- Saudi Arabia

- /

- Chemicals

- /

- SASE:2290

With Yanbu National Petrochemical Company (TADAWUL:2290) It Looks Like You'll Get What You Pay For

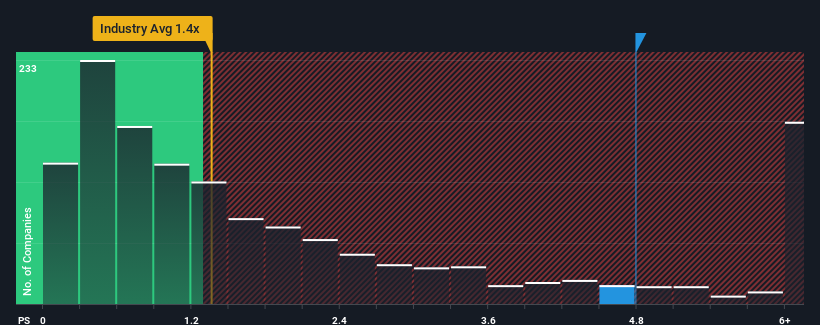

When close to half the companies in the Chemicals industry in Saudi Arabia have price-to-sales ratios (or "P/S") below 2x, you may consider Yanbu National Petrochemical Company (TADAWUL:2290) as a stock to avoid entirely with its 4.8x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

View our latest analysis for Yanbu National Petrochemical

How Has Yanbu National Petrochemical Performed Recently?

Recent times haven't been great for Yanbu National Petrochemical as its revenue has been falling quicker than most other companies. One possibility is that the P/S ratio is high because investors think the company will turn things around completely and accelerate past most others in the industry. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Yanbu National Petrochemical.How Is Yanbu National Petrochemical's Revenue Growth Trending?

Yanbu National Petrochemical's P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

Retrospectively, the last year delivered a frustrating 42% decrease to the company's top line. As a result, revenue from three years ago have also fallen 13% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Turning to the outlook, the next three years should generate growth of 21% per year as estimated by the ten analysts watching the company. With the industry only predicted to deliver 4.1% per year, the company is positioned for a stronger revenue result.

In light of this, it's understandable that Yanbu National Petrochemical's P/S sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Bottom Line On Yanbu National Petrochemical's P/S

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our look into Yanbu National Petrochemical shows that its P/S ratio remains high on the merit of its strong future revenues. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. Unless these conditions change, they will continue to provide strong support to the share price.

It is also worth noting that we have found 1 warning sign for Yanbu National Petrochemical that you need to take into consideration.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SASE:2290

Yanbu National Petrochemical

Manufactures and sells petrochemical products in the Kingdom of Saudi Arabia, the United States, Africa, the Middle East, Europe, and Asia.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives