- Finland

- /

- Medical Equipment

- /

- HLSE:REG1V

Revenio Group Oyj And 2 More Stocks Possibly Priced Below Their Estimated Value

Reviewed by Simply Wall St

As global markets react to the recent U.S. election results and economic policy shifts, major indices like the S&P 500 have reached record highs, fueled by investor optimism around potential growth and tax reforms. Amidst these developments, identifying stocks that may be undervalued can present intriguing opportunities for investors seeking to capitalize on discrepancies between market price and intrinsic value.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| goeasy (TSX:GSY) | CA$178.25 | CA$354.07 | 49.7% |

| KMC (Kuei Meng) International (TWSE:5306) | NT$125.00 | NT$248.24 | 49.6% |

| Aidma Holdings (TSE:7373) | ¥1698.00 | ¥3388.64 | 49.9% |

| Adventure (TSE:6030) | ¥3590.00 | ¥7109.49 | 49.5% |

| North Electro-OpticLtd (SHSE:600184) | CN¥11.35 | CN¥22.56 | 49.7% |

| Laboratorio Reig Jofre (BME:RJF) | €2.87 | €5.74 | 50% |

| Medios (XTRA:ILM1) | €14.76 | €29.48 | 49.9% |

| BuySell TechnologiesLtd (TSE:7685) | ¥3925.00 | ¥7814.84 | 49.8% |

| Delixi New Energy Technology (SHSE:603032) | CN¥17.95 | CN¥35.78 | 49.8% |

| Cellnex Telecom (BME:CLNX) | €32.47 | €64.68 | 49.8% |

Let's dive into some prime choices out of the screener.

Revenio Group Oyj (HLSE:REG1V)

Overview: Revenio Group Oyj specializes in ophthalmological devices and software for diagnosing glaucoma, macular degeneration, and diabetic retinopathy across Finland, Europe, North America, and internationally, with a market cap of €776.60 million.

Operations: Revenue from the Health Tech segment, which focuses on ophthalmological devices and software solutions for diagnosing eye conditions, amounts to €102.49 million.

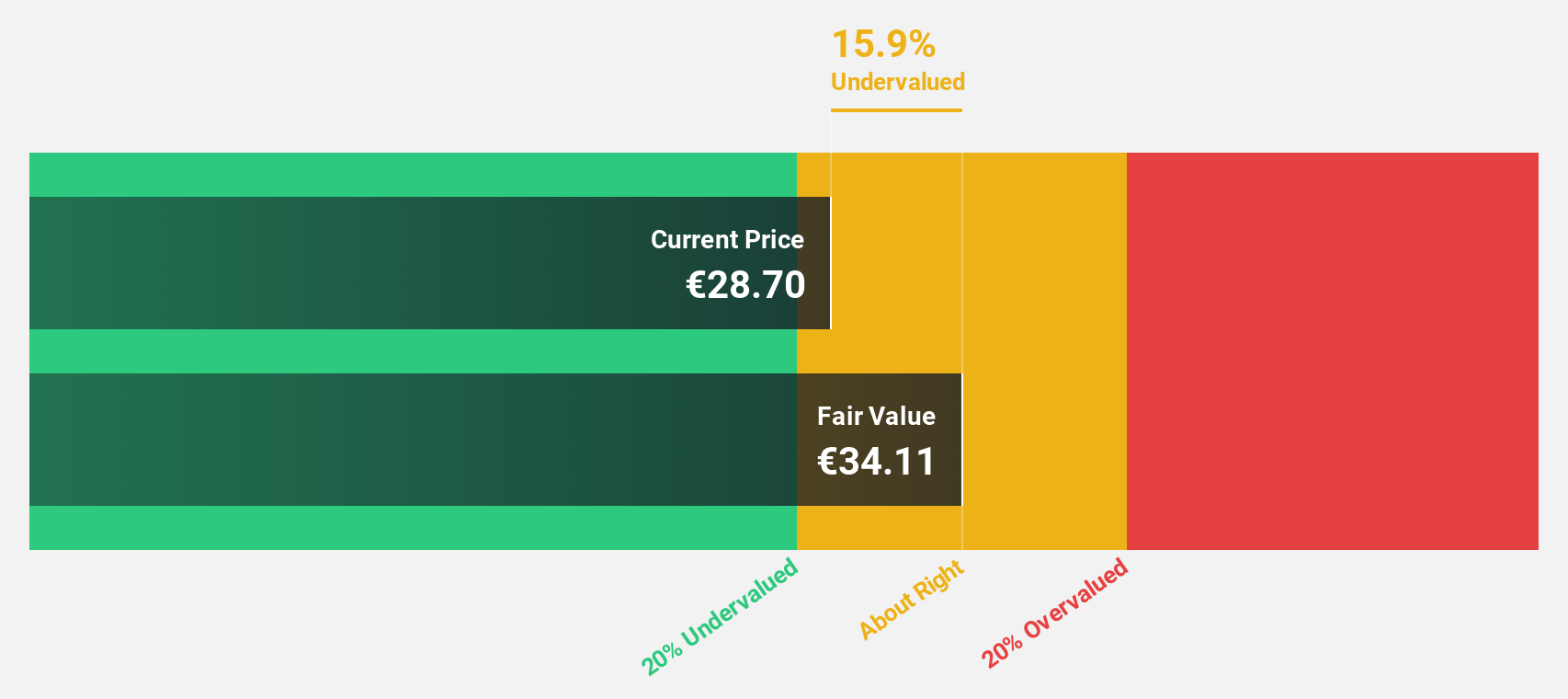

Estimated Discount To Fair Value: 23.4%

Revenio Group Oyj is trading at €29.2, which is 23.4% below its estimated fair value of €38.14, indicating potential undervaluation based on cash flows. Despite a slight decline in quarterly net income to €4.2 million from €4.5 million the previous year, revenue increased to €23.9 million from €22 million year-over-year for Q3 2024, with annual earnings growth forecasted at 19.1%, outpacing the Finnish market's growth rate of 14.3%.

- The analysis detailed in our Revenio Group Oyj growth report hints at robust future financial performance.

- Get an in-depth perspective on Revenio Group Oyj's balance sheet by reading our health report here.

National Industrialization (SASE:2060)

Overview: National Industrialization Company engages in the petrochemicals, chemicals, plastics, engineering, and metals sectors globally with a market cap of SAR7.25 billion.

Operations: The company's revenue is primarily derived from its petrochemical segment at SAR1.95 billion, followed by the downstream & others segment at SAR1.37 billion, and the chemicals segment contributing SAR433.69 million.

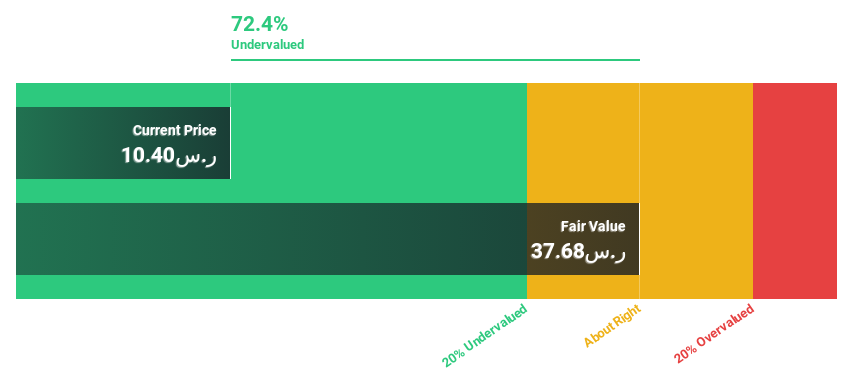

Estimated Discount To Fair Value: 44.6%

National Industrialization is trading at SAR 10.84, significantly below its estimated fair value of SAR 19.58, highlighting potential undervaluation based on cash flows. Despite a year-over-year increase in quarterly net income to SAR 89.05 million from SAR 78.21 million, nine-month profit margins have decreased to 1.4% from 6.6%. Earnings are forecasted to grow at an impressive rate of over 30% annually, outpacing the Saudi Arabian market growth expectations of 6.7%.

- Our growth report here indicates National Industrialization may be poised for an improving outlook.

- Click here to discover the nuances of National Industrialization with our detailed financial health report.

Guangzhou Fangbang ElectronicsLtd (SHSE:688020)

Overview: Guangzhou Fangbang Electronics Co., Ltd is involved in the research, development, production, sale, and service of electronic materials in China with a market cap of CN¥3.37 billion.

Operations: Guangzhou Fangbang Electronics Co., Ltd generates its revenue through the research, development, production, sale, and service of electronic materials in China.

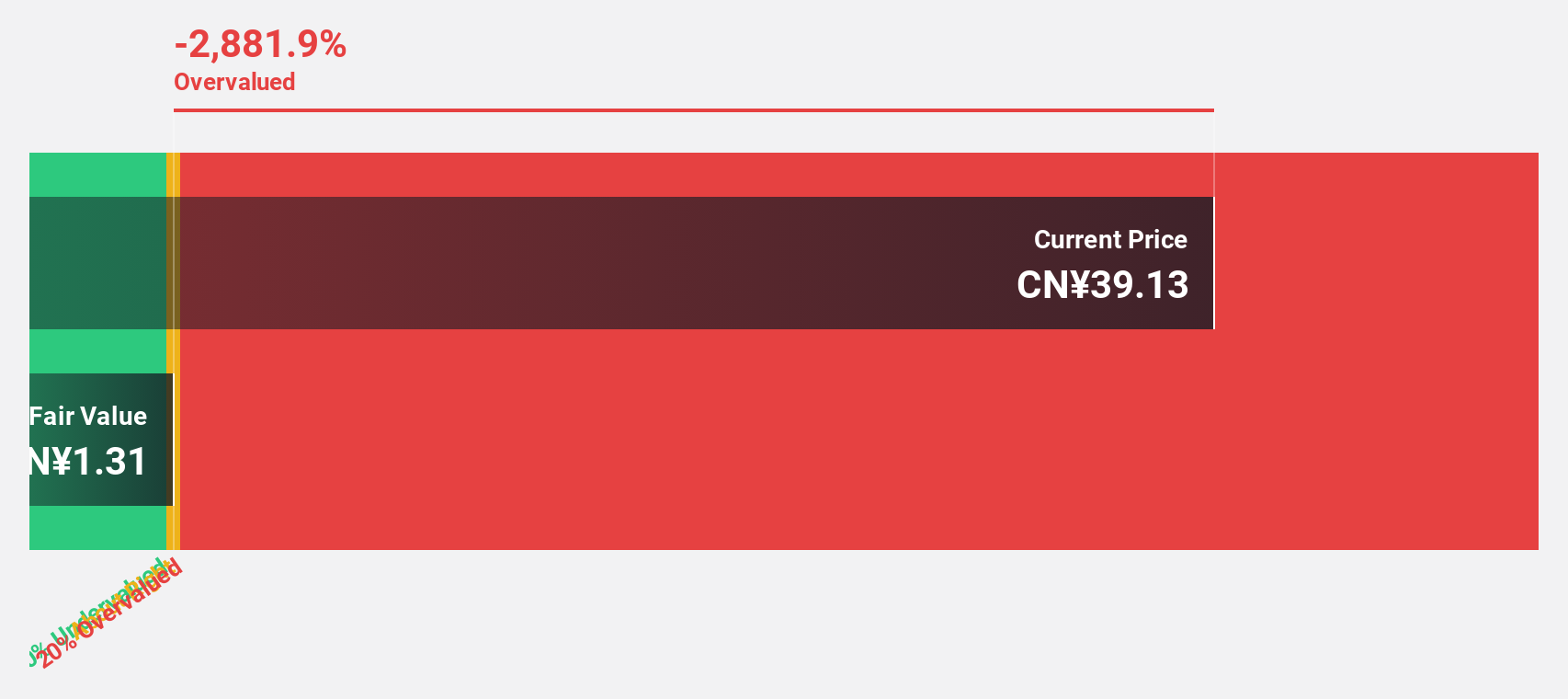

Estimated Discount To Fair Value: 27.9%

Guangzhou Fangbang Electronics Ltd. is trading at CNY 42, below the estimated fair value of CNY 58.28, indicating potential undervaluation based on cash flows. Despite a net loss reduction to CNY 39.63 million for the first nine months of 2024 from CNY 52.46 million a year earlier, revenue forecasts suggest growth at an impressive rate of over 60% annually. The company is expected to become profitable within three years, surpassing average market growth expectations in China.

- Our comprehensive growth report raises the possibility that Guangzhou Fangbang ElectronicsLtd is poised for substantial financial growth.

- Delve into the full analysis health report here for a deeper understanding of Guangzhou Fangbang ElectronicsLtd.

Seize The Opportunity

- Navigate through the entire inventory of 890 Undervalued Stocks Based On Cash Flows here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About HLSE:REG1V

Revenio Group Oyj

Provides ophthalmological devices and software solutions for the diagnosis of glaucoma, macular degeneration, and diabetic retinopathy in Finland, rest of Europe, North America, and internationally.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives