Here's Why Swedbank (STO:SWED A) Has Caught The Eye Of Investors

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Swedbank (STO:SWED A). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

Check out our latest analysis for Swedbank

How Fast Is Swedbank Growing?

Generally, companies experiencing growth in earnings per share (EPS) should see similar trends in share price. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. Impressively, Swedbank has grown EPS by 37% per year, compound, in the last three years. If the company can sustain that sort of growth, we'd expect shareholders to come away satisfied.

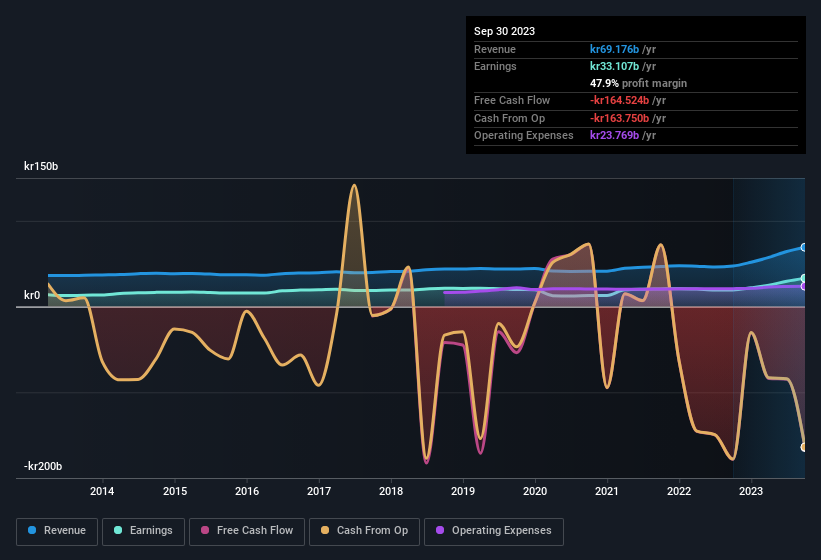

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. Our analysis has highlighted that Swedbank's revenue from operations did not account for all of their revenue in the previous 12 months, so our analysis of its margins might not accurately reflect the underlying business. EBIT margins for Swedbank remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 46% to kr69b. That's a real positive.

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

In investing, as in life, the future matters more than the past. So why not check out this free interactive visualization of Swedbank's forecast profits?

Are Swedbank Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. Because often, the purchase of stock is a sign that the buyer views it as undervalued. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

The kr51k worth of shares that insiders sold during the last 12 months pales in comparison to the kr27m they spent on acquiring shares in the company. This adds to the interest in Swedbank because it suggests that those who understand the company best, are optimistic. Zooming in, we can see that the biggest insider purchase was by Director Goran Bengtsson for kr18m worth of shares, at about kr179 per share.

It's reassuring that Swedbank insiders are buying the stock, but that's not the only reason to think management are fair to shareholders. Namely, Swedbank has a very reasonable level of CEO pay. For companies with market capitalisations over kr84b, like Swedbank, the median CEO pay is around kr28m.

The Swedbank CEO received kr18m in compensation for the year ending December 2022. That seems pretty reasonable, especially given it's below the median for similar sized companies. While the level of CEO compensation shouldn't be the biggest factor in how the company is viewed, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. Generally, arguments can be made that reasonable pay levels attest to good decision-making.

Does Swedbank Deserve A Spot On Your Watchlist?

If you believe that share price follows earnings per share you should definitely be delving further into Swedbank's strong EPS growth. But wait, it gets better. We have seen insider buying and the executive pay seems on the modest side of things. All in all, this stock is worth the time to delve deeper into the details. Still, you should learn about the 2 warning signs we've spotted with Swedbank (including 1 which is significant).

Keen growth investors love to see insider buying. Thankfully, Swedbank isn't the only one. You can see a a curated list of Swedish companies which have exhibited consistent growth accompanied by recent insider buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:SWED A

Swedbank

Provides various banking products and services to private and corporate customers in Sweden, Estonia, Latvia, Lithuania, Norway, the United States, Finland, Denmark, Luxembourg, and China.

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives