- Saudi Arabia

- /

- REITS

- /

- SASE:4340

Al Wathba National Insurance Company PJSC And 2 Other Middle Eastern Dividend Stocks

Reviewed by Simply Wall St

Amid a backdrop of fluctuating indices and investor caution in the Middle East, highlighted by Saudi Arabia's stock index experiencing its worst session in six weeks, dividend stocks remain a focal point for those seeking stability and income. In this environment, identifying robust companies with consistent dividend payouts can be an attractive strategy for investors looking to navigate market uncertainties while securing steady returns.

Top 10 Dividend Stocks In The Middle East

| Name | Dividend Yield | Dividend Rating |

| Emaar Properties PJSC (DFM:EMAAR) | 7.33% | ★★★★★☆ |

| Anadolu Hayat Emeklilik Anonim Sirketi (IBSE:ANHYT) | 7.30% | ★★★★★☆ |

| Arab National Bank (SASE:1080) | 6.00% | ★★★★★☆ |

| Saudi Awwal Bank (SASE:1060) | 5.89% | ★★★★★☆ |

| National Bank of Ras Al-Khaimah (P.S.C.) (ADX:RAKBANK) | 7.72% | ★★★★★☆ |

| Saudi National Bank (SASE:1180) | 5.70% | ★★★★★☆ |

| Saudi Telecom (SASE:7010) | 9.78% | ★★★★★☆ |

| Delek Group (TASE:DLEKG) | 8.39% | ★★★★★☆ |

| Commercial Bank of Dubai PSC (DFM:CBD) | 6.03% | ★★★★★☆ |

| Emirates NBD Bank PJSC (DFM:EMIRATESNBD) | 4.45% | ★★★★★☆ |

Click here to see the full list of 74 stocks from our Top Middle Eastern Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

Al Wathba National Insurance Company PJSC (ADX:AWNIC)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Al Wathba National Insurance Company PJSC operates in the general insurance and reinsurance sectors both within the United Arab Emirates and internationally, with a market cap of AED724.50 million.

Operations: Al Wathba National Insurance Company PJSC generates its revenue primarily through its activities in the general insurance and reinsurance sectors across both domestic and international markets.

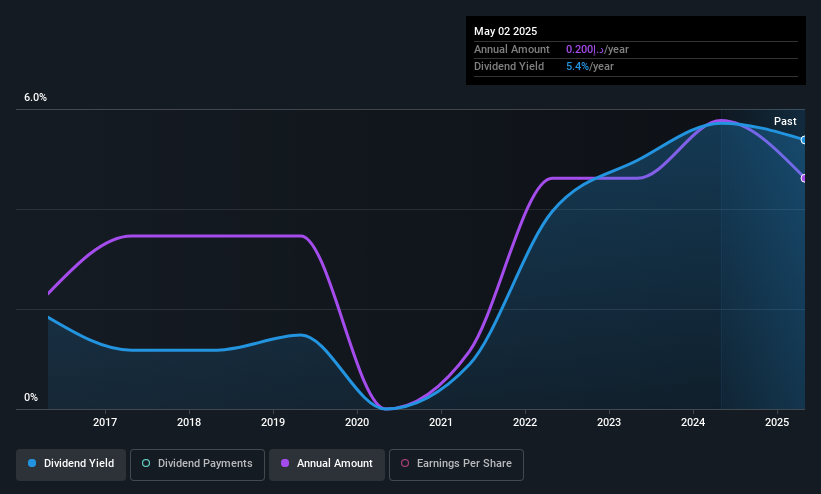

Dividend Yield: 5.7%

Al Wathba National Insurance Company PJSC's dividend payments have been volatile over the past decade, with a recent approval for a 20% cash dividend amounting to AED 41.40 million. The company's payout ratios indicate dividends are covered by earnings (84.6%) and cash flows (83.9%). Despite an increase in dividends over ten years, the stock's high volatility and recent net loss of AED 16.05 million might concern investors seeking stable income sources.

- Take a closer look at Al Wathba National Insurance Company PJSC's potential here in our dividend report.

- Insights from our recent valuation report point to the potential overvaluation of Al Wathba National Insurance Company PJSC shares in the market.

Dubai Insurance Company (P.S.C.) (DFM:DIN)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Dubai Insurance Company (P.S.C.) operates in the United Arab Emirates, offering a range of insurance products for both individuals and corporates, with a market cap of AED1.40 billion.

Operations: The company's revenue is derived from two main segments: Life and Medical insurance, which generates AED597.88 million, and Motor and General insurance, contributing AED740.23 million.

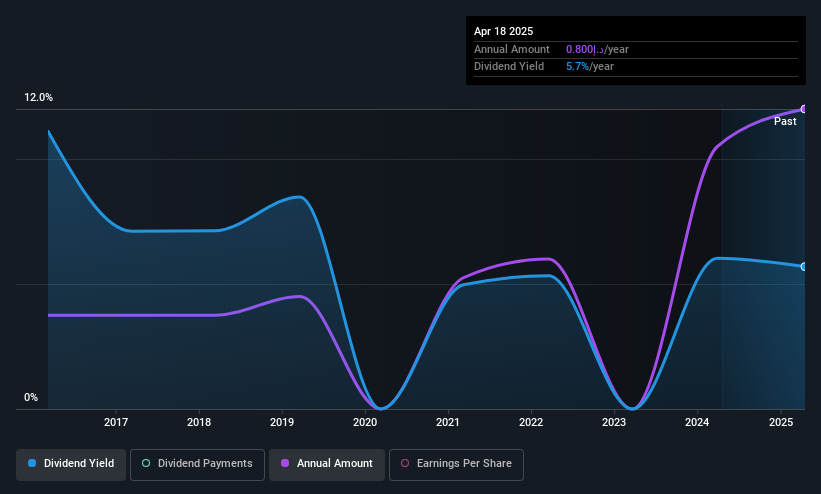

Dividend Yield: 5.7%

Dubai Insurance Company (P.S.C.) offers a stable dividend profile with consistent payments over the past decade. Despite a lower dividend yield of 5.71% compared to top-tier payers, dividends are well-covered by earnings and cash flows, indicated by payout ratios of 59.3% and 38.9%, respectively. The recent net income increase to AED 46.46 million for Q1 2025 supports its reliable dividend strategy, although profit margins have declined from last year’s figures.

- Click here to discover the nuances of Dubai Insurance Company (P.S.C.) with our detailed analytical dividend report.

- The valuation report we've compiled suggests that Dubai Insurance Company (P.S.C.)'s current price could be inflated.

Al Rajhi REIT Fund (SASE:4340)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: The Al Rajhi REIT Fund is a Sharia-compliant investment fund listed on Tadawul that focuses on generating periodic income through investments in income-generating real estate assets in Saudi Arabia, with a market cap of SAR2.30 billion.

Operations: The Al Rajhi REIT Fund derives its revenue primarily from the commercial real estate segment, generating SAR260.26 million.

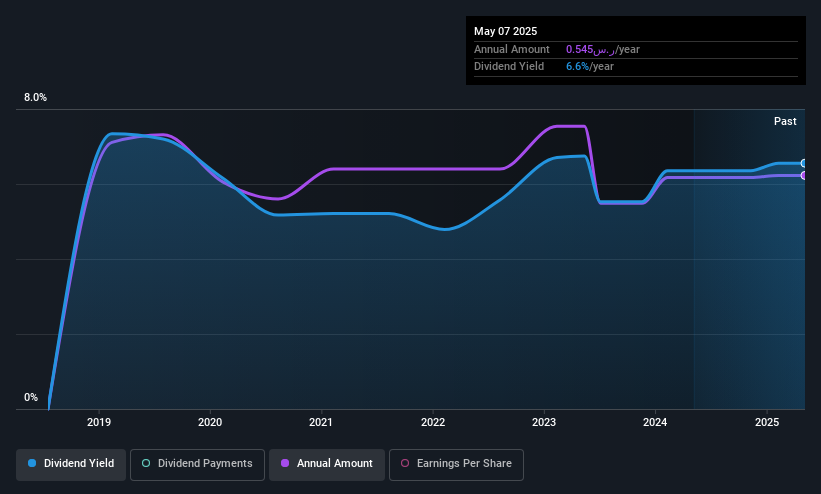

Dividend Yield: 6.5%

Al Rajhi REIT Fund's dividend payments have been volatile, with a recent decrease to SAR 0.13 per share, highlighting an unstable track record despite a yield in the top 25% of the Saudi market. The fund's payout ratios of 96.8% for earnings and 98.3% for cash flows suggest dividends are covered but leave little room for growth or stability. Earnings grew significantly last year, yet large one-off items affect financial results' quality.

- Get an in-depth perspective on Al Rajhi REIT Fund's performance by reading our dividend report here.

- Our comprehensive valuation report raises the possibility that Al Rajhi REIT Fund is priced lower than what may be justified by its financials.

Taking Advantage

- Navigate through the entire inventory of 74 Top Middle Eastern Dividend Stocks here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SASE:4340

Al Rajhi REIT Fund

The Al Rajhi REIT is a Sharia compliant fund, listed on Tadawul, with the objective of generating periodic income, through investing in income-generating real estate assets in Saudi Arabia.

Good value with proven track record and pays a dividend.

Market Insights

Community Narratives