- Saudi Arabia

- /

- Food and Staples Retail

- /

- SASE:4061

Take Care Before Jumping Onto Anaam International Holding Group Company (TADAWUL:4061) Even Though It's 95% Cheaper

The Anaam International Holding Group Company (TADAWUL:4061) share price has fared very poorly over the last month, falling by a substantial 95%. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 94% loss during that time.

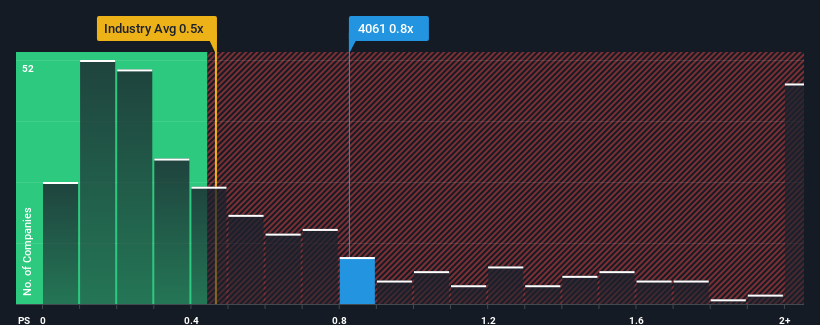

Although its price has dipped substantially, it's still not a stretch to say that Anaam International Holding Group's price-to-sales (or "P/S") ratio of 0.8x right now seems quite "middle-of-the-road" compared to the Consumer Retailing industry in Saudi Arabia, where the median P/S ratio is around 1.3x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Check out our latest analysis for Anaam International Holding Group

What Does Anaam International Holding Group's Recent Performance Look Like?

For example, consider that Anaam International Holding Group's financial performance has been pretty ordinary lately as revenue growth is non-existent. One possibility is that the P/S is moderate because investors think this benign revenue growth rate might not be enough to outperform the broader industry in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Although there are no analyst estimates available for Anaam International Holding Group, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is Anaam International Holding Group's Revenue Growth Trending?

Anaam International Holding Group's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Retrospectively, the last year delivered virtually the same number to the company's top line as the year before. The latest three year period has seen an incredible overall rise in revenue, in spite of this mediocre revenue growth of late. Accordingly, shareholders will be pleased, but also have some serious questions to ponder about the last 12 months.

When compared to the industry's one-year growth forecast of 12%, the most recent medium-term revenue trajectory is noticeably more alluring

In light of this, it's curious that Anaam International Holding Group's P/S sits in line with the majority of other companies. It may be that most investors are not convinced the company can maintain its recent growth rates.

What We Can Learn From Anaam International Holding Group's P/S?

With its share price dropping off a cliff, the P/S for Anaam International Holding Group looks to be in line with the rest of the Consumer Retailing industry. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We didn't quite envision Anaam International Holding Group's P/S sitting in line with the wider industry, considering the revenue growth over the last three-year is higher than the current industry outlook. There could be some unobserved threats to revenue preventing the P/S ratio from matching this positive performance. At least the risk of a price drop looks to be subdued if recent medium-term revenue trends continue, but investors seem to think future revenue could see some volatility.

It is also worth noting that we have found 4 warning signs for Anaam International Holding Group (2 don't sit too well with us!) that you need to take into consideration.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SASE:4061

Anaam International Holding Group

Through its subsidiaries, engages in the agricultural activities, foodstuff trading, and entertainment and beauty businesses.

Very low with weak fundamentals.

Market Insights

Community Narratives