- Saudi Arabia

- /

- Packaging

- /

- SASE:9548

Arabian Plastic Industrial (TADAWUL:9548) Shareholders Will Want The ROCE Trajectory To Continue

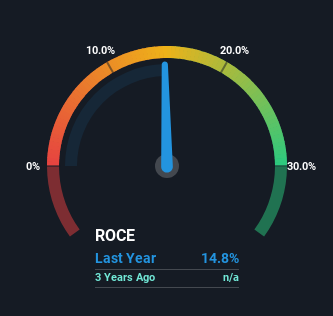

Finding a business that has the potential to grow substantially is not easy, but it is possible if we look at a few key financial metrics. Typically, we'll want to notice a trend of growing return on capital employed (ROCE) and alongside that, an expanding base of capital employed. This shows us that it's a compounding machine, able to continually reinvest its earnings back into the business and generate higher returns. Speaking of which, we noticed some great changes in Arabian Plastic Industrial's (TADAWUL:9548) returns on capital, so let's have a look.

Understanding Return On Capital Employed (ROCE)

Just to clarify if you're unsure, ROCE is a metric for evaluating how much pre-tax income (in percentage terms) a company earns on the capital invested in its business. The formula for this calculation on Arabian Plastic Industrial is:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.15 = ر.س14m ÷ (ر.س164m - ر.س69m) (Based on the trailing twelve months to June 2023).

Thus, Arabian Plastic Industrial has an ROCE of 15%. In absolute terms, that's a pretty normal return, and it's somewhat close to the Packaging industry average of 13%.

Check out our latest analysis for Arabian Plastic Industrial

Historical performance is a great place to start when researching a stock so above you can see the gauge for Arabian Plastic Industrial's ROCE against it's prior returns. If you'd like to look at how Arabian Plastic Industrial has performed in the past in other metrics, you can view this free graph of past earnings, revenue and cash flow.

What Does the ROCE Trend For Arabian Plastic Industrial Tell Us?

Arabian Plastic Industrial's ROCE growth is quite impressive. The figures show that over the last two years, ROCE has grown 55% whilst employing roughly the same amount of capital. So our take on this is that the business has increased efficiencies to generate these higher returns, all the while not needing to make any additional investments. It's worth looking deeper into this though because while it's great that the business is more efficient, it might also mean that going forward the areas to invest internally for the organic growth are lacking.

Another thing to note, Arabian Plastic Industrial has a high ratio of current liabilities to total assets of 42%. This effectively means that suppliers (or short-term creditors) are funding a large portion of the business, so just be aware that this can introduce some elements of risk. Ideally we'd like to see this reduce as that would mean fewer obligations bearing risks.

The Key Takeaway

To bring it all together, Arabian Plastic Industrial has done well to increase the returns it's generating from its capital employed. And investors seem to expect more of this going forward, since the stock has rewarded shareholders with a 36% return over the last year. In light of that, we think it's worth looking further into this stock because if Arabian Plastic Industrial can keep these trends up, it could have a bright future ahead.

On a final note, we found 2 warning signs for Arabian Plastic Industrial (1 is significant) you should be aware of.

If you want to search for solid companies with great earnings, check out this free list of companies with good balance sheets and impressive returns on equity.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SASE:9548

Arabian Plastic Industrial

Produces and sells injection molding, extrusion film, blow molding, and thermoforming disposable products in the Kingdom of Saudi Arabia.

Moderate with acceptable track record.

Market Insights

Community Narratives