- Saudi Arabia

- /

- Renewable Energy

- /

- SASE:2082

Global Market's Hidden Gems: 3 Stocks That Might Be Trading Below Their Estimated Value

Reviewed by Simply Wall St

In the midst of ongoing trade tensions and fluctuating global markets, investors have been navigating a complex landscape marked by mixed performances across major indices. While large-cap tech stocks in the U.S. faced headwinds due to new export restrictions, smaller-cap indexes like the S&P MidCap 400 and Russell 2000 showed resilience with gains. In such an environment, identifying stocks that are potentially undervalued can be crucial for those looking to capitalize on market inefficiencies. These hidden gems may offer opportunities for growth as they trade below their estimated value amidst broader economic uncertainties.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Andritz (WBAG:ANDR) | €56.50 | €112.96 | 50% |

| Qt Group Oyj (HLSE:QTCOM) | €57.20 | €114.25 | 49.9% |

| Alexander Marine (TWSE:8478) | NT$141.00 | NT$278.56 | 49.4% |

| Etteplan Oyj (HLSE:ETTE) | €11.55 | €22.94 | 49.7% |

| Jerónimo Martins SGPS (ENXTLS:JMT) | €21.40 | €42.23 | 49.3% |

| Wenzhou Yihua Connector (SZSE:002897) | CN¥39.00 | CN¥77.23 | 49.5% |

| Shanghai HIUV New MaterialsLtd (SHSE:688680) | CN¥36.39 | CN¥71.66 | 49.2% |

| Bloks Group (SEHK:325) | HK$122.60 | HK$244.78 | 49.9% |

| Nordic Semiconductor (OB:NOD) | NOK118.40 | NOK235.37 | 49.7% |

| Longino & Cardenal (BIT:LON) | €1.35 | €2.69 | 49.8% |

Here we highlight a subset of our preferred stocks from the screener.

ACWA Power (SASE:2082)

Overview: ACWA Power Company, with a market cap of SAR238.82 billion, focuses on investing in, developing, operating, and maintaining power generation, water desalination, and green hydrogen production plants across the Kingdom of Saudi Arabia, the Middle East, Asia, and Africa.

Operations: The company's revenue segments include SAR1.43 billion from renewables and SAR4.86 billion from thermal and water desalination operations.

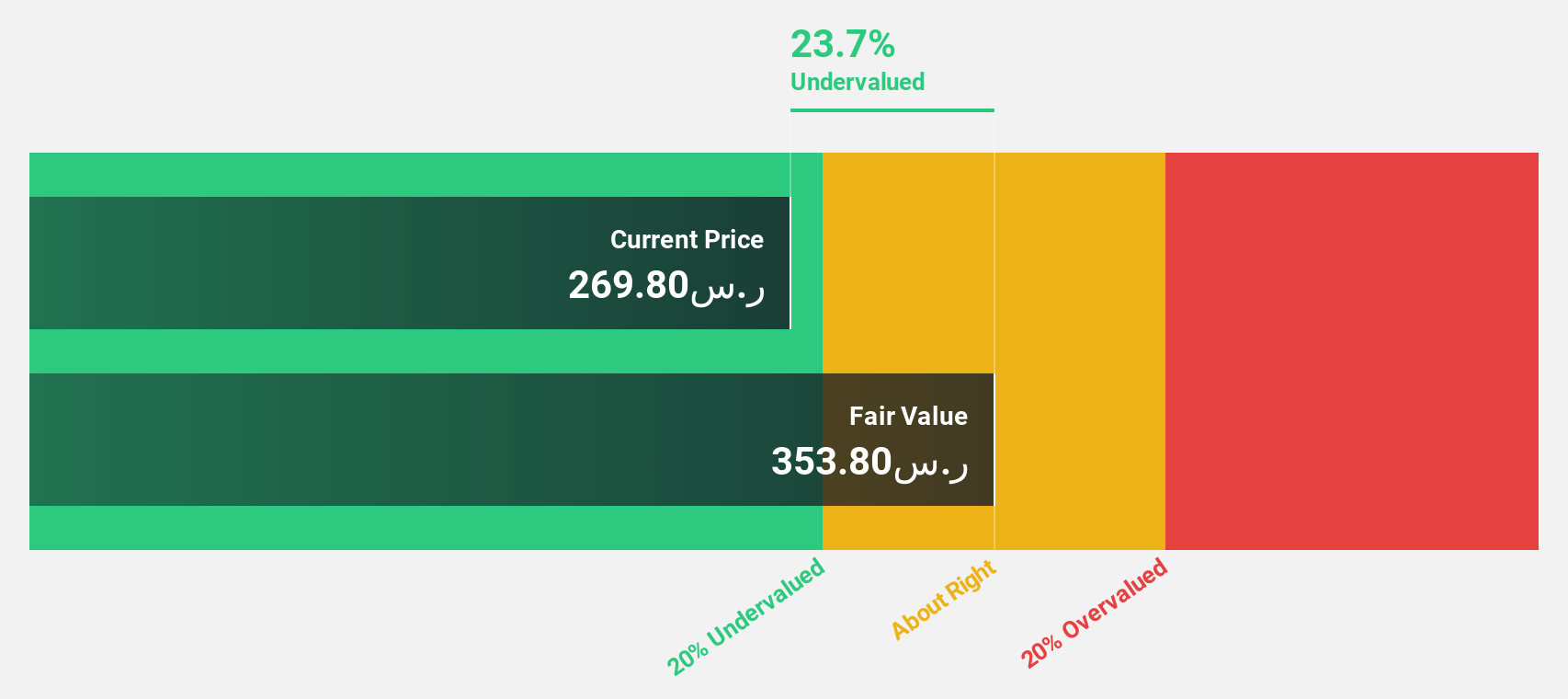

Estimated Discount To Fair Value: 27.7%

ACWA Power is trading at SAR 329.2, below its estimated fair value of SAR 455.13, indicating it may be undervalued based on cash flows. Despite large one-off items affecting earnings quality, the company has shown strong revenue growth (20.6% annually) and significant earnings growth forecasts (21.3% annually). Recent financial results for 2024 showed increased sales of SAR 6.3 billion and net income of SAR 1.76 billion, supporting its robust performance trajectory amid market conditions.

- Our growth report here indicates ACWA Power may be poised for an improving outlook.

- Get an in-depth perspective on ACWA Power's balance sheet by reading our health report here.

Recruit Holdings (TSE:6098)

Overview: Recruit Holdings Co., Ltd. offers HR technology and business solutions aimed at transforming the world of work, with a market cap of ¥10.57 trillion.

Operations: The company's revenue is derived from HR Technology at ¥1.10 billion, Temporary Staffing at ¥1.67 billion, and Matching & Solutions at ¥815.40 million.

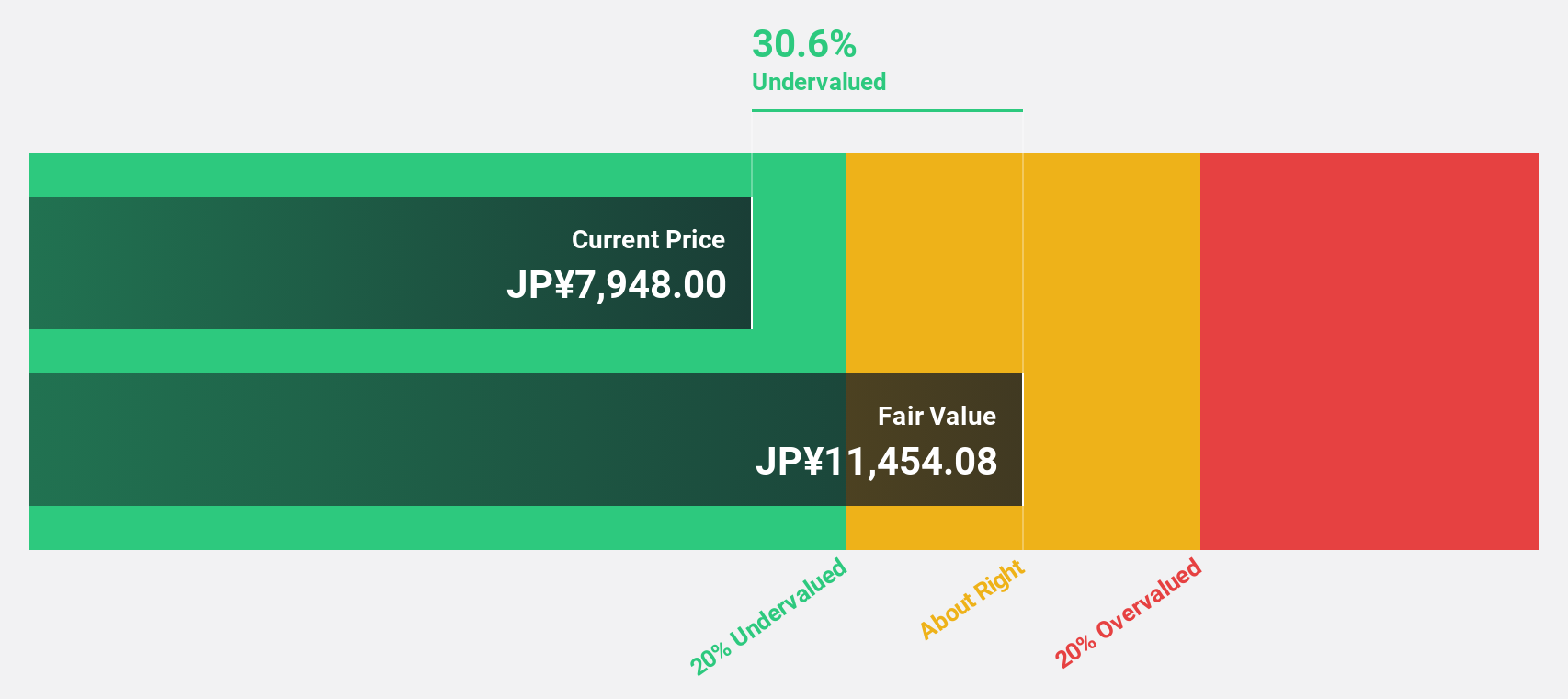

Estimated Discount To Fair Value: 28.0%

Recruit Holdings is trading at ¥7,601, significantly below its estimated fair value of ¥10,556.48, highlighting potential undervaluation based on cash flows. Despite high share price volatility recently, the company forecasts solid earnings growth of 10.2% annually, outpacing the Japanese market average. The recent share buyback program worth ¥450 billion aims to enhance shareholder returns and support long-term strategic goals by utilizing internal funds for sustainable profit growth and enterprise value enhancement.

- The growth report we've compiled suggests that Recruit Holdings' future prospects could be on the up.

- Take a closer look at Recruit Holdings' balance sheet health here in our report.

Andritz (WBAG:ANDR)

Overview: Andritz AG is a global company that supplies plants, equipment, and services to the pulp and paper industry, metalworking and steel industries, hydropower stations, and solid/liquid separation sectors across various regions including Europe, North America, South America, China, Asia, with a market capitalization of approximately €5.51 billion.

Operations: The company's revenue is derived from four main segments: Metals (€1.81 billion), Hydro Power (€1.54 billion), Pulp & Paper (€3.46 billion), and Environment & Energy (€1.50 billion).

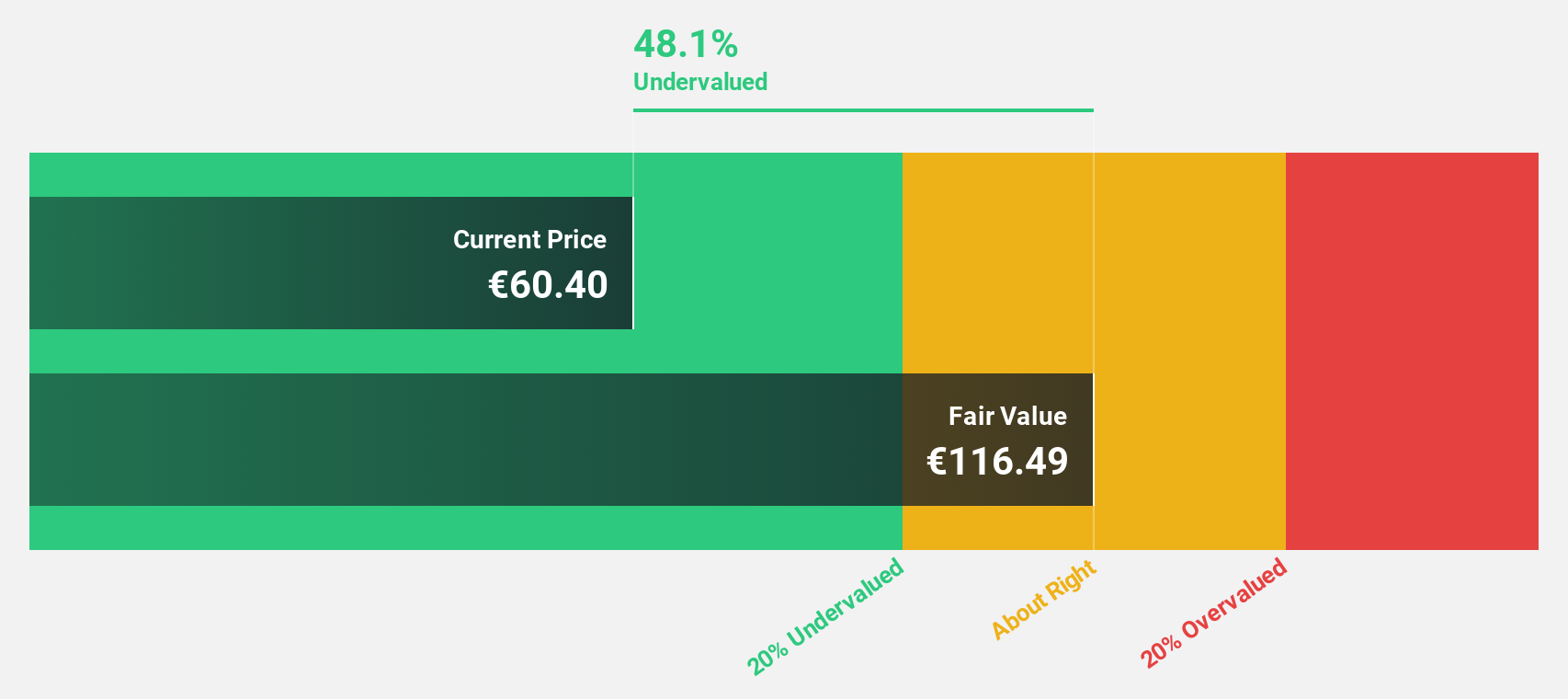

Estimated Discount To Fair Value: 50%

Andritz is trading at €56.5, significantly below its estimated fair value of €112.96, suggesting potential undervaluation based on cash flows. The company forecasts earnings growth of 9.2% annually, surpassing the Austrian market average. Recent board changes include Dr. Barbara Steger's election to the Supervisory Board and Alexander Isola's departure after nine years, while annual sales slightly decreased to €8.33 billion from €8.67 billion in 2024 with a net income of €496.5 million.

- Our expertly prepared growth report on Andritz implies its future financial outlook may be stronger than recent results.

- Click here to discover the nuances of Andritz with our detailed financial health report.

Next Steps

- Get an in-depth perspective on all 457 Undervalued Global Stocks Based On Cash Flows by using our screener here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SASE:2082

ACWA Power

Engages in the investment, development, operation, and maintenance of power generation, water desalination, and green hydrogen production plants in the Kingdom of Saudi Arabia, the Middle East, Asia, and Africa.

Reasonable growth potential low.

Similar Companies

Market Insights

Community Narratives