Can Skandinaviska Enskilda Banken’s Value Keep Rising After Its 200% Five-Year Rally?

Reviewed by Bailey Pemberton

If you own shares of Skandinaviska Enskilda Banken or are just considering whether now is the right moment to jump in, it is natural to ask: is this stock still on the rise, or are we nearing the top? Let’s talk through what is really happening. Over the past year, the company has rewarded investors with a striking 29.6% gain. Even more impressively, its stock has soared by 107.4% over the last three years and an eye-catching 201.7% over five years. That is the kind of consistent performance that turns heads.

Still, not every week brings good news. Over the last seven days, the share price has slipped by 1.0%. Yet looking at the big picture, these shorter-term dips seem minor compared to the steady long-term climb. In the past month, there has even been a modest 1.4% increase. These movements have caught the attention of both Bulls and Bears, especially as European financial stocks respond to shifting risk appetites and broader economic policies throughout the region. If you are trying to decide what to do with your own shares, it is important to separate short-term noise from longer-term trends.

So, is Skandinaviska Enskilda Banken’s strong run justified by its valuation? Using six classic undervaluation checks, the company scores a 4 out of 6, showing considerable value among its peers, but not a slam dunk across every metric. In the next section, we will break down those valuation measures to see where the stock shines, and where there might be room for caution. After that, I will let you in on an even better way to think about valuation, one that could change how you evaluate the stock entirely.

Why Skandinaviska Enskilda Banken is lagging behind its peers

Approach 1: Skandinaviska Enskilda Banken Excess Returns Analysis

The Excess Returns valuation model focuses on how much value a company generates above its cost of equity. This essentially measures how efficiently the bank puts shareholders’ money to work. For Skandinaviska Enskilda Banken, this method provides insight into whether the business is adding real value for its investors, rather than simply growing for growth’s sake.

Looking at the data, the company’s book value stands at SEK108.86 per share, with a stable earnings per share (EPS) estimate of SEK17.01, as projected by 12 analysts. The average cost of equity is SEK7.65 per share. Excess return is a robust SEK9.36 per share. Skandinaviska Enskilda Banken’s average return on equity is 13.83 percent, and the stable book value is projected to rise to SEK123.03 per share, based on estimates from 10 analysts.

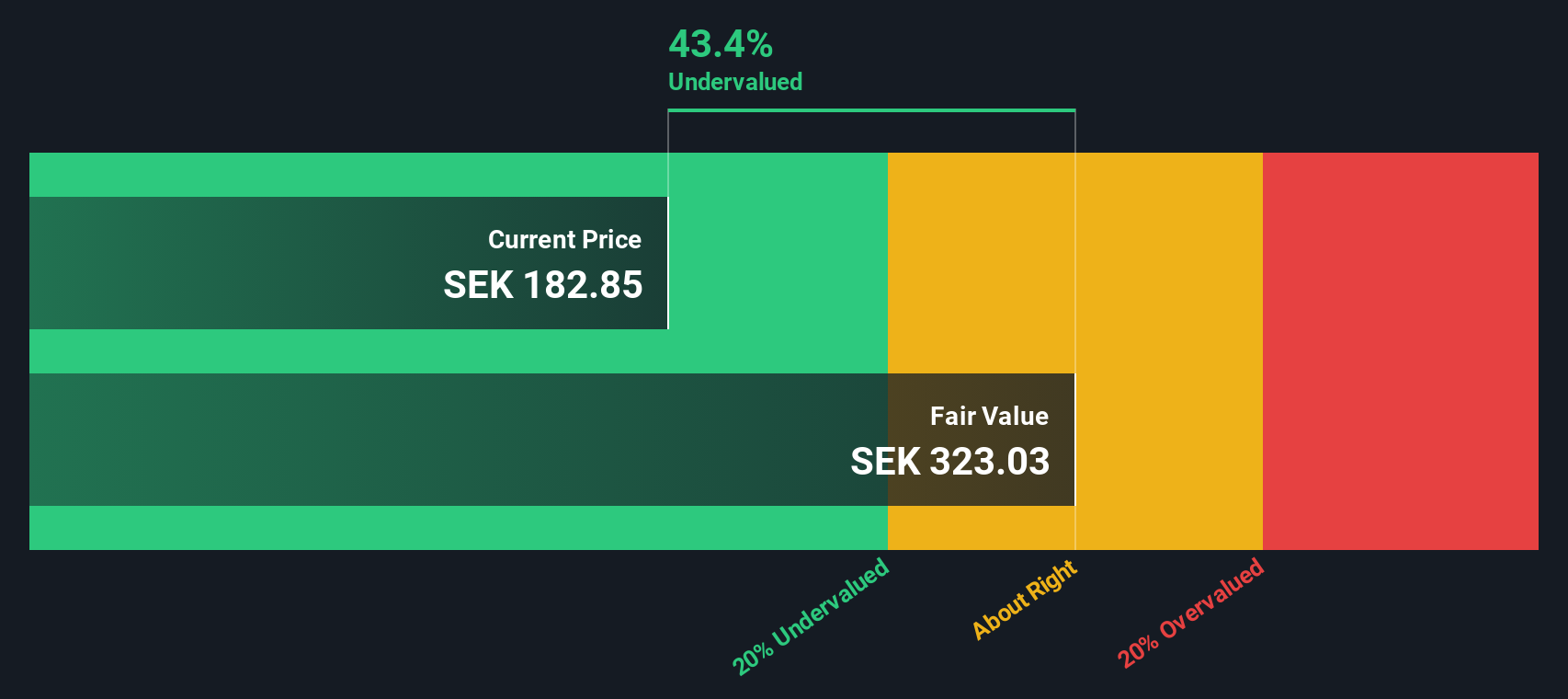

After accounting for these metrics, the excess returns model puts the intrinsic value at SEK323.40 per share. This implies the stock is currently trading at a 43.5 percent discount to its estimated fair value, which strongly suggests it is undervalued compared to what shareholders might reasonably expect based on return potential.

Result: UNDERVALUED

Our Excess Returns analysis suggests Skandinaviska Enskilda Banken is undervalued by 43.5%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Skandinaviska Enskilda Banken Price vs Earnings

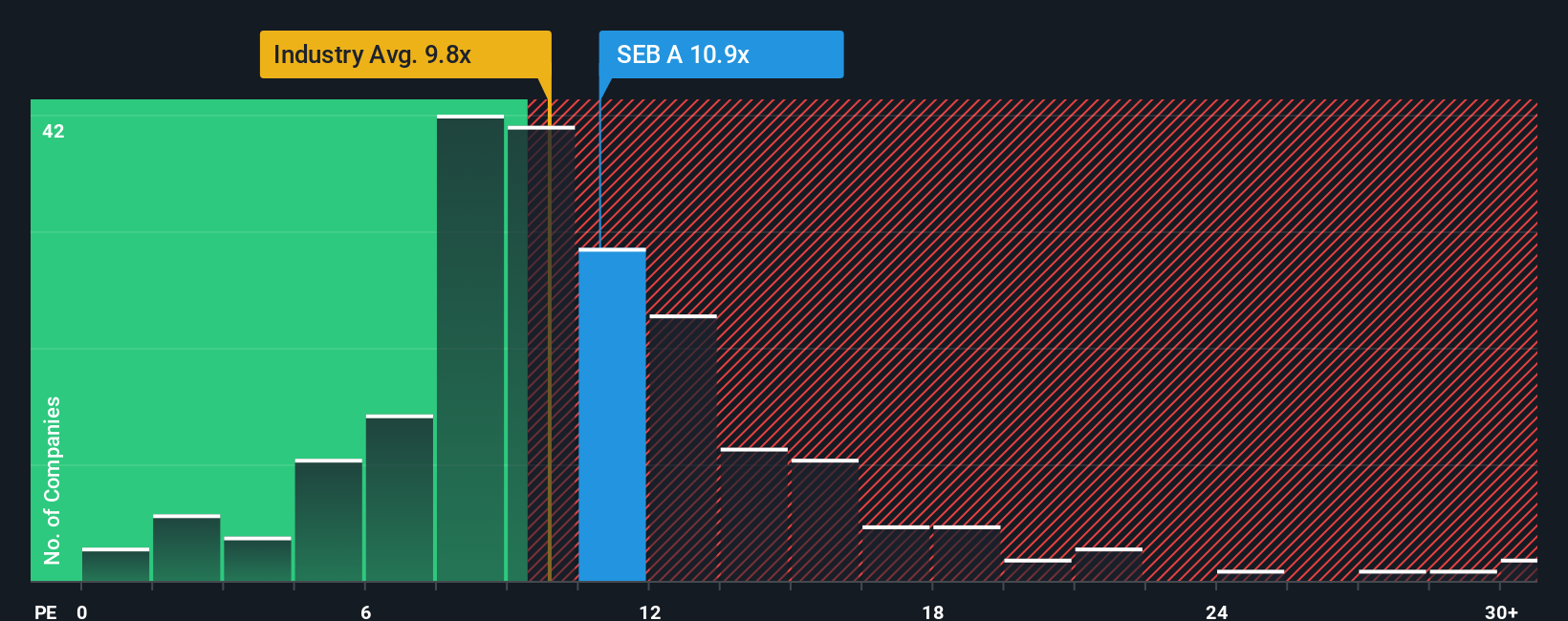

The Price-to-Earnings (PE) ratio is a preferred valuation metric for profitable companies because it relates a company’s share price to its earnings, providing a clear picture of how much investors are paying for each unit of profit generated. For banks like Skandinaviska Enskilda Banken, which have consistent earnings, the PE ratio helps investors quickly size up whether shares are trading at a premium or a discount to expectations for growth and risk.

The “right” or fair PE ratio depends on factors like growth outlook and risk profile. Companies expected to grow faster or with less uncertainty usually carry higher PE ratios. Comparing Skandinaviska Enskilda Banken, its current PE stands at 10.93x. This is nearly in line with both the average of its immediate peers at 11.16x and the broader banking industry average of 10.27x.

However, benchmarks like industry averages or peer groups do not account for company-specific details such as future earnings growth, profit margins, or company size, which can matter a lot. That is where Simply Wall St’s "Fair Ratio" comes in. This proprietary measure incorporates exactly these dynamics, offering a tailored benchmark based on company fundamentals. For Skandinaviska Enskilda Banken, the Fair Ratio is 11.08x. That is almost identical to the company's current ratio of 10.93x, indicating the valuation is about right.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Skandinaviska Enskilda Banken Narrative

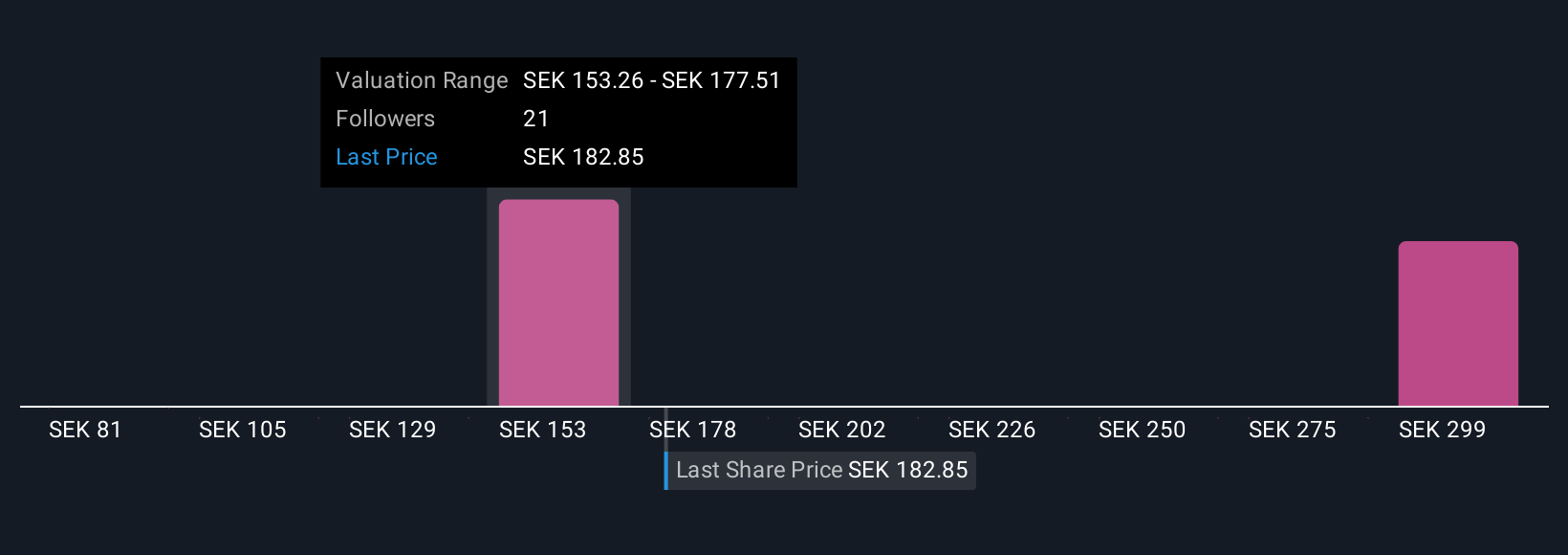

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is simply your investment story, the set of beliefs and assumptions you hold about Skandinaviska Enskilda Banken’s future, including the numbers you think are realistic for revenue, earnings, and profit margins. Narratives connect the dots between a company’s story, a financial forecast, and the resulting fair value, turning abstract data into actionable insights.

On Simply Wall St’s Community page, Narratives make this process accessible for everyone, powering millions of investors’ decisions. By building your own Narrative (or following others’), you can see how your assumptions play out, compare your computed fair value to the current share price, and quickly judge if the stock is a buy or sell, all based on your personalized view. Narratives automatically stay up to date as fresh news or earnings are released, keeping your perspective relevant and timely.

For example, some investors believe SEB’s expansion into AI-powered efficiency and rising fee income will drive solid earnings growth, supporting a higher price target (like SEK190.0 per share). Others see risks from margin compression and market instability, justifying a more cautious outlook (targeting as low as SEK151.0). With Narratives, you can put your own expectations into numbers and make truly informed decisions, instead of simply following consensus estimates.

Do you think there's more to the story for Skandinaviska Enskilda Banken? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:SEB A

Skandinaviska Enskilda Banken

Provides corporate, retail, investment, and private banking services.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives