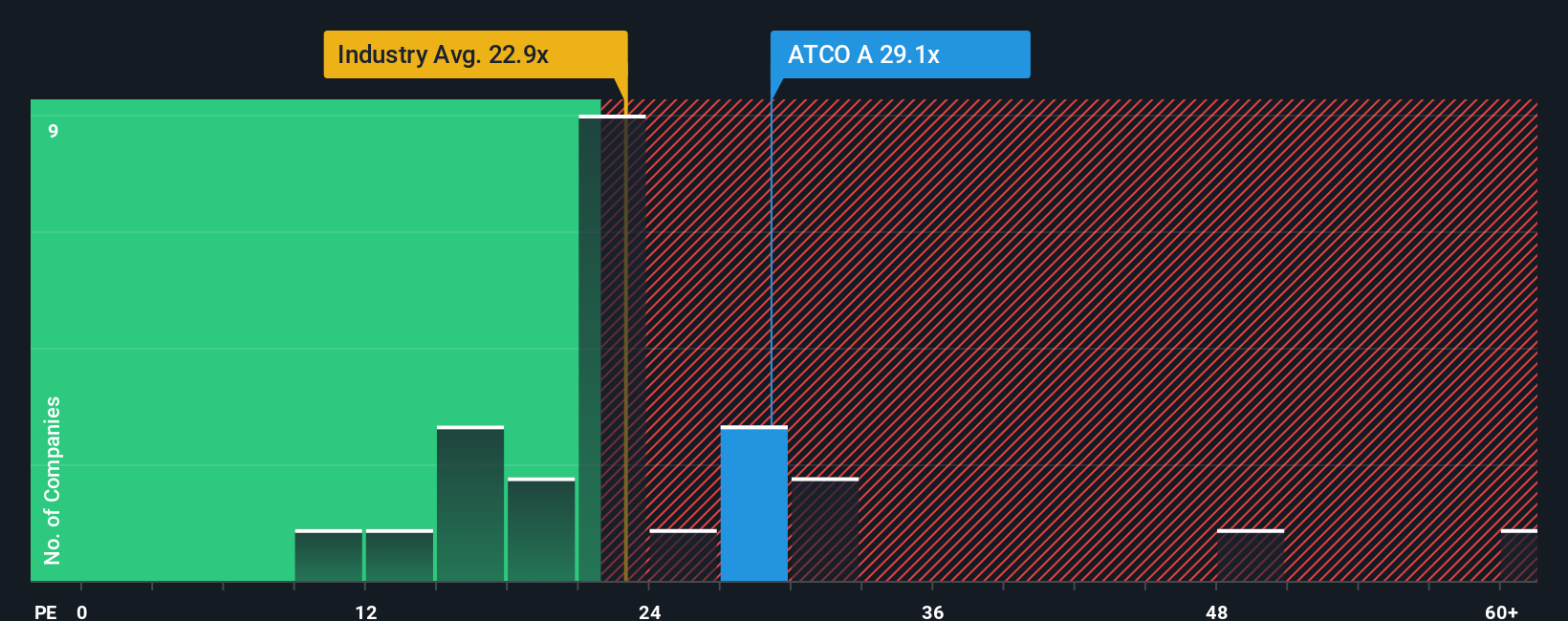

While analyst consensus points to Atlas Copco as slightly undervalued, looking at how shares trade against the broader industry tells another story. The company is priced at 29.6 times its earnings, well above both the Swedish Machinery industry average of 22.8x and the peer average of 24.8x. Its fair ratio is 29.9x, suggesting only a minor gap that could narrow quickly if market sentiment turns. This makes valuation risk and opportunity both real considerations.

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Atlas Copco for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Atlas Copco Narrative

If you see things differently or want hands-on insight, dive into the numbers yourself and shape a narrative in just a few quick steps with Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Atlas Copco.

Looking for more investment ideas?

Markets move fast, and having the right tools can help you stay a step ahead. Take action now and uncover unique opportunities you may be missing.

- Fuel your portfolio with the next generation of artificial intelligence leaders by starting your search among these 25 AI penny stocks.

- Capture dependable yields and potential income by checking out these 19 dividend stocks with yields > 3% offering attractive returns over 3%.

- Jump on stocks trading below their intrinsic value by exploring these 892 undervalued stocks based on cash flows, which are primed for strong cash flow growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:ATCO A

Atlas Copco

Provides compressed air and gas, vacuum, energy, dewatering and industrial pumps, industrial power tools, and assembly and machine vision solutions in North America, South America, Europe, Africa, the Middle East, Asia, and Oceania.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives