As global markets navigate a complex landscape marked by mixed earnings reports, AI competition concerns, and varied central bank policies, investors are increasingly seeking stability amidst volatility. The Federal Reserve's decision to hold rates steady and the European Central Bank's rate cut highlight divergent economic strategies that are influencing market dynamics worldwide. In this environment, dividend stocks can offer a reliable income stream and potential for long-term growth, making them an attractive option for those looking to balance risk with reward in their portfolios.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Totech (TSE:9960) | 3.80% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.31% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.85% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.54% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.01% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.29% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.53% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.41% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.99% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.68% | ★★★★★★ |

Click here to see the full list of 1959 stocks from our Top Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

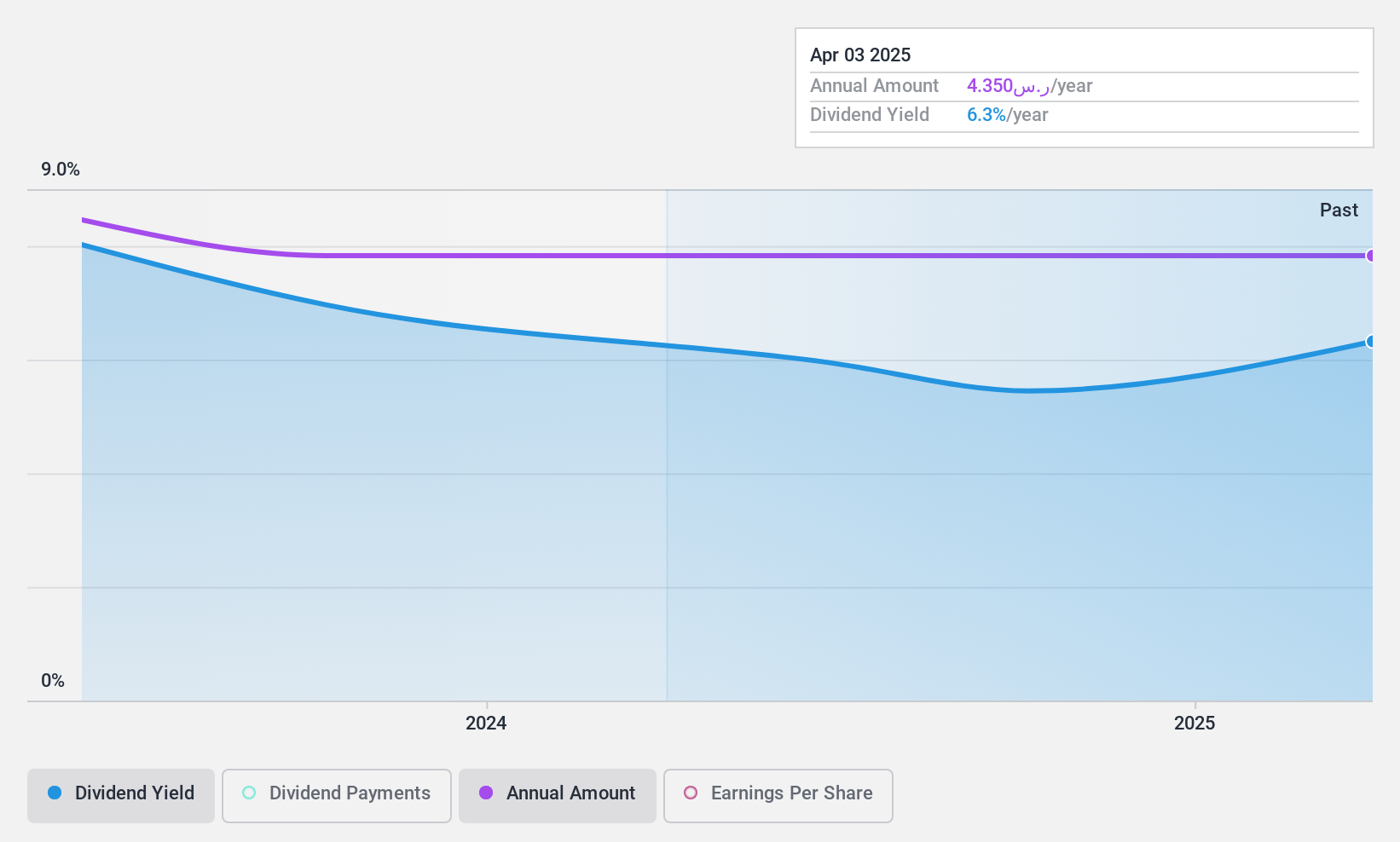

Saudi Networkers Services (SASE:9543)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Saudi Networkers Services Company operates in the implementation, establishment, maintenance, operation, installation, and management of telecommunication networks in Saudi Arabia with a market cap of SAR501 million.

Operations: Saudi Networkers Services Company generates revenue primarily from its Computer Services segment, amounting to SAR560.41 million.

Dividend Yield: 5.2%

Saudi Networkers Services offers a compelling dividend profile, trading at 56.7% below its estimated fair value. Its dividend yield of 5.21% ranks in the top 25% of the Saudi Arabian market, supported by sustainable payout ratios with earnings and cash flows covering dividends at 64.5% and 65.9%, respectively. While dividends have been stable and growing over two years, their short history may be a consideration for some investors seeking long-term reliability.

- Click here and access our complete dividend analysis report to understand the dynamics of Saudi Networkers Services.

- Insights from our recent valuation report point to the potential undervaluation of Saudi Networkers Services shares in the market.

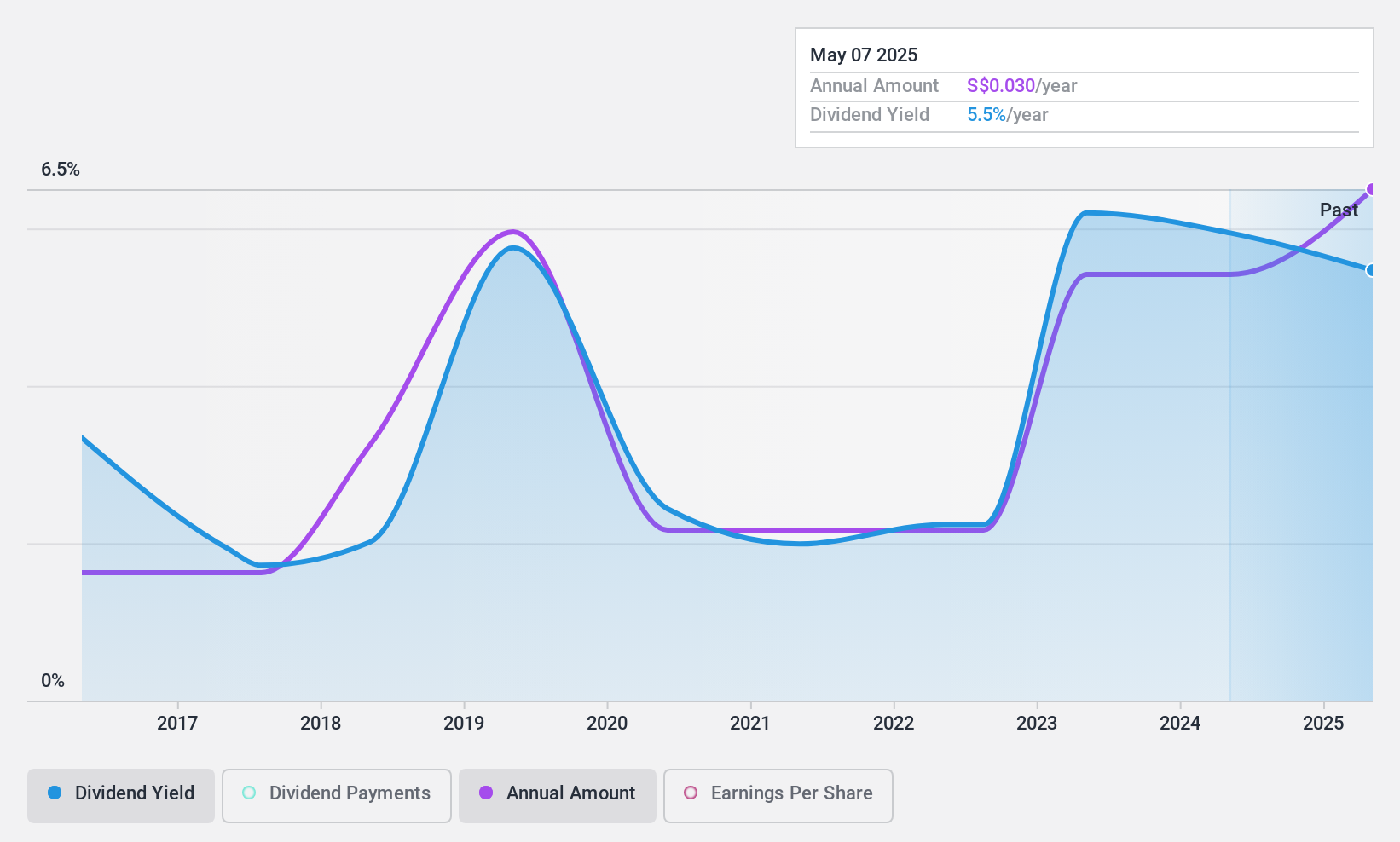

China Sunsine Chemical Holdings (SGX:QES)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: China Sunsine Chemical Holdings Ltd. is an investment holding company that manufactures and sells specialty chemicals globally, with a market cap of SGD429.02 million.

Operations: China Sunsine Chemical Holdings Ltd. generates revenue from its primary segments, including CN¥4.39 billion from Rubber Chemicals, CN¥203 million from Heating Power, and CN¥25.06 million from Waste Treatment.

Dividend Yield: 5.5%

China Sunsine Chemical Holdings' dividend profile is marked by a low payout ratio of 21.1% and a cash payout ratio of 34%, indicating strong coverage by earnings and cash flows. However, its dividends have been volatile over the past decade, affecting reliability. Trading significantly below estimated fair value, it offers potential value to investors despite its lower-than-top-tier dividend yield in the Singapore market. Recent management changes could impact operational stability positively.

- Delve into the full analysis dividend report here for a deeper understanding of China Sunsine Chemical Holdings.

- Our expertly prepared valuation report China Sunsine Chemical Holdings implies its share price may be lower than expected.

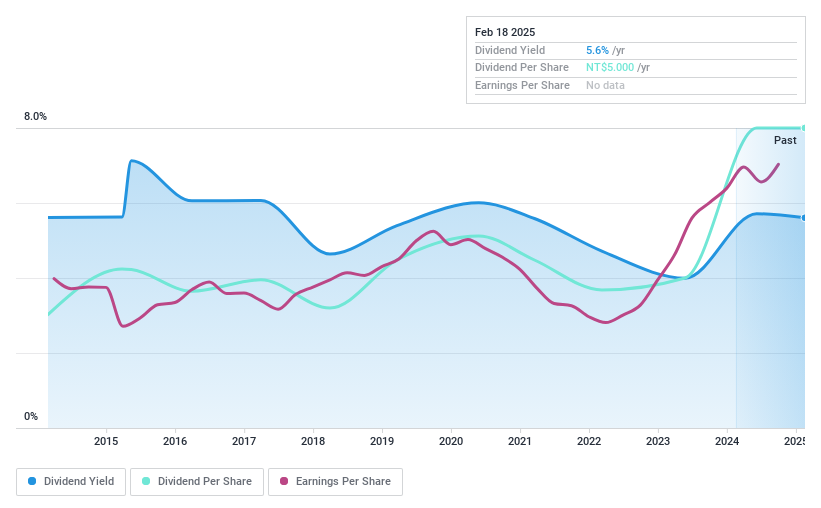

Yuanta Futures (TPEX:6023)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Yuanta Futures Co., Ltd. operates as a futures brokerage firm with a presence in Taiwan, other parts of Asia, Europe, America, and internationally, and has a market cap of NT$25.08 billion.

Operations: Yuanta Futures Co., Ltd. generates revenue primarily through its Brokers segment, which accounts for NT$3.72 billion, and its Dealers segment, contributing NT$267.84 million.

Dividend Yield: 5.8%

Yuanta Futures offers a compelling dividend profile with stable and growing dividends over the past decade. Its dividend yield of 5.78% ranks in the top 25% of Taiwan's market, supported by sustainable payout ratios—71.1% for earnings and 78.7% for cash flows. Recent earnings growth, demonstrated by increased revenue and net income, further strengthens its financial position. The recent private placement could impact shareholder value but reflects strategic capital management initiatives approved by the board.

- Click here to discover the nuances of Yuanta Futures with our detailed analytical dividend report.

- Upon reviewing our latest valuation report, Yuanta Futures' share price might be too optimistic.

Summing It All Up

- Get an in-depth perspective on all 1959 Top Dividend Stocks by using our screener here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:QES

China Sunsine Chemical Holdings

An investment holding company, manufactures and sells specialty chemicals in the People’s Republic of China, rest of Asia, the United States, Europe, and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Market Insights

Community Narratives