- Saudi Arabia

- /

- Chemicals

- /

- SASE:2250

Some Investors May Be Worried About Saudi Industrial Investment Group's (TADAWUL:2250) Returns On Capital

To avoid investing in a business that's in decline, there's a few financial metrics that can provide early indications of aging. Businesses in decline often have two underlying trends, firstly, a declining return on capital employed (ROCE) and a declining base of capital employed. This indicates to us that the business is not only shrinking the size of its net assets, but its returns are falling as well. On that note, looking into Saudi Industrial Investment Group (TADAWUL:2250), we weren't too upbeat about how things were going.

Understanding Return On Capital Employed (ROCE)

For those that aren't sure what ROCE is, it measures the amount of pre-tax profits a company can generate from the capital employed in its business. The formula for this calculation on Saudi Industrial Investment Group is:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.048 = ر.س799m ÷ (ر.س19b - ر.س2.5b) (Based on the trailing twelve months to December 2020).

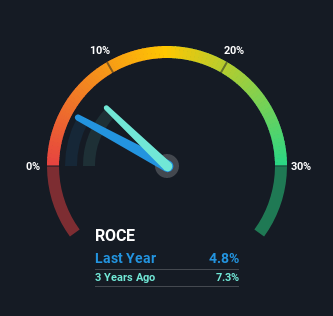

So, Saudi Industrial Investment Group has an ROCE of 4.8%. On its own, that's a low figure but it's around the 5.8% average generated by the Chemicals industry.

View our latest analysis for Saudi Industrial Investment Group

Above you can see how the current ROCE for Saudi Industrial Investment Group compares to its prior returns on capital, but there's only so much you can tell from the past. If you'd like, you can check out the forecasts from the analysts covering Saudi Industrial Investment Group here for free.

The Trend Of ROCE

We are a bit anxious about the trends of ROCE at Saudi Industrial Investment Group. Unfortunately, returns have declined substantially over the last five years to the 4.8% we see today. What's equally concerning is that the amount of capital deployed in the business has shrunk by 31% over that same period. The combination of lower ROCE and less capital employed can indicate that a business is likely to be facing some competitive headwinds or seeing an erosion to its moat. If these underlying trends continue, we wouldn't be too optimistic going forward.

In Conclusion...

In summary, it's unfortunate that Saudi Industrial Investment Group is shrinking its capital base and also generating lower returns. Since the stock has skyrocketed 220% over the last five years, it looks like investors have high expectations of the stock. Regardless, we don't feel too comfortable with the fundamentals so we'd be steering clear of this stock for now.

If you'd like to know about the risks facing Saudi Industrial Investment Group, we've discovered 4 warning signs that you should be aware of.

While Saudi Industrial Investment Group isn't earning the highest return, check out this free list of companies that are earning high returns on equity with solid balance sheets.

If you’re looking to trade a wide range of investments, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SASE:2250

Saudi Industrial Investment Group

Operates as a petrochemical company in the Kingdom of Saudi Arabia.

Flawless balance sheet with moderate growth potential.

Market Insights

Community Narratives