- Saudi Arabia

- /

- Chemicals

- /

- SASE:2350

Potential Upside For Saudi Kayan Petrochemical Company (TADAWUL:2350) Not Without Risk

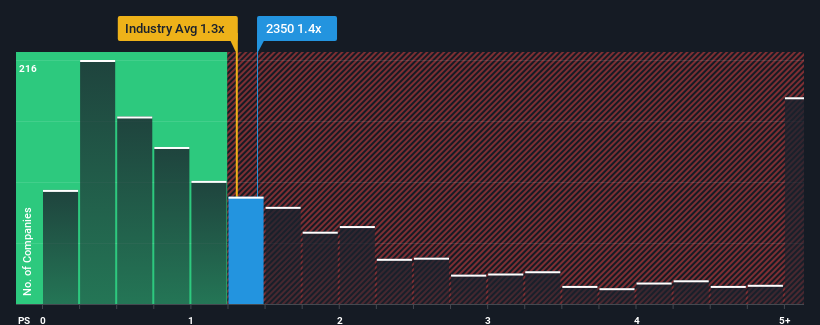

With a median price-to-sales (or "P/S") ratio of close to 1.9x in the Chemicals industry in Saudi Arabia, you could be forgiven for feeling indifferent about Saudi Kayan Petrochemical Company's (TADAWUL:2350) P/S ratio of 1.4x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

View our latest analysis for Saudi Kayan Petrochemical

What Does Saudi Kayan Petrochemical's Recent Performance Look Like?

Saudi Kayan Petrochemical has been doing a reasonable job lately as its revenue hasn't declined as much as most other companies. One possibility is that the P/S ratio is moderate because investors think this relatively better revenue performance might be about to evaporate. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value. In saying that, existing shareholders probably aren't too pessimistic about the share price if the company's revenue continues outplaying the industry.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Saudi Kayan Petrochemical.How Is Saudi Kayan Petrochemical's Revenue Growth Trending?

In order to justify its P/S ratio, Saudi Kayan Petrochemical would need to produce growth that's similar to the industry.

Retrospectively, the last year delivered a frustrating 1.7% decrease to the company's top line. This means it has also seen a slide in revenue over the longer-term as revenue is down 18% in total over the last three years. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 7.0% per year during the coming three years according to the eight analysts following the company. Meanwhile, the rest of the industry is forecast to only expand by 4.7% each year, which is noticeably less attractive.

With this in consideration, we find it intriguing that Saudi Kayan Petrochemical's P/S is closely matching its industry peers. It may be that most investors aren't convinced the company can achieve future growth expectations.

What Does Saudi Kayan Petrochemical's P/S Mean For Investors?

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Looking at Saudi Kayan Petrochemical's analyst forecasts revealed that its superior revenue outlook isn't giving the boost to its P/S that we would've expected. There could be some risks that the market is pricing in, which is preventing the P/S ratio from matching the positive outlook. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

A lot of potential risks can sit within a company's balance sheet. You can assess many of the main risks through our free balance sheet analysis for Saudi Kayan Petrochemical with six simple checks.

If these risks are making you reconsider your opinion on Saudi Kayan Petrochemical, explore our interactive list of high quality stocks to get an idea of what else is out there.

If you're looking to trade Saudi Kayan Petrochemical, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SASE:2350

Saudi Kayan Petrochemical

Manufactures and sells chemicals, polymers, and specialty products.

Very undervalued with reasonable growth potential.

Market Insights

Community Narratives