- Saudi Arabia

- /

- Basic Materials

- /

- SASE:3005

Can You Imagine How Umm Al-Qura Cement's (TADAWUL:3005) Shareholders Feel About The 86% Share Price Increase?

One simple way to benefit from the stock market is to buy an index fund. But if you buy good businesses at attractive prices, your portfolio returns could exceed the average market return. For example, the Umm Al-Qura Cement Company (TADAWUL:3005) share price is up 86% in the last three years, clearly besting the market return of around 18% (not including dividends). On the other hand, the returns haven't been quite so good recently, with shareholders up just 53% , including dividends .

See our latest analysis for Umm Al-Qura Cement

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

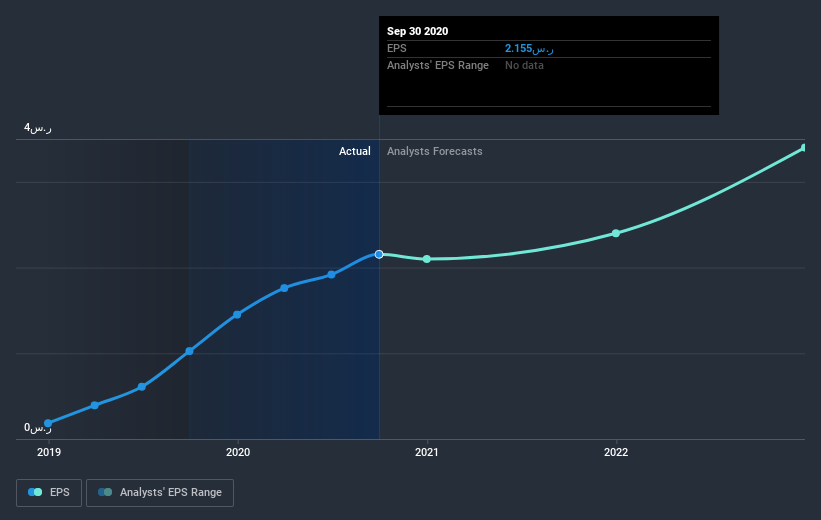

Umm Al-Qura Cement was able to grow its EPS at 54% per year over three years, sending the share price higher. The average annual share price increase of 23% is actually lower than the EPS growth. So one could reasonably conclude that the market has cooled on the stock.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

We know that Umm Al-Qura Cement has improved its bottom line over the last three years, but what does the future have in store? You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. We note that for Umm Al-Qura Cement the TSR over the last 3 years was 93%, which is better than the share price return mentioned above. This is largely a result of its dividend payments!

A Different Perspective

It's nice to see that Umm Al-Qura Cement shareholders have received a total shareholder return of 53% over the last year. That's including the dividend. That's better than the annualised return of 4% over half a decade, implying that the company is doing better recently. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. It's always interesting to track share price performance over the longer term. But to understand Umm Al-Qura Cement better, we need to consider many other factors. For instance, we've identified 1 warning sign for Umm Al-Qura Cement that you should be aware of.

Of course Umm Al-Qura Cement may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on SA exchanges.

When trading Umm Al-Qura Cement or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SASE:3005

Umm Al-Qura Cement

Manufactures and sells clinker and cement products in the Kingdom of Saudi Arabia.

Excellent balance sheet with reasonable growth potential.