- South Korea

- /

- Pharma

- /

- KOSE:A326030

Harvia Oyj And 2 More Stocks Estimated To Be Below Intrinsic Value

Reviewed by Simply Wall St

As global markets continue to react to political developments and economic indicators, major indexes like the S&P 500 have reached new highs amid optimism over potential trade deals and AI investments. In this environment of fluctuating growth and value stock performance, identifying stocks that are estimated to be below their intrinsic value can offer opportunities for investors seeking long-term gains.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Sichuan Injet Electric (SZSE:300820) | CN¥50.58 | CN¥100.77 | 49.8% |

| GlobalData (AIM:DATA) | £1.78 | £3.56 | 49.9% |

| Fudo Tetra (TSE:1813) | ¥2192.00 | ¥4357.83 | 49.7% |

| J Trust (TSE:8508) | ¥520.00 | ¥1039.92 | 50% |

| Bufab (OM:BUFAB) | SEK464.20 | SEK926.28 | 49.9% |

| Greenworks (Jiangsu) (SZSE:301260) | CN¥13.83 | CN¥27.64 | 50% |

| IDP Education (ASX:IEL) | A$13.17 | A$26.31 | 49.9% |

| Allied Blenders and Distillers (NSEI:ABDL) | ₹394.40 | ₹787.12 | 49.9% |

| Condor Energies (TSX:CDR) | CA$1.83 | CA$3.64 | 49.7% |

| Vista Group International (NZSE:VGL) | NZ$3.24 | NZ$6.15 | 47.3% |

Below we spotlight a couple of our favorites from our exclusive screener.

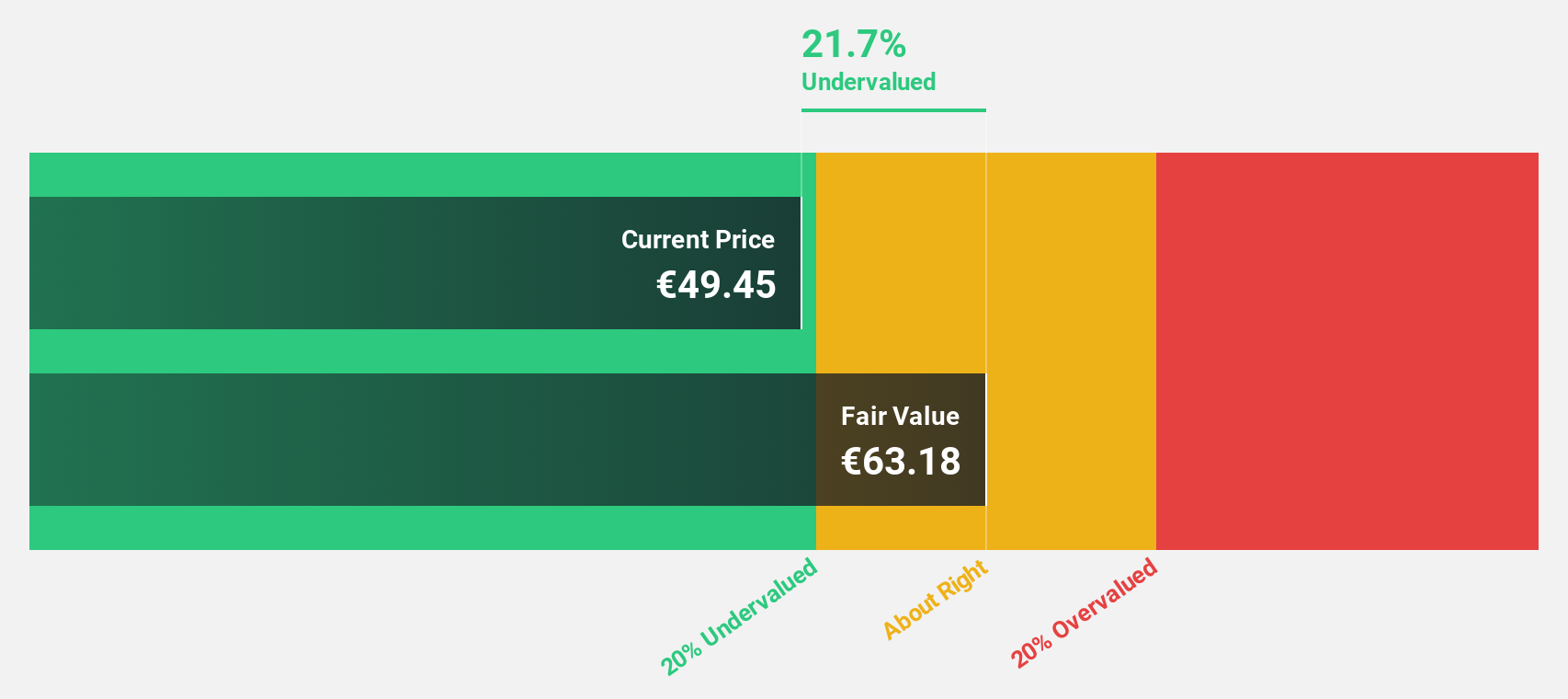

Harvia Oyj (HLSE:HARVIA)

Overview: Harvia Oyj is a company that manufactures and distributes traditional, steam, and infrared saunas, with a market cap of €885.39 million.

Operations: The company's revenue segment includes Building Materials - HVAC Equipment, generating €163.66 million.

Estimated Discount To Fair Value: 10.1%

Harvia Oyj's recent earnings report shows a positive trend, with net income for the third quarter increasing to €5.46 million from €4.47 million year-over-year, and nine-month sales reaching €124.25 million. Despite a high debt level, Harvia is trading 10.1% below its estimated fair value of €52.26 per share, suggesting it could be undervalued based on discounted cash flow analysis. Projected earnings growth outpaces the Finnish market at 17.3% annually.

- The analysis detailed in our Harvia Oyj growth report hints at robust future financial performance.

- Get an in-depth perspective on Harvia Oyj's balance sheet by reading our health report here.

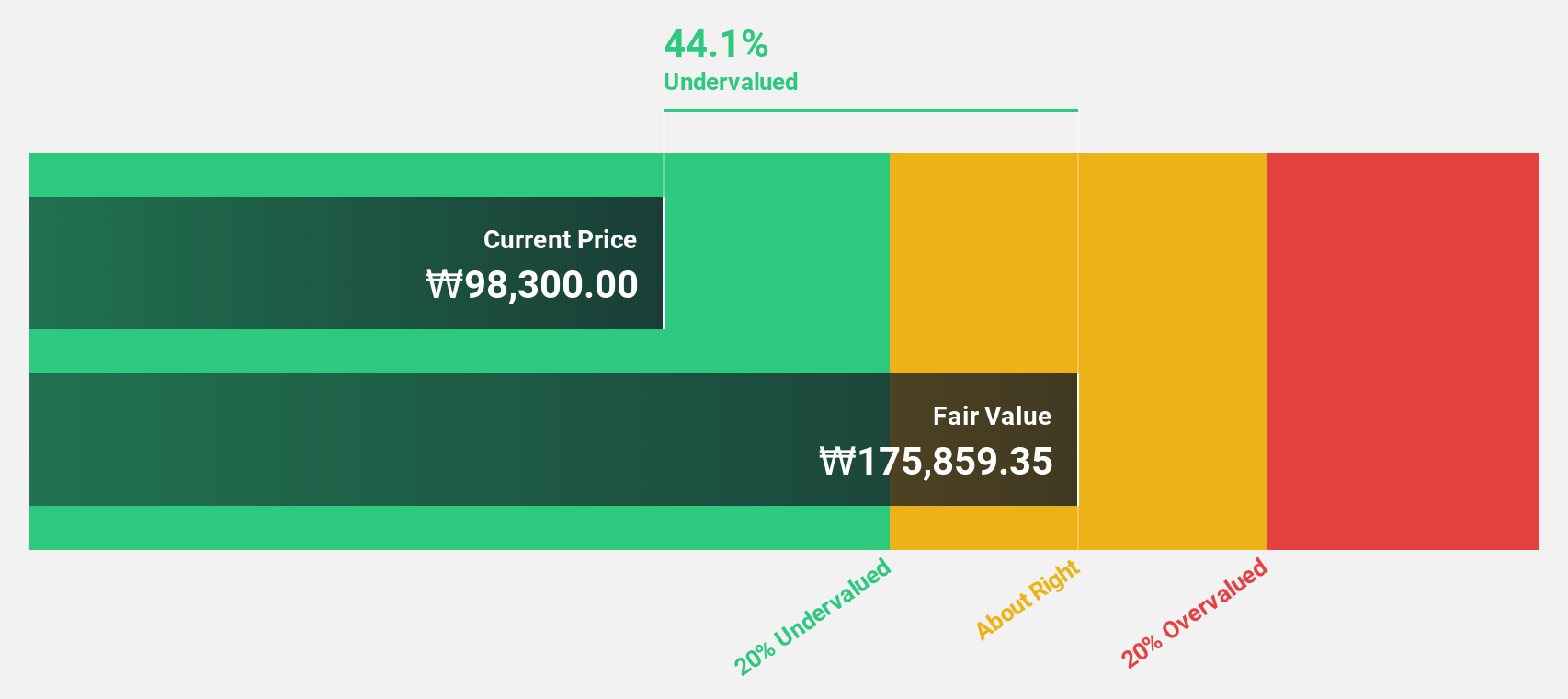

SK Biopharmaceuticals (KOSE:A326030)

Overview: SK Biopharmaceuticals Co., Ltd. is a pharmaceutical company focused on the research and development of drugs for central nervous system disorders, with a market cap of approximately ₩8.55 trillion.

Operations: The company generates revenue from its New Drug Development segment, totaling approximately ₩511.33 million.

Estimated Discount To Fair Value: 45.1%

SK Biopharmaceuticals is trading significantly below its estimated fair value of ₩198,795.73 at ₩109,200, indicating potential undervaluation based on cash flows. The company's earnings and revenue are forecast to grow substantially faster than the Korean market, with earnings expected to increase by over 51% annually. Recent strategic alliances in radiopharmaceutical research may enhance its pipeline and contribute to this growth trajectory, despite high non-cash earnings levels.

- Our expertly prepared growth report on SK Biopharmaceuticals implies its future financial outlook may be stronger than recent results.

- Delve into the full analysis health report here for a deeper understanding of SK Biopharmaceuticals.

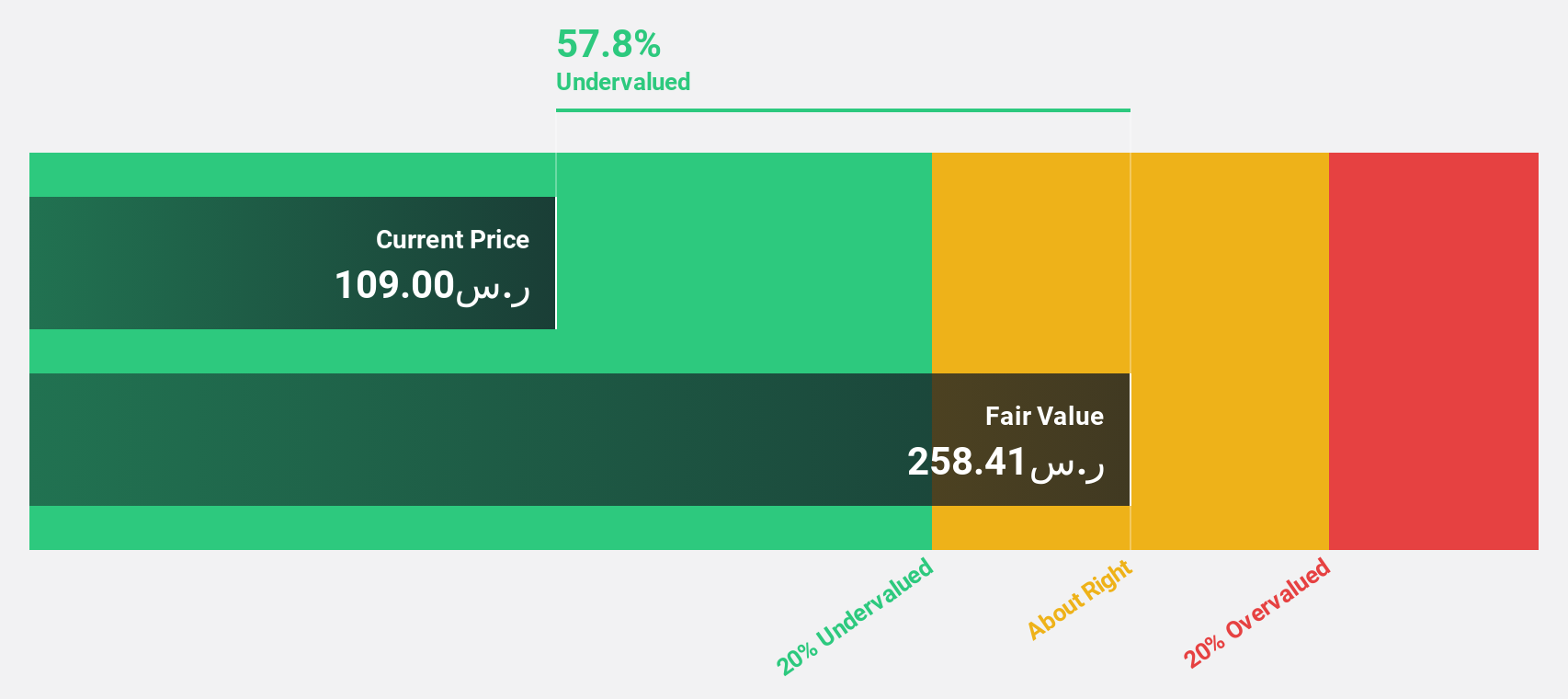

Arabian Contracting Services (SASE:4071)

Overview: Arabian Contracting Services Company, along with its subsidiaries, operates in the printing business across Saudi Arabia and Egypt, with a market capitalization of SAR8.45 billion.

Operations: The company's revenue primarily stems from its Advertising Segment, which generated SAR1.52 billion.

Estimated Discount To Fair Value: 12.2%

Arabian Contracting Services is trading at SAR 153.6, below its fair value of SAR 174.86, suggesting potential undervaluation based on cash flows. Despite lower profit margins this year, earnings are forecast to grow at 28.1% annually, outpacing the Saudi Arabian market's growth rate of 6%. Recent private placements and strong revenue growth forecasts bolster its financial outlook, though interest payments remain a concern due to insufficient coverage by earnings.

- Our earnings growth report unveils the potential for significant increases in Arabian Contracting Services' future results.

- Navigate through the intricacies of Arabian Contracting Services with our comprehensive financial health report here.

Where To Now?

- Delve into our full catalog of 904 Undervalued Stocks Based On Cash Flows here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A326030

SK Biopharmaceuticals

A pharmaceutical company, engages in the research and development of drugs for the treatment of central nervous system disorders.

Exceptional growth potential with excellent balance sheet.

Market Insights

Community Narratives