- Saudi Arabia

- /

- IT

- /

- SASE:7203

High Growth Tech And 2 Other Promising Tech Stocks

Reviewed by Simply Wall St

In light of recent market movements, where U.S. stocks have shown solid gains and the technology-heavy Nasdaq Composite has led the charge with significant recovery, it's clear that investor sentiment is buoyed by positive economic indicators and hopes for a soft landing. Amid this optimistic backdrop, identifying high-growth tech stocks becomes crucial as these companies often thrive in environments where innovation and consumer spending are robust.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Imeik Technology DevelopmentLtd | 26.15% | 23.64% | ★★★★★★ |

| Sarepta Therapeutics | 24.22% | 44.94% | ★★★★★★ |

| TG Therapeutics | 28.62% | 43.05% | ★★★★★★ |

| eWeLLLtd | 26.52% | 27.53% | ★★★★★★ |

| Medley | 24.97% | 30.50% | ★★★★★★ |

| G1 Therapeutics | 24.26% | 51.62% | ★★★★★★ |

| KebNi | 34.75% | 86.11% | ★★★★★★ |

| Adveritas | 66.47% | 103.87% | ★★★★★★ |

| Adocia | 59.08% | 63.00% | ★★★★★★ |

| UTI | 103.56% | 122.67% | ★★★★★★ |

Click here to see the full list of 1263 stocks from our High Growth Tech and AI Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

TeraWulf (NasdaqCM:WULF)

Simply Wall St Growth Rating: ★★★★★☆

Overview: TeraWulf Inc., along with its subsidiaries, operates as a digital asset technology company in the United States and has a market cap of $1.84 billion.

Operations: TeraWulf Inc. generates revenue primarily through digital currency mining, with a reported revenue of $120.25 million. The company focuses on leveraging advanced technology to mine digital assets efficiently within the United States.

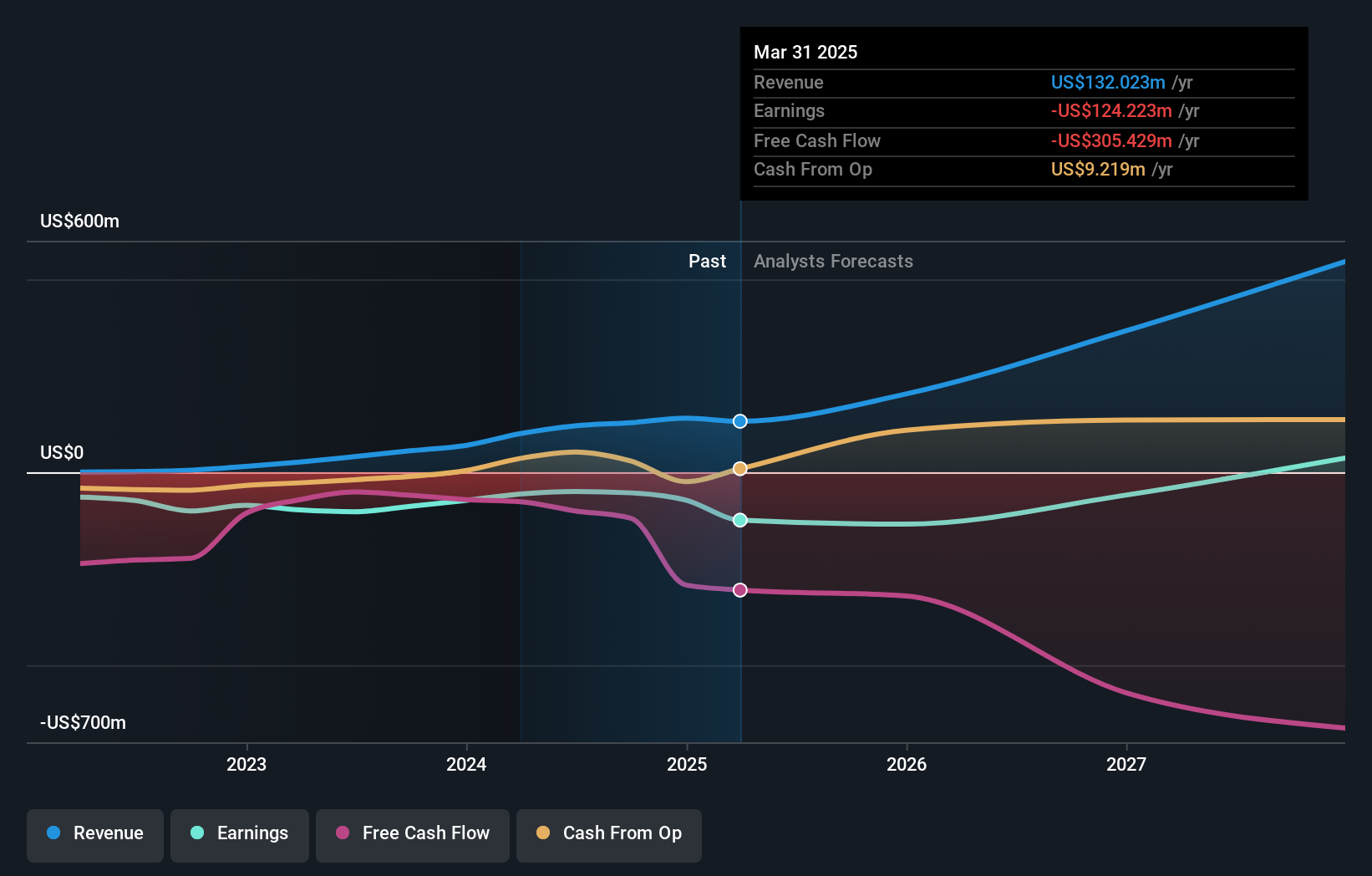

TeraWulf's revenue is forecast to grow at 45.8% per year, significantly outpacing the US market's 8.8% growth rate. Despite a net loss of $10.88 million in Q2 2024, down from $17.54 million a year ago, the company shows promise with earnings projected to increase by 112.65% annually over the next three years. With R&D expenses reflecting their commitment to innovation and financial prudence evidenced by eliminating $77.5 million in debt, TeraWulf's strategic moves position it well within the high-growth tech sector.

Neurocrine Biosciences (NasdaqGS:NBIX)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Neurocrine Biosciences, Inc. discovers, develops, and markets pharmaceuticals for neurological, neuroendocrine, and neuropsychiatric disorders in the United States and internationally with a market cap of $15.24 billion.

Operations: Neurocrine Biosciences generates revenue primarily through the research, development, and commercialization of pharmaceuticals, amounting to $2.12 billion. The company's focus is on treatments for neurological, neuroendocrine, and neuropsychiatric disorders in both domestic and international markets.

Neurocrine Biosciences reported $590.2 million in Q2 2024 revenue, a 30.36% increase from $452.7 million the previous year, while net income fell to $65 million from $95.5 million. Despite this, their R&D expenses reflect a significant commitment to innovation, with a notable increase contributing to future growth prospects; earnings are projected to grow by 29.4% annually over the next three years, outpacing the US market's 15.2%. The recent launch of INGREZZA SPRINKLE and FDA approvals for crinecerfont highlight their robust pipeline and strategic focus on high unmet medical needs within neuroendocrinology and neuropsychiatry sectors.

- Delve into the full analysis health report here for a deeper understanding of Neurocrine Biosciences.

Gain insights into Neurocrine Biosciences' past trends and performance with our Past report.

Elm (SASE:7203)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Elm Company offers ready-made and customized digital solutions in Saudi Arabia, with a market cap of SAR79.38 billion.

Operations: Elm generates revenue primarily from three segments: Digital Business (SAR4.69 billion), Professional Services (SAR152.67 million), and Business Process Outsourcing (SAR1.77 billion). The company focuses on providing tailored digital solutions within Saudi Arabia.

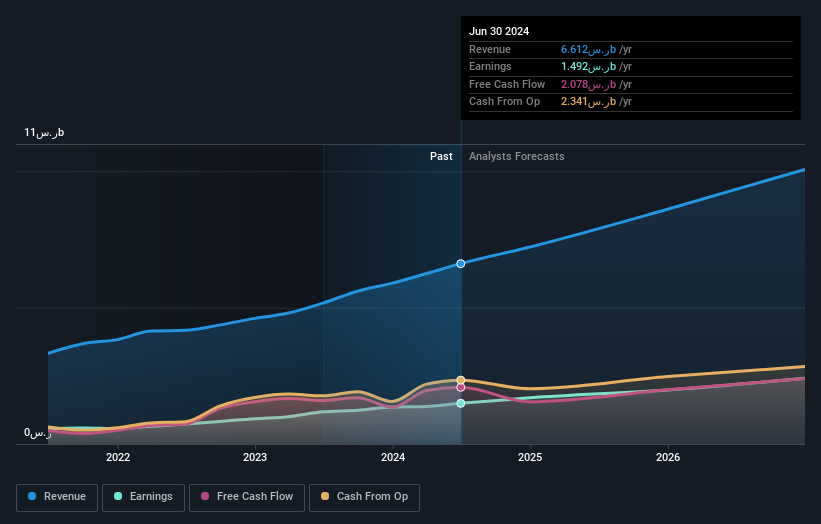

Elm's earnings are forecast to grow 18.9% annually, outpacing the SA market's 7%. The company reported Q2 sales of SAR 1.77 billion, a notable increase from SAR 1.40 billion last year, with net income rising to SAR 486.24 million from SAR 372.77 million. Their strategic partnership with the Ministry of Interior and SDAIA is poised to drive future revenue, contributing approximately 42% of total revenue in 2023 alone. Elm's commitment to R&D is evident with significant investments aimed at innovation and expansion in digital products and services.

- Get an in-depth perspective on Elm's performance by reading our health report here.

Review our historical performance report to gain insights into Elm's's past performance.

Next Steps

- Dive into all 1263 of the High Growth Tech and AI Stocks we have identified here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Elm might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SASE:7203

Elm

Provides information security services for government entities, individuals, and private sector companies in Saudi Arabia.

Flawless balance sheet with solid track record.