- Saudi Arabia

- /

- Gas Utilities

- /

- SASE:9516

Revenues Not Telling The Story For Natural Gas Distribution Company (TADAWUL:9516)

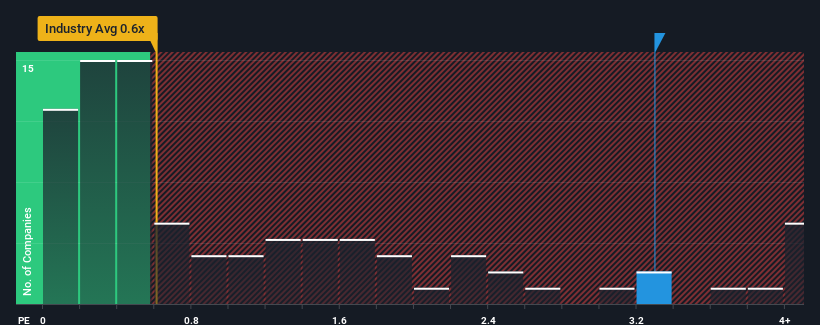

When you see that almost half of the companies in the Gas Utilities industry in Saudi Arabia have price-to-sales ratios (or "P/S") below 0.6x, Natural Gas Distribution Company (TADAWUL:9516) looks to be giving off strong sell signals with its 3.3x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Natural Gas Distribution

What Does Natural Gas Distribution's Recent Performance Look Like?

It looks like revenue growth has deserted Natural Gas Distribution recently, which is not something to boast about. It might be that many are expecting an improvement to the uninspiring revenue performance over the coming period, which has kept the P/S from collapsing. If not, then existing shareholders may be a little nervous about the viability of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Natural Gas Distribution will help you shine a light on its historical performance.Do Revenue Forecasts Match The High P/S Ratio?

In order to justify its P/S ratio, Natural Gas Distribution would need to produce outstanding growth that's well in excess of the industry.

Taking a look back first, we see that there was hardly any revenue growth to speak of for the company over the past year. The longer-term trend has been no better as the company has no revenue growth to show for over the last three years either. So it seems apparent to us that the company has struggled to grow revenue meaningfully over that time.

Weighing that recent medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 0.4% shows it's about the same on an annualised basis.

With this information, we find it interesting that Natural Gas Distribution is trading at a high P/S compared to the industry. It seems most investors are ignoring the fairly average recent growth rates and are willing to pay up for exposure to the stock. Although, additional gains will be difficult to achieve as a continuation of recent revenue trends would weigh down the share price eventually.

The Key Takeaway

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of Natural Gas Distribution revealed its three-year revenue trends aren't impacting its high P/S as much as we would have predicted, given they look similar to current industry expectations. When we see average revenue with industry-like growth combined with a high P/S, we suspect the share price is at risk of declining, bringing the P/S back in line with the industry too. If recent medium-term revenue trends continue, it will place shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

And what about other risks? Every company has them, and we've spotted 3 warning signs for Natural Gas Distribution (of which 2 don't sit too well with us!) you should know about.

If these risks are making you reconsider your opinion on Natural Gas Distribution, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Natural Gas Distribution might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SASE:9516

Natural Gas Distribution

Distributes natural gas through pipelines in Saudi Arabia.

Flawless balance sheet with proven track record.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026