- Saudi Arabia

- /

- Transportation

- /

- SASE:4261

3 Growth Companies With High Insider Ownership Showing Up To 78% Earnings Growth

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by interest rate adjustments and sector-specific shifts, the U.S. indices have shown resilience with notable gains in the S&P 500 and Nasdaq Composite, driven by strong performances in utilities, real estate, and AI-related stocks. Amid these broader economic developments, identifying growth companies with high insider ownership can be particularly appealing; such companies often benefit from aligned interests between management and shareholders, potentially leading to impressive earnings growth even in fluctuating market conditions.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Lavvi Empreendimentos Imobiliários (BOVESPA:LAVV3) | 11.9% | 21.1% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 34% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 30.1% |

| People & Technology (KOSDAQ:A137400) | 16.4% | 35.6% |

| Arctech Solar Holding (SHSE:688408) | 37.8% | 29.8% |

| Laopu Gold (SEHK:6181) | 36.4% | 33.2% |

| Medley (TSE:4480) | 34% | 30.4% |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.7% | 49.1% |

| HANA Micron (KOSDAQ:A067310) | 18.3% | 105.8% |

| UTI (KOSDAQ:A179900) | 33.1% | 134.6% |

Here we highlight a subset of our preferred stocks from the screener.

Theeb Rent A Car (SASE:4261)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Theeb Rent A Car Company operates in the Kingdom of Saudi Arabia, offering car rental and leasing services, with a market cap of SAR3.30 billion.

Operations: The company's revenue segments consist of SAR415.70 million from leasing, SAR298.25 million from car sales, and SAR503.49 million from short-term leases in the Kingdom of Saudi Arabia.

Insider Ownership: 35.5%

Earnings Growth Forecast: 18% p.a.

Theeb Rent A Car demonstrates promising growth potential with earnings forecasted to grow 18% annually, outpacing the SA market's 6.8%. Recent earnings showed strong performance, with Q2 sales at SAR 321.78 million and net income rising to SAR 44.58 million. However, its dividend yield of 2.16% isn't well covered by free cash flows, and debt coverage by operating cash flow remains a concern despite a favorable price-to-earnings ratio of 21.1x compared to the market average.

- Click here and access our complete growth analysis report to understand the dynamics of Theeb Rent A Car.

- In light of our recent valuation report, it seems possible that Theeb Rent A Car is trading beyond its estimated value.

QuakeSafe Technologies (SZSE:300767)

Simply Wall St Growth Rating: ★★★★☆☆

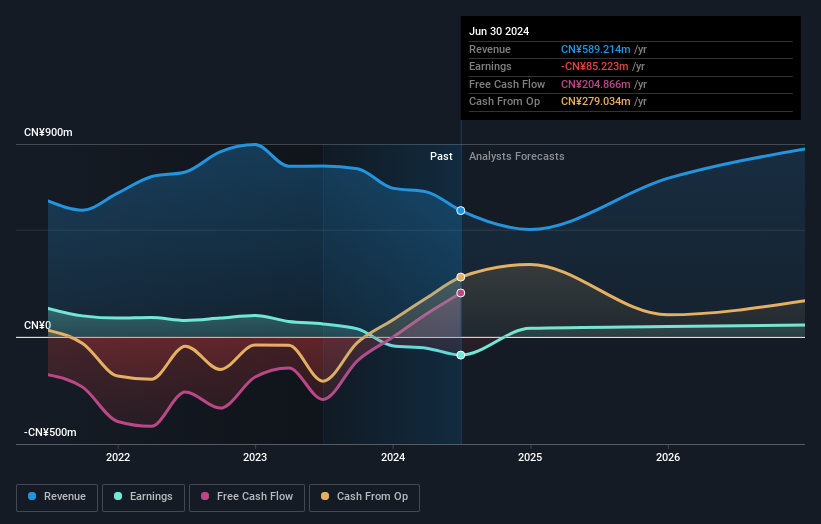

Overview: QuakeSafe Technologies Co., Ltd. develops, produces, and sells anti-seismic and shock absorber products in China with a market cap of CN¥2.64 billion.

Operations: QuakeSafe Technologies generates revenue through the development, production, and sale of anti-seismic and shock absorber products in China.

Insider Ownership: 20.3%

Earnings Growth Forecast: 78.7% p.a.

QuakeSafe Technologies is expected to achieve profitability within three years, with earnings projected to grow at 78.69% annually, surpassing market averages. Despite trading at 78.2% below its estimated fair value, the company's recent financial performance shows a decline, with half-year sales dropping to CNY 220.46 million and a net loss of CNY 29.22 million compared to last year's net income of CNY 14.87 million. The share price remains highly volatile over the past three months.

- Navigate through the intricacies of QuakeSafe Technologies with our comprehensive analyst estimates report here.

- Our comprehensive valuation report raises the possibility that QuakeSafe Technologies is priced higher than what may be justified by its financials.

Semperit Holding (WBAG:SEM)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Semperit Aktiengesellschaft Holding is a global company that develops, produces, and sells rubber products for the medical and industrial sectors with a market cap of €236.59 million.

Operations: The company's revenue segments include €44.50 million from Surgical Operations, €380.44 million from Semperit Engineered Applications, and €291.45 million from Semperit Industrial Applications.

Insider Ownership: 10.1%

Earnings Growth Forecast: 41.4% p.a.

Semperit Holding is trading at 45.4% below its estimated fair value, indicating potential undervaluation compared to peers. Despite a volatile share price and declining profit margins from last year, the company shows promise with earnings projected to grow significantly at 41.36% annually, outpacing the Austrian market average of 6.7%. Recent financials reveal improved net income for Q2 2024 at €6.03 million, although revenue has slightly decreased year-over-year.

- Get an in-depth perspective on Semperit Holding's performance by reading our analyst estimates report here.

- According our valuation report, there's an indication that Semperit Holding's share price might be on the cheaper side.

Summing It All Up

- Get an in-depth perspective on all 1489 Fast Growing Companies With High Insider Ownership by using our screener here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Theeb Rent A Car might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SASE:4261

Theeb Rent A Car

Provides car rental and leasing services in the Kingdom of Saudi Arabia.

Good value with moderate growth potential.