- Saudi Arabia

- /

- Specialty Stores

- /

- SASE:4190

Jarir Marketing Company (TADAWUL:4190) Looks Inexpensive But Perhaps Not Attractive Enough

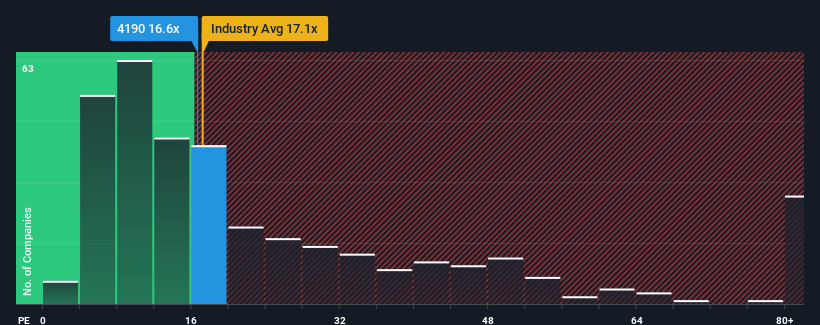

Jarir Marketing Company's (TADAWUL:4190) price-to-earnings (or "P/E") ratio of 16.6x might make it look like a buy right now compared to the market in Saudi Arabia, where around half of the companies have P/E ratios above 26x and even P/E's above 44x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

Jarir Marketing could be doing better as it's been growing earnings less than most other companies lately. The P/E is probably low because investors think this lacklustre earnings performance isn't going to get any better. If you still like the company, you'd be hoping earnings don't get any worse and that you could pick up some stock while it's out of favour.

See our latest analysis for Jarir Marketing

How Is Jarir Marketing's Growth Trending?

Jarir Marketing's P/E ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the market.

Taking a look back first, we see that there was hardly any earnings per share growth to speak of for the company over the past year. This isn't what shareholders were looking for as it means they've been left with a 4.0% decline in EPS over the last three years in total. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Shifting to the future, estimates from the twelve analysts covering the company suggest earnings should grow by 4.4% per year over the next three years. Meanwhile, the rest of the market is forecast to expand by 16% per year, which is noticeably more attractive.

With this information, we can see why Jarir Marketing is trading at a P/E lower than the market. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Bottom Line On Jarir Marketing's P/E

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Jarir Marketing's analyst forecasts revealed that its inferior earnings outlook is contributing to its low P/E. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

We don't want to rain on the parade too much, but we did also find 1 warning sign for Jarir Marketing that you need to be mindful of.

If you're unsure about the strength of Jarir Marketing's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SASE:4190

Jarir Marketing

Engages in the retail and wholesale trading of office and school supplies in the Kingdom of Saudi Arabia, Egypt, and other Gulf countries.

Flawless balance sheet, undervalued and pays a dividend.