TF Bank (OM:TFBANK) Profit Margin Jumps to 38.2%, Challenging Market Valuation Concerns

Reviewed by Simply Wall St

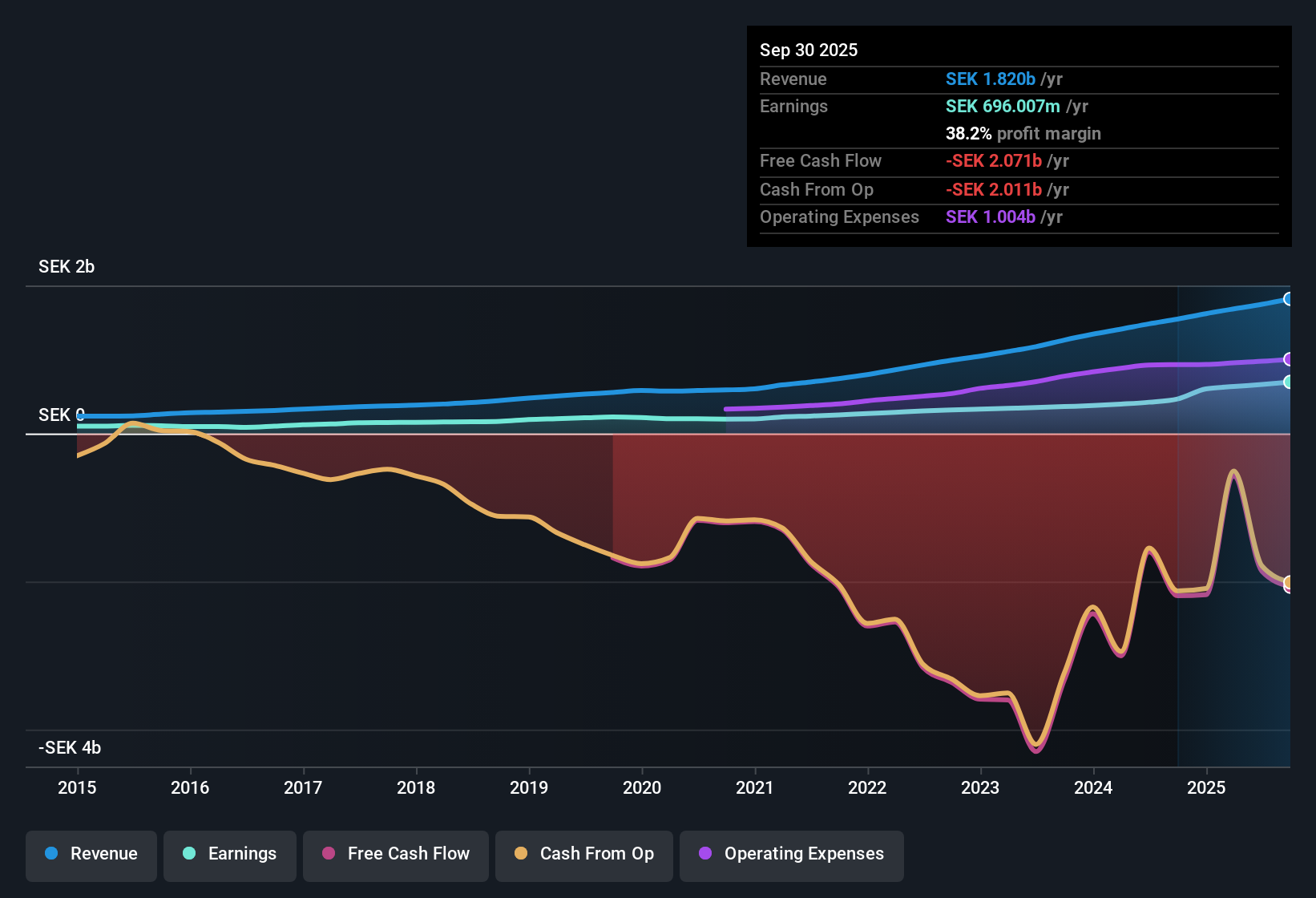

TF Bank (OM:TFBANK) reported a net profit margin of 38.2%, a notable jump from 30.1% a year earlier, while earnings for the past twelve months surged by 49.4% and revenue is projected to climb by 34.9% per year. Although the company’s recent growth outpaces its five-year historical average and the broader market, analysts forecast TF Bank's earnings will rise at 13.11% per year, lagging the Swedish market’s 16.4% pace. These results spotlight robust profitability and momentum, but also set the stage for questions about whether this premium growth rate can continue and justify the current valuation.

See our full analysis for TF Bank.The next section compares these headline results with the core narrative most investors follow, highlighting where TF Bank’s story is confirmed and where it faces new scrutiny.

Curious how numbers become stories that shape markets? Explore Community Narratives

Profit Margin Hits 38%, Peers Trail Behind

- TF Bank’s latest net profit margin is 38.2%, a marked step above last year’s 30.1% and higher than many regional banks. This demonstrates resilience in core banking operations.

- Sustained strong margins heavily support the optimistic view that TF Bank's tech-enabled business model can keep outpacing rivals.

- The consistent margin expansion is cited as a sign of lasting operational leverage compared to sector averages.

- Analysts highlight that above-industry margins create opportunities for accelerated reinvestment and potential product expansion.

Growth Outpaces Five-Year Average

- Earnings grew by 49.4% this year, nearly double the 24.7% annual pace over the past five years. This reflects a steep acceleration on the bottom line.

- This surge raises eyebrows among cautious investors who question whether current momentum is sustainable.

- Bears point to analyst forecasts of 13.11% earnings growth ahead, which is slower than the recent surge and below the Swedish market’s 16.4% expectation.

- Critics highlight that beating the historical trend does not guarantee future outperformance as growth returns toward sector norms.

Trading at 48% Above DCF Fair Value

- At SEK 174.42, TF Bank’s shares trade well above its DCF fair value of SEK 117.80, and its 16.2x Price-to-Earnings ratio is far above the peer average (11.5x) and industry average (9.7x).

- This premium valuation prompts debate on whether market enthusiasm is justified by growth potential.

- Supporters argue that persistent growth and high-quality earnings help defend a valuation premium over peers.

- However, skeptics warn that unless future growth delivers, such a large gap above fair value may expose the stock to sharp corrections.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on TF Bank's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Although TF Bank’s recent explosive growth impresses, its premium valuation and lower forward earnings forecasts raise concerns about future performance and downside risks.

If you are concerned that paying too much could lead to fragile returns, explore value-driven stocks that trade under fair value by focusing on these 881 undervalued stocks based on cash flows and help protect your portfolio from overpaying.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TF Bank might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:TFBANK

TF Bank

A digital bank, provides consumer banking services and e-commerce solutions through a proprietary IT platform in Sweden .

Outstanding track record with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives