Volvo Car AB (publ.) (OM:VOLCAR B) Eyes Growth with Novo Energy Acquisition and Strong Sales Performance

Reviewed by Simply Wall St

Core Advantages Driving Sustained Success for Volvo Car AB (publ.)

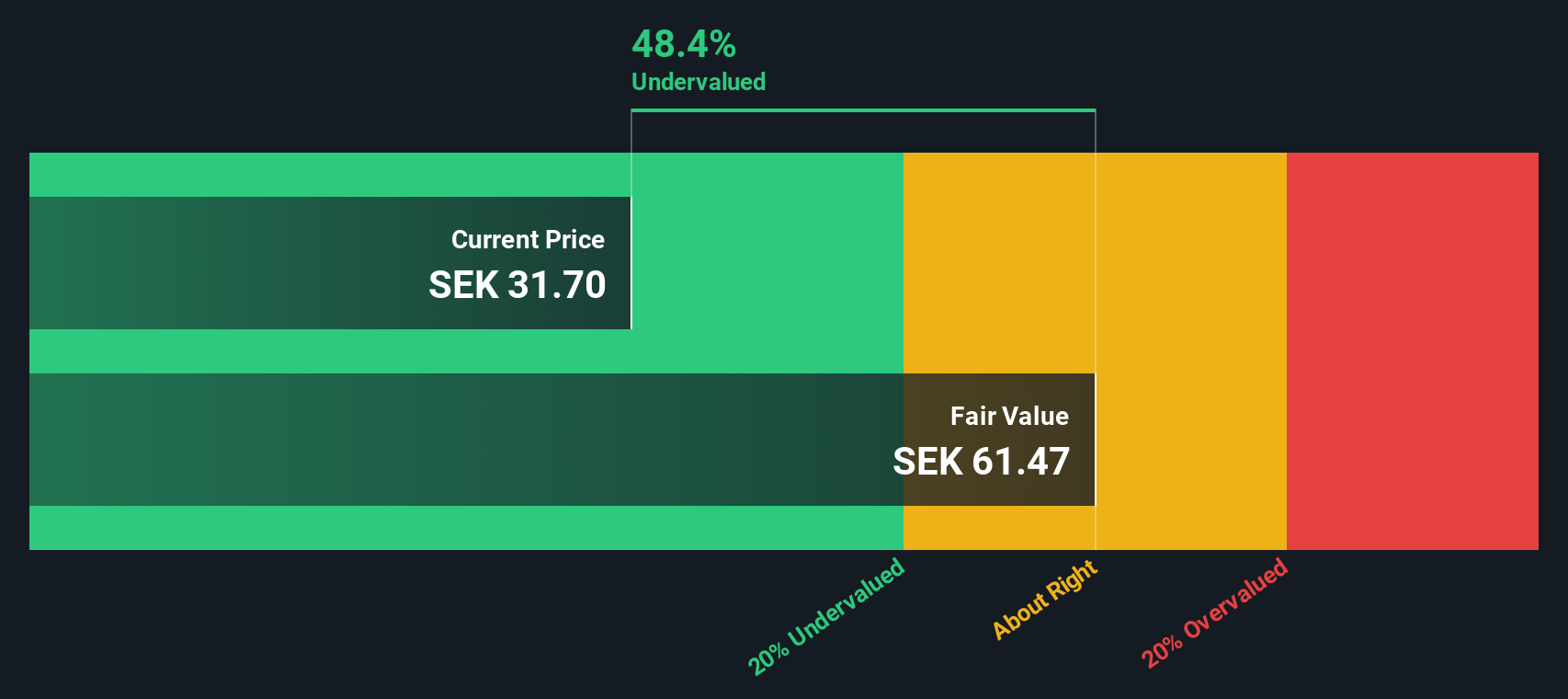

Volvo Car AB has demonstrated impressive financial health, with a notable earnings growth of 29.1% over the past year, significantly outpacing the auto industry average. This performance is further supported by a strong profit growth of 17.8% annually over the past five years. The company has effectively managed its financial structure, maintaining a satisfactory net debt to equity ratio of 4.2%, which underscores its stability. Additionally, the strategic decision to repurchase shares reflects confidence in its financial trajectory and commitment to enhancing shareholder value. The company's current trading price of SEK23.12, well below its estimated fair value of SEK112.65, suggests an undervaluation that could present potential growth opportunities.

Vulnerabilities Impacting Volvo Car AB (publ.)

Despite its strong earnings growth, Volvo Car AB faces challenges such as a return on equity of 11.8%, which falls below the industry threshold of 20%. This indicates room for improvement in capital efficiency. Furthermore, the company's earnings growth forecast of 13.4% is slightly lower than the Swedish market's 15.5%, suggesting potential competitive pressures. The revenue growth forecast of 6.1% per year, while faster than the Swedish market average, remains below the significant growth threshold of 20%, highlighting the need for strategic enhancements to accelerate growth.

Future Prospects for Volvo Car AB (publ.) in the Market

Volvo Car AB is poised to capitalize on its strategic initiatives, such as the acquisition of the EV battery joint venture Novo Energy, which aligns with its commitment to innovation and sustainability. This move could enhance its market position in the burgeoning electric vehicle sector. Additionally, the company's focus on expanding its footprint in Asia, as highlighted by CEO Ronojoy Banerjee, presents significant growth potential. The introduction of new product lines catering to emerging consumer trends further underscores Volvo's proactive approach to maintaining market relevance.

Competitive Pressures and Market Risks Facing Volvo Car AB (publ.)

Volvo Car AB's market environment is not without its challenges. Economic headwinds, as noted by CEO Ronojoy Banerjee, could impact consumer spending and, consequently, the company's sales. Regulatory changes pose another potential risk, requiring the company to remain agile and adaptable. Supply chain disruptions, highlighted by COO James Rowan, emphasize the need for strategic supplier diversification to ensure efficient product delivery. These external factors necessitate vigilant monitoring and strategic adjustments to safeguard Volvo's market share and growth trajectory.

Explore the current health of Volvo Car AB (publ.) and how it reflects on its financial stability and growth potential.

Conclusion

Volvo Car AB's impressive financial performance, marked by a 29.1% earnings growth in the past year, reflects its strong market position and effective financial management, as evidenced by a stable net debt to equity ratio of 4.2%. However, the company's return on equity of 11.8% highlights the need for improved capital efficiency to meet industry standards. Strategic initiatives, such as the acquisition of Novo Energy and expansion in Asia, position Volvo to capitalize on the growing electric vehicle market, although economic headwinds and regulatory changes pose challenges. Despite these risks, the current trading price of SEK23.12, significantly below the estimated fair value of SEK112.65, suggests potential for substantial growth, making it an attractive opportunity for investors seeking value in the automotive sector.

Key Takeaways

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About OM:VOLCAR B

Volvo Car AB (publ.)

Designs, develops, manufactures, assembles, and sells passenger cars in Sweden and internationally.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives