- Saudi Arabia

- /

- Metals and Mining

- /

- SASE:2200

Investors Who Bought Arabian Pipes (TADAWUL:2200) Shares Five Years Ago Are Now Up 127%

When you buy a stock there is always a possibility that it could drop 100%. But on the bright side, you can make far more than 100% on a really good stock. One great example is Arabian Pipes Company (TADAWUL:2200) which saw its share price drive 127% higher over five years. On top of that, the share price is up 44% in about a quarter.

Check out our latest analysis for Arabian Pipes

Arabian Pipes isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. When a company doesn't make profits, we'd generally expect to see good revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

In the last 5 years Arabian Pipes saw its revenue grow at 14% per year. That's a pretty good long term growth rate. We'd argue this growth has been reflected in the share price which has climbed at a rate of 18% per year over in that time. It's well worth monitoring the growth trend in revenue, because if growth accelerates, that might signal an opportunity. Accelerating growth can be a sign of an inflection point - and could indicate profits lie ahead. Worth watching 100%

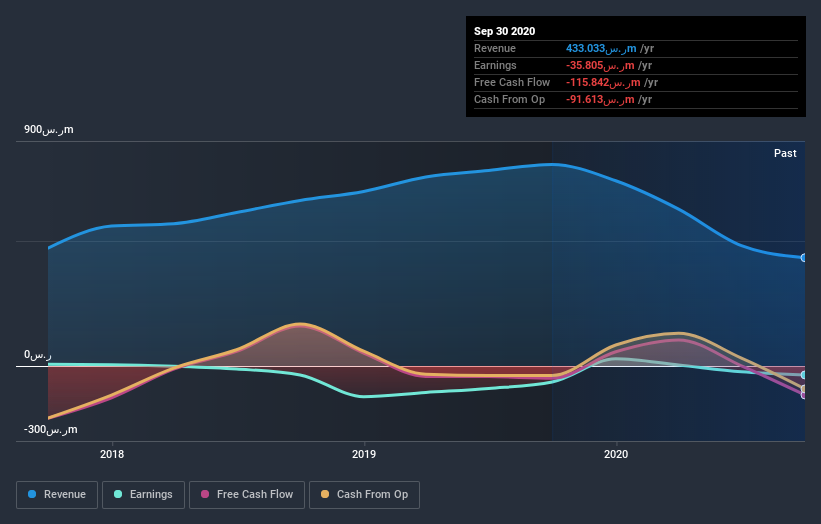

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

It's good to see that Arabian Pipes has rewarded shareholders with a total shareholder return of 47% in the last twelve months. That gain is better than the annual TSR over five years, which is 18%. Therefore it seems like sentiment around the company has been positive lately. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Like risks, for instance. Every company has them, and we've spotted 3 warning signs for Arabian Pipes (of which 2 don't sit too well with us!) you should know about.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on SA exchanges.

If you decide to trade Arabian Pipes, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

If you're looking to trade Arabian Pipes, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SASE:2200

Arabian Pipes

Engages in the production and marketing of steel tubes in the Kingdom of Saudi Arabia.

Excellent balance sheet and good value.

Market Insights

Community Narratives