As global markets navigate through a landscape marked by fluctuating inflation rates and policy adjustments, Sweden's market remains a focal point for investors seeking stability through dividend stocks. In this context, understanding the attributes that define resilient and attractive dividend stocks becomes crucial, especially in an environment where economic indicators and central bank policies influence market dynamics significantly.

Top 10 Dividend Stocks In Sweden

| Name | Dividend Yield | Dividend Rating |

| Zinzino (OM:ZZ B) | 4.23% | ★★★★★★ |

| Betsson (OM:BETS B) | 6.12% | ★★★★★☆ |

| Loomis (OM:LOOMIS) | 4.29% | ★★★★★☆ |

| HEXPOL (OM:HPOL B) | 3.12% | ★★★★★☆ |

| Axfood (OM:AXFO) | 3.05% | ★★★★★☆ |

| Duni (OM:DUNI) | 4.45% | ★★★★★☆ |

| Nordea Bank Abp (OM:NDA SE) | 8.14% | ★★★★★☆ |

| Skandinaviska Enskilda Banken (OM:SEB A) | 5.70% | ★★★★★☆ |

| Avanza Bank Holding (OM:AZA) | 4.20% | ★★★★★☆ |

| Husqvarna (OM:HUSQ B) | 3.46% | ★★★★☆☆ |

Click here to see the full list of 22 stocks from our Top Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

FM Mattsson (OM:FMM B)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: FM Mattsson AB (publ) specializes in developing, manufacturing, and selling water taps and related products for bathrooms and kitchens across several European countries, with a market capitalization of approximately SEK 2.19 billion.

Operations: FM Mattsson AB generates revenue primarily from the Nordic countries, totaling SEK 1.12 billion, and from international markets, amounting to SEK 783.23 million.

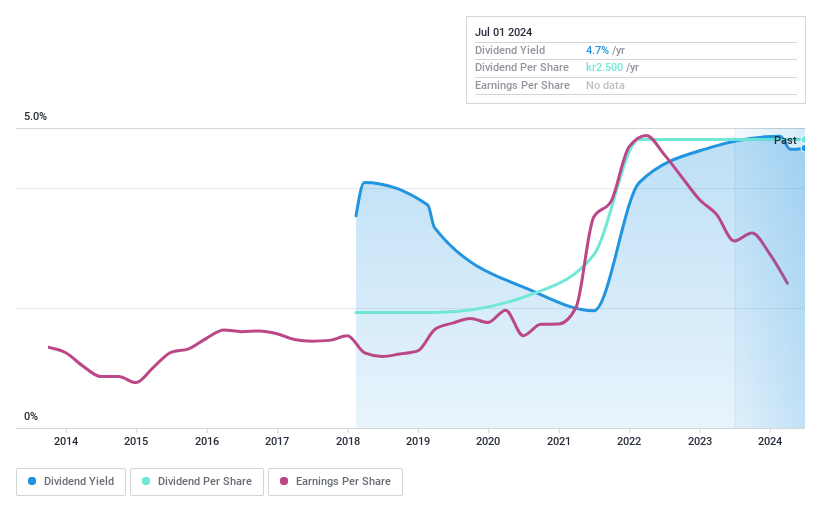

Dividend Yield: 4.8%

FM Mattsson's recent earnings show a decline, with Q1 2024 sales dropping to SEK 493.4 million from SEK 533.2 million year-over-year and net income falling to SEK 28.2 million from SEK 52.9 million. Despite this, the company maintains a reasonably covered dividend with a cash payout ratio of 49.5% and an earnings payout ratio of 86.3%. Trading at 56.8% below estimated fair value, it offers potential value but has an unstable dividend track record and less than ten years of consistent dividend payments, suggesting caution for long-term stability in its dividends.

- Take a closer look at FM Mattsson's potential here in our dividend report.

- In light of our recent valuation report, it seems possible that FM Mattsson is trading behind its estimated value.

Husqvarna (OM:HUSQ B)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Husqvarna AB (publ) specializes in manufacturing and distributing outdoor power products, watering products, and lawn care equipment, with a market capitalization of approximately SEK 49.56 billion.

Operations: Husqvarna AB's revenue is primarily derived from three segments: Gardena at SEK 13.06 billion, Husqvarna Construction at SEK 8.23 billion, and Husqvarna Forest & Garden at SEK 29.38 billion.

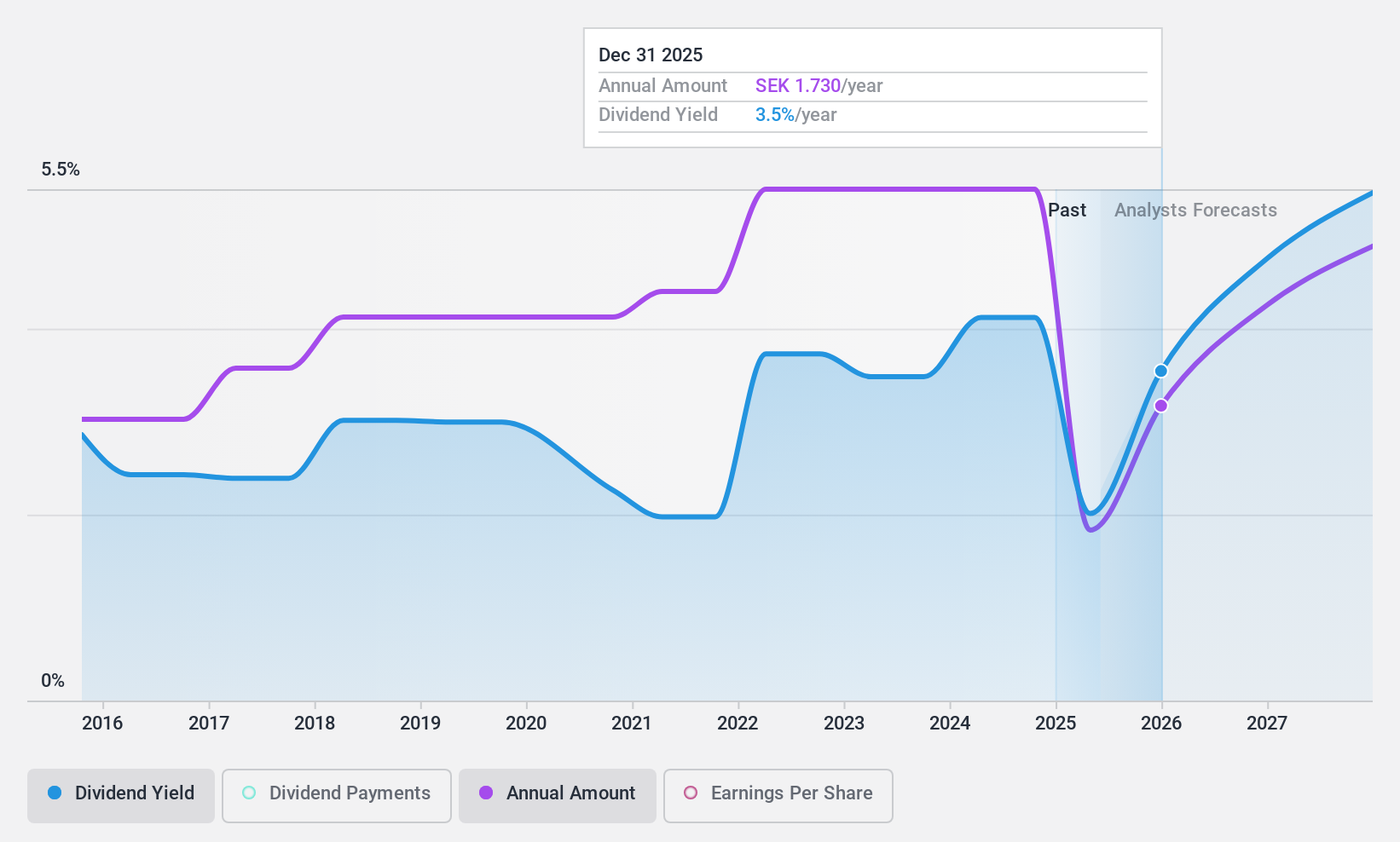

Dividend Yield: 3.5%

Husqvarna's recent financial performance shows a decline, with Q1 2024 sales at SEK 14.72 billion and net income at SEK 1.32 billion, both down from the previous year. The company maintains a dividend of SEK 3.00 per share, paid in two installments, despite earnings challenges and a high payout ratio of 92.8%. While dividends have been stable over the past decade, the coverage by earnings is weak, indicating potential sustainability issues ahead unless profitability improves.

- Delve into the full analysis dividend report here for a deeper understanding of Husqvarna.

- The analysis detailed in our Husqvarna valuation report hints at an deflated share price compared to its estimated value.

Skandinaviska Enskilda Banken (OM:SEB A)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Skandinaviska Enskilda Banken AB (publ), commonly known as SEB, is a Swedish financial services group offering corporate, retail, investment, and private banking services with a market capitalization of approximately SEK 307.24 billion.

Operations: Skandinaviska Enskilda Banken AB (SEB) generates revenue through various segments including Baltic (SEK 13.55 billion), Investment Management (SEK 3.16 billion), Large Corporates & Financial Institutions (SEK 31.98 billion), Private Wealth Management & Family Office (SEK 4.46 billion), and Corporate & Private Customers excluding Private Wealth Management & Family Office (SEK 25.42 billion).

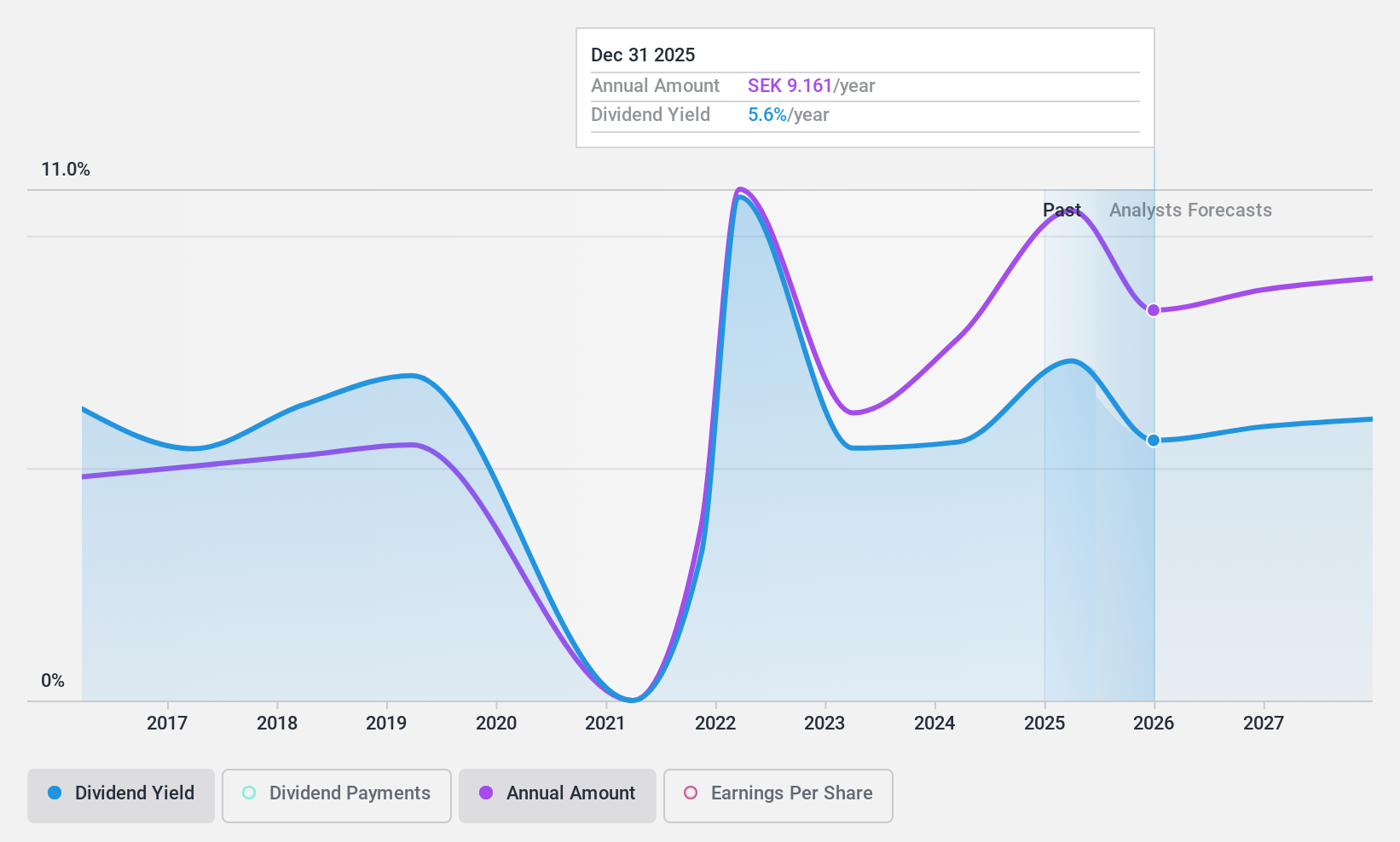

Dividend Yield: 5.7%

Skandinaviska Enskilda Banken AB reported a slight increase in Q1 2024 earnings with a net interest income of SEK 11.77 billion and net income of SEK 9.50 billion. Despite this, earnings are expected to decline by an average of 6.5% annually over the next three years. The bank maintains a stable dividend, recently announcing an ordinary dividend of SEK 8.50 and a special dividend of SEK 3 per share, supported by a reasonable payout ratio of 46.3%. However, its dividend track record has been inconsistent over the past decade, raising concerns about future reliability despite current coverage by earnings.

- Navigate through the intricacies of Skandinaviska Enskilda Banken with our comprehensive dividend report here.

- Our valuation report unveils the possibility Skandinaviska Enskilda Banken's shares may be trading at a premium.

Make It Happen

- Embark on your investment journey to our 22 Top Dividend Stocks selection here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Husqvarna might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:HUSQ B

Husqvarna

Produces and sells outdoor power products, watering products, and lawn care power equipment.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives