- Saudi Arabia

- /

- Metals and Mining

- /

- SASE:1211

Saudi Arabian Mining Company (Ma'aden)'s (TADAWUL:1211) investors will be pleased with their splendid 236% return over the last five years

When you buy a stock there is always a possibility that it could drop 100%. But on the bright side, you can make far more than 100% on a really good stock. For example, the Saudi Arabian Mining Company (Ma'aden) (TADAWUL:1211) share price has soared 236% in the last half decade. Most would be very happy with that. It's down 2.8% in the last seven days.

With that in mind, it's worth seeing if the company's underlying fundamentals have been the driver of long term performance, or if there are some discrepancies.

See our latest analysis for Saudi Arabian Mining Company (Ma'aden)

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During the last half decade, Saudi Arabian Mining Company (Ma'aden) became profitable. Sometimes, the start of profitability is a major inflection point that can signal fast earnings growth to come, which in turn justifies very strong share price gains. Since the company was unprofitable five years ago, but not three years ago, it's worth taking a look at the returns in the last three years, too. We can see that the Saudi Arabian Mining Company (Ma'aden) share price is up 79% in the last three years. During the same period, EPS grew by 1.5% each year. This EPS growth is lower than the 21% average annual increase in the share price over three years. So one can reasonably conclude the market is more enthusiastic about the stock than it was three years ago.

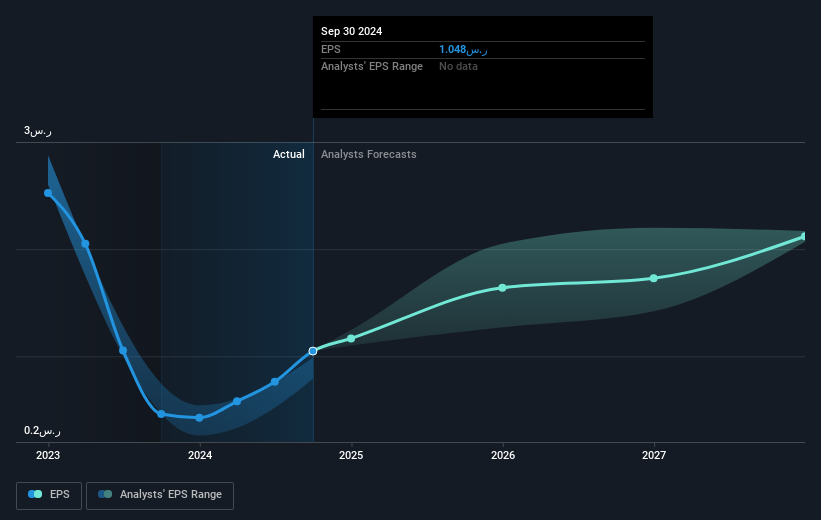

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

We know that Saudi Arabian Mining Company (Ma'aden) has improved its bottom line lately, but is it going to grow revenue? You could check out this free report showing analyst revenue forecasts.

A Different Perspective

It's good to see that Saudi Arabian Mining Company (Ma'aden) has rewarded shareholders with a total shareholder return of 3.2% in the last twelve months. However, the TSR over five years, coming in at 27% per year, is even more impressive. Potential buyers might understandably feel they've missed the opportunity, but it's always possible business is still firing on all cylinders. Is Saudi Arabian Mining Company (Ma'aden) cheap compared to other companies? These 3 valuation measures might help you decide.

Of course Saudi Arabian Mining Company (Ma'aden) may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Saudi exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SASE:1211

Saudi Arabian Mining Company (Ma'aden)

Operates as a mining and metals company in the Kingdom of Saudi Arabia, Indian Subcontinent, Japan, the United States, Europe, Australia, Brazil, Africa, GCC, and internationally.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives