- Saudi Arabia

- /

- Retail Distributors

- /

- SASE:9537

Further Upside For Amwaj International Company (TADAWUL:9537) Shares Could Introduce Price Risks After 29% Bounce

Amwaj International Company (TADAWUL:9537) shareholders have had their patience rewarded with a 29% share price jump in the last month. Taking a wider view, although not as strong as the last month, the full year gain of 23% is also fairly reasonable.

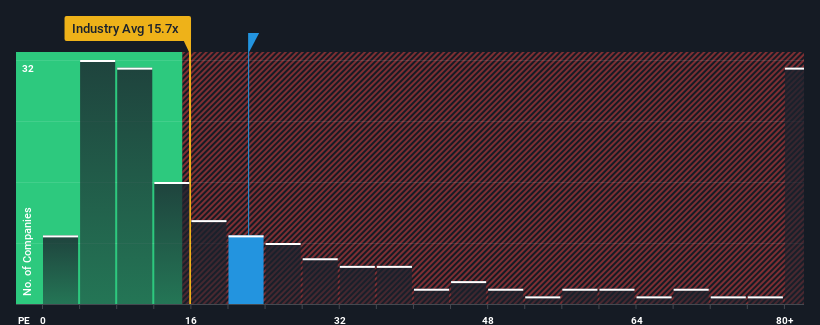

Even after such a large jump in price, Amwaj International may still be sending bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 22.1x, since almost half of all companies in Saudi Arabia have P/E ratios greater than 28x and even P/E's higher than 42x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

Earnings have risen at a steady rate over the last year for Amwaj International, which is generally not a bad outcome. It might be that many expect the respectable earnings performance to degrade, which has repressed the P/E. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

View our latest analysis for Amwaj International

Does Growth Match The Low P/E?

There's an inherent assumption that a company should underperform the market for P/E ratios like Amwaj International's to be considered reasonable.

Retrospectively, the last year delivered a decent 2.7% gain to the company's bottom line. The latest three year period has also seen an excellent 55% overall rise in EPS, aided somewhat by its short-term performance. So we can start by confirming that the company has done a great job of growing earnings over that time.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 16% shows it's about the same on an annualised basis.

In light of this, it's peculiar that Amwaj International's P/E sits below the majority of other companies. Apparently some shareholders are more bearish than recent times would indicate and have been accepting lower selling prices.

The Final Word

The latest share price surge wasn't enough to lift Amwaj International's P/E close to the market median. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Amwaj International currently trades on a lower than expected P/E since its recent three-year growth is in line with the wider market forecast. There could be some unobserved threats to earnings preventing the P/E ratio from matching the company's performance. It appears some are indeed anticipating earnings instability, because the persistence of these recent medium-term conditions should normally provide more support to the share price.

Before you settle on your opinion, we've discovered 3 warning signs for Amwaj International that you should be aware of.

Of course, you might also be able to find a better stock than Amwaj International. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SASE:9537

Amwaj International

Engages in distributing and selling electronic and home appliances.

Medium-low with adequate balance sheet.

Market Insights

Community Narratives