- Saudi Arabia

- /

- Metals and Mining

- /

- SASE:2240

Did You Miss Zamil Industrial Investment's (TADAWUL:2240) 79% Share Price Gain?

These days it's easy to simply buy an index fund, and your returns should (roughly) match the market. But you can significantly boost your returns by picking above-average stocks. For example, the Zamil Industrial Investment Company (TADAWUL:2240) share price is up 79% in the last year, clearly besting the market return of around 27% (not including dividends). That's a solid performance by our standards! On the other hand, longer term shareholders have had a tougher run, with the stock falling 7.7% in three years.

View our latest analysis for Zamil Industrial Investment

Because Zamil Industrial Investment made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Zamil Industrial Investment actually shrunk its revenue over the last year, with a reduction of 21%. Despite the lack of revenue growth, the stock has returned a solid 79% the last twelve months. We can correlate the share price rise with revenue or profit growth, but it seems the market had previously expected weaker results, and sentiment around the stock is improving.

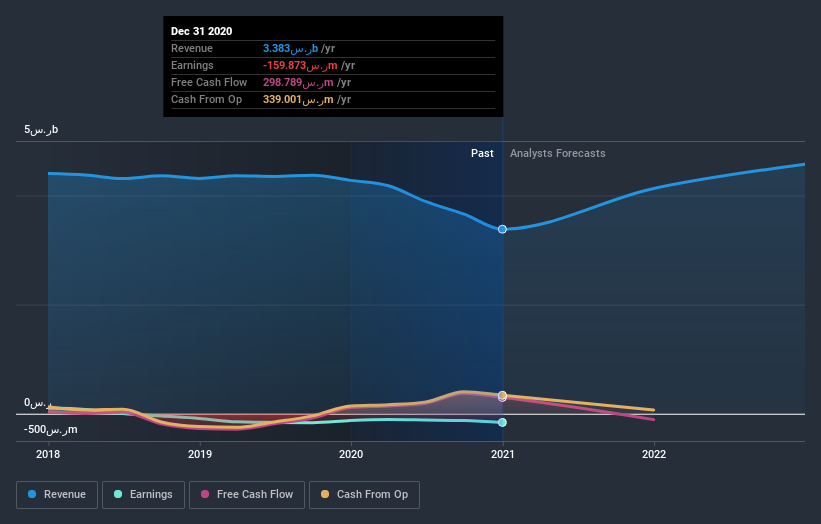

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. So we recommend checking out this free report showing consensus forecasts

A Different Perspective

It's good to see that Zamil Industrial Investment has rewarded shareholders with a total shareholder return of 79% in the last twelve months. Notably the five-year annualised TSR loss of 1.0% per year compares very unfavourably with the recent share price performance. We generally put more weight on the long term performance over the short term, but the recent improvement could hint at a (positive) inflection point within the business. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Even so, be aware that Zamil Industrial Investment is showing 1 warning sign in our investment analysis , you should know about...

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on SA exchanges.

When trading Zamil Industrial Investment or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Zamil Industrial Investment might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SASE:2240

Zamil Industrial Investment

Engages in the design and engineering, manufacturing, and fabrication of construction materials, pre-engineering steel buildings, steel structures, air conditions, and climate control systems for commercial, industrial, and residential applications, as well as for telecom and broadcasting towers, process equipment, fiberglass, rockwool and engineering plastic foam insulation, and solar power projects.

Reasonable growth potential and fair value.