- Saudi Arabia

- /

- Metals and Mining

- /

- SASE:1322

Exploring 3 Undiscovered Gems In The Middle East Market

Reviewed by Simply Wall St

As the Middle East market experiences a period of moderation with UAE stocks easing due to slipping oil prices and profit-taking, investors are keeping a close eye on broader economic indicators that could impact small-cap companies. In this environment, identifying promising stocks involves looking for those with strong fundamentals and growth potential despite the current market challenges.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Qassim Cement | NA | 4.02% | -11.40% | ★★★★★★ |

| Saudi Azm for Communication and Information Technology | 3.26% | 17.17% | 23.30% | ★★★★★★ |

| Najran Cement | 14.49% | -4.20% | -30.16% | ★★★★★★ |

| Mackolik Internet Hizmetleri Ticaret | 14.04% | 29.58% | 34.64% | ★★★★★☆ |

| Sönmez Filament Sentetik Iplik ve Elyaf Sanayi | NA | 54.80% | 42.62% | ★★★★★☆ |

| Gür-Sel Turizm Tasimacilik ve Servis Ticaret | 4.69% | 36.04% | 53.41% | ★★★★★☆ |

| Birikim Varlik Yonetim Anonim Sirketi | 59.38% | 42.42% | 36.01% | ★★★★☆☆ |

| Bosch Fren Sistemleri Sanayi ve Ticaret | 36.11% | 41.59% | 7.72% | ★★★★☆☆ |

| Blume Metal Kimya Anonim Sirketi | 4.78% | 36.99% | 42.99% | ★★★★☆☆ |

| Marmaris Altinyunus Turistik Tesisler | NA | 47.16% | -34.78% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

National Cement Company (Public Shareholding) (DFM:NCC)

Simply Wall St Value Rating: ★★★★★★

Overview: National Cement Company (Public Shareholding Co.) is involved in the production and distribution of cement and related products both within the United Arab Emirates and internationally, with a market capitalization of AED1.54 billion.

Operations: NCC's revenue primarily comes from its cement segment, which generated AED217.42 million. The company's financial performance is reflected in its net profit margin trends over recent periods, highlighting the impact of cost management on profitability.

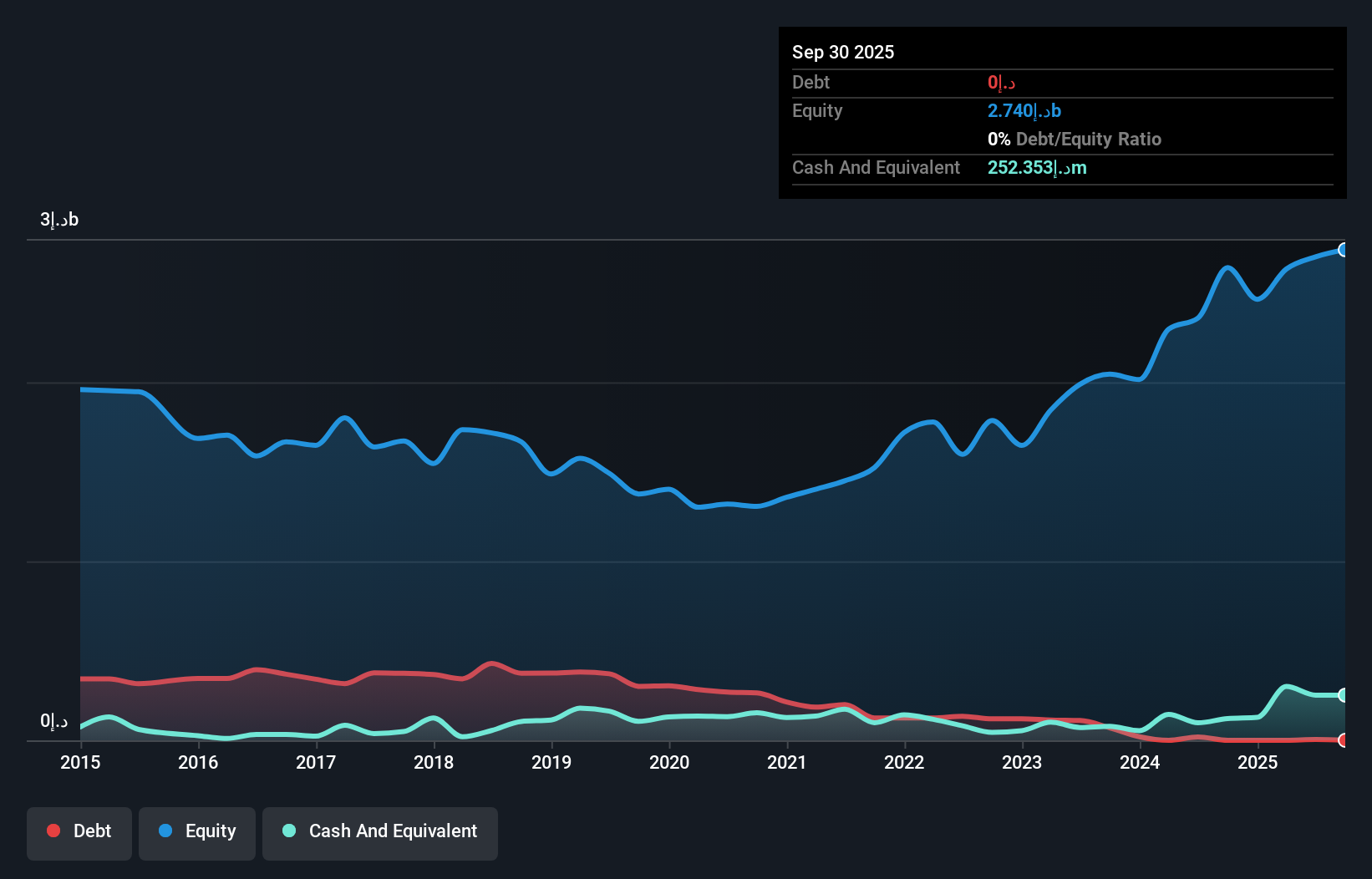

National Cement Company, a smaller player in the Middle East market, shows promise with its robust financial health. The company is debt-free, contrasting sharply with a 20.2% debt-to-equity ratio five years ago. Its earnings have impressively grown by 47% annually over the past five years, although recent growth of 23.5% lags behind the industry average of 77.1%. Trading at nearly 31% below estimated fair value suggests potential undervaluation. Recent results highlight strong performance with Q3 sales reaching AED 65 million and net income doubling to AED 14 million compared to last year’s figures, indicating solid operational progress despite volatility in share price.

Al Masane Al Kobra Mining (SASE:1322)

Simply Wall St Value Rating: ★★★★★★

Overview: Al Masane Al Kobra Mining Company is involved in the production of non-ferrous metal ores and precious metals in Saudi Arabia, with a market capitalization of SAR7.46 billion.

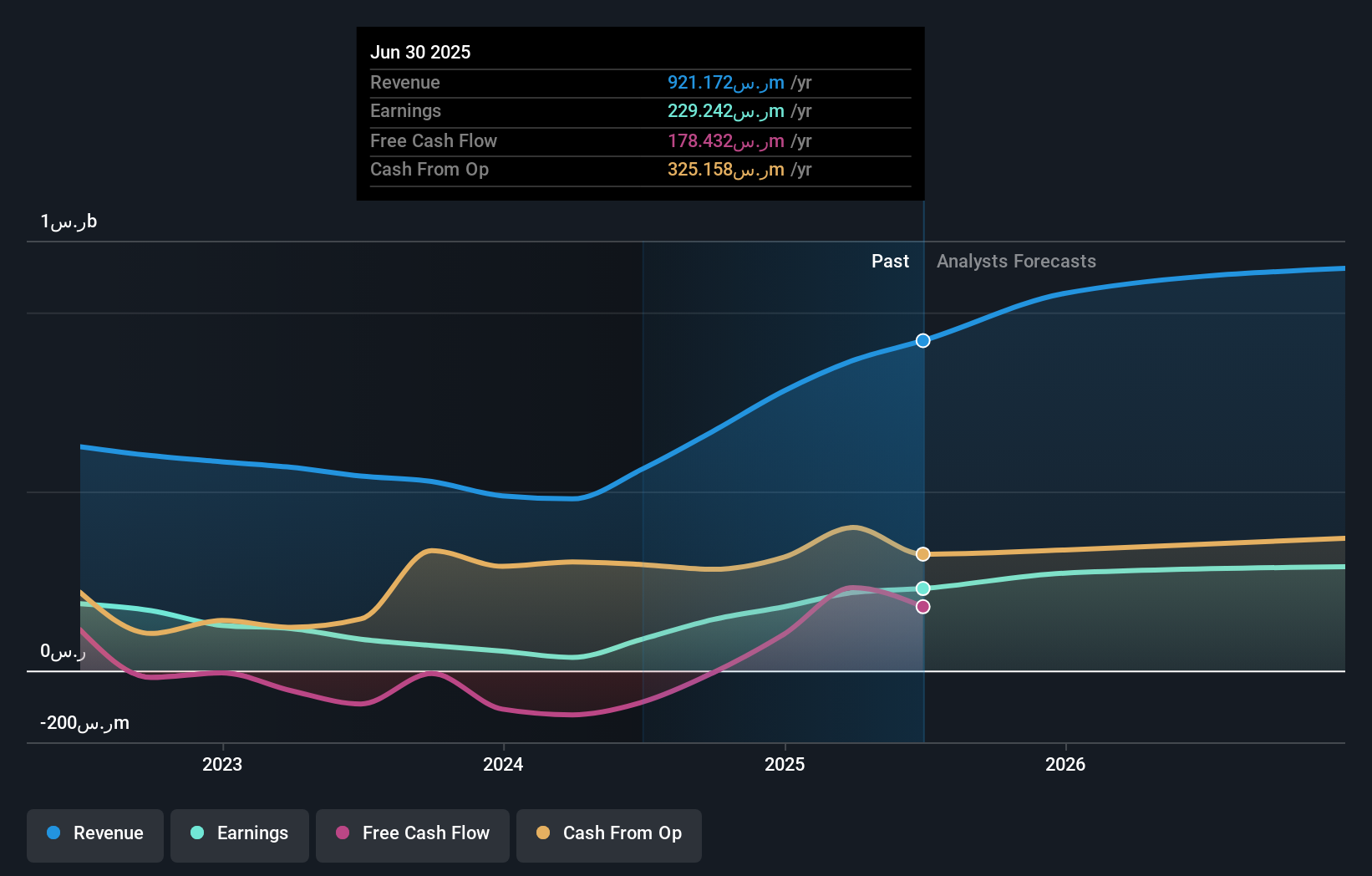

Operations: The company's revenue primarily comes from three mining segments: Mount Guyan Mine (SAR416.57 million), Moyeath Mine (SAR280.68 million), and Al Masane Mine (SAR279.02 million).

Al Masane Al Kobra Mining, a key player in the Middle East mining sector, has demonstrated robust growth with earnings surging by 75.9% over the past year, significantly outpacing the industry's 5.6% growth. The company's debt to equity ratio impressively reduced from 75.1% to 2.9% over five years, indicating strong financial management and stability. Recent discoveries of copper, zinc, gold, and silver in Najran add potential for future expansion as exploration covers less than 10% of the area so far. With sales rising to SAR 271 million this quarter from SAR 216 million last year and net income at SAR 81 million compared to SAR 60 million previously, AMAK is on a promising trajectory bolstered by its strategic resource developments and sound financial health evidenced by its P/E ratio of just under industry average at 29x.

Al Rajhi REIT Fund (SASE:4340)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Al Rajhi REIT Fund is a Sharia compliant investment fund listed on Tadawul, focusing on generating periodic income through investments in income-generating real estate assets in Saudi Arabia, with a market cap of SAR2.23 billion.

Operations: The fund primarily earns revenue from its commercial real estate investments, totaling SAR258.85 million.

Al Rajhi REIT Fund, a smaller player in the Middle East's real estate investment landscape, has demonstrated notable financial resilience. Its earnings have surged by 30.6% over the past year, outpacing the broader REIT industry which saw a -36.7% change. The fund's debt-to-equity ratio improved from 51.8% to 39.9% over five years, highlighting effective debt management with a satisfactory net debt-to-equity of 35.7%. Despite an SAR80.9M one-off gain impacting recent results, its price-to-earnings ratio of 11.9x suggests good value against the SA market average of 18.1x, while dividends remain attractive with SAR0.13 per share distributed recently.

- Click to explore a detailed breakdown of our findings in Al Rajhi REIT Fund's health report.

Explore historical data to track Al Rajhi REIT Fund's performance over time in our Past section.

Turning Ideas Into Actions

- Reveal the 185 hidden gems among our Middle Eastern Undiscovered Gems With Strong Fundamentals screener with a single click here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SASE:1322

Al Masane Al Kobra Mining

Engages in the production of non-ferrous metal ores and precious metals in Kingdom of Saudi Arabia.

Flawless balance sheet with solid track record.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)