- Netherlands

- /

- Capital Markets

- /

- ENXTAM:CVC

Three Stocks That May Be Undervalued In September 2024

Reviewed by Simply Wall St

As global markets react to the Federal Reserve's first rate cut in over four years, U.S. stocks have surged to new highs, with smaller-cap indexes also showing significant gains. Amid this optimistic environment, identifying undervalued stocks becomes crucial for investors looking to capitalize on potential growth opportunities. In this article, we will explore three stocks that may be undervalued in September 2024.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Trimegah Bangun Persada (IDX:NCKL) | IDR900.00 | IDR1798.96 | 50% |

| Venus Pipes and Tubes (NSEI:VENUSPIPES) | ₹2187.30 | ₹4363.36 | 49.9% |

| VIOL (KOSDAQ:A335890) | ₩8870.00 | ₩17718.44 | 49.9% |

| Hibino (TSE:2469) | ¥3475.00 | ¥6929.65 | 49.9% |

| ArcticZymes Technologies (OB:AZT) | NOK17.96 | NOK35.82 | 49.9% |

| Trustmark (NasdaqGS:TRMK) | US$32.48 | US$64.65 | 49.8% |

| Banca Sistema (BIT:BST) | €1.442 | €2.87 | 49.8% |

| Rajesh Exports (NSEI:RAJESHEXPO) | ₹292.90 | ₹584.12 | 49.9% |

| Visional (TSE:4194) | ¥8490.00 | ¥16914.20 | 49.8% |

| Power Wind Health Industry (TWSE:8462) | NT$131.50 | NT$262.72 | 49.9% |

Here's a peek at a few of the choices from the screener.

CVC Capital Partners (ENXTAM:CVC)

Overview: CVC Capital Partners plc is a private equity and venture capital firm specializing in middle market secondaries, infrastructure and credit, management buyouts, leveraged buyouts, growth equity, mature investments, recapitalizations, strip sales, and spinouts with a market cap of €21.53 billion.

Operations: The firm's revenue segments include middle market secondaries, infrastructure and credit, management buyouts, leveraged buyouts, growth equity, mature investments, recapitalizations, strip sales, and spinouts.

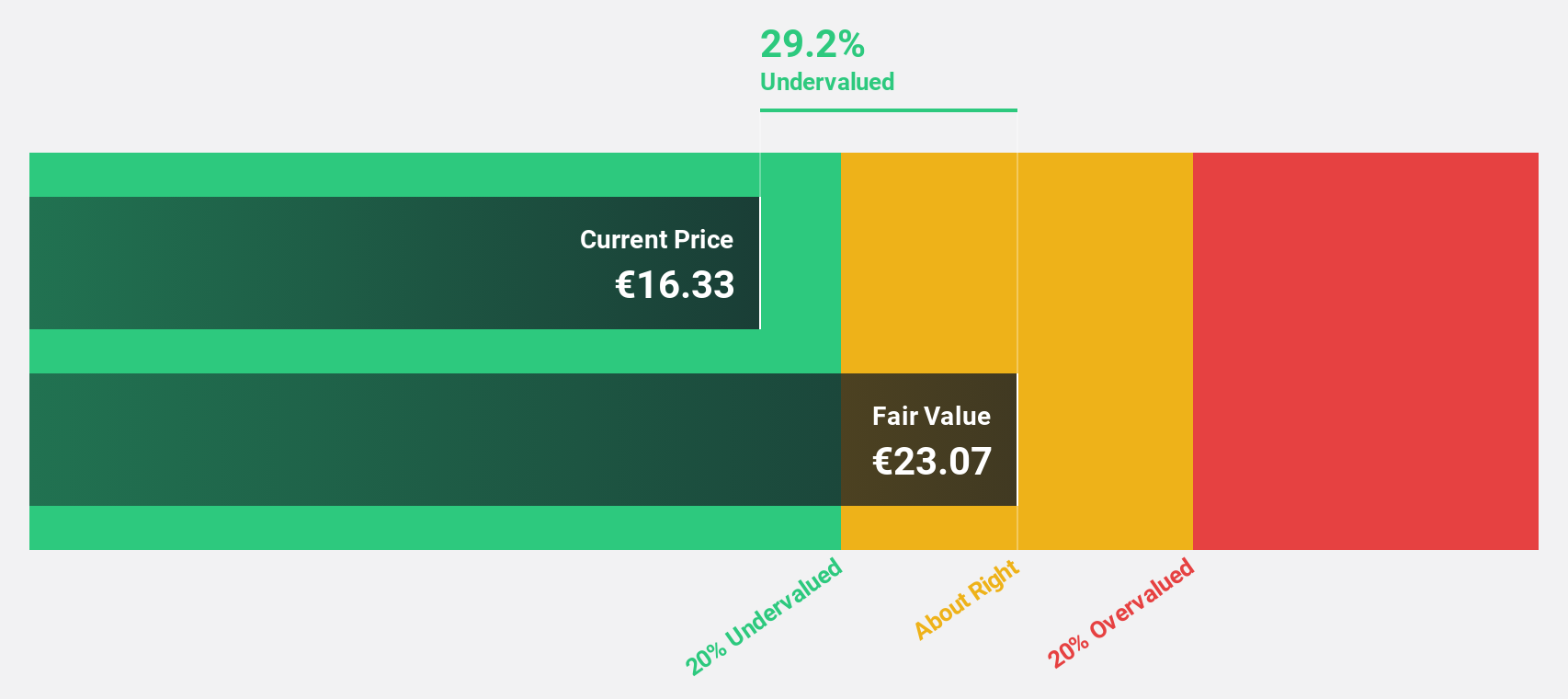

Estimated Discount To Fair Value: 25.4%

CVC Capital Partners is trading at €20.25, significantly below its estimated fair value of €27.14. Despite a high debt level, the firm’s earnings are forecast to grow 32.6% annually, outpacing the Dutch market's 18.8%. Recent M&A activities include a potential €15.6 billion bid for Deutsche Bahn’s DB Schenker unit, signaling aggressive expansion efforts. This growth trajectory and undervaluation based on discounted cash flow analysis position CVC as an attractive investment opportunity in the private equity sector.

- Insights from our recent growth report point to a promising forecast for CVC Capital Partners' business outlook.

- Navigate through the intricacies of CVC Capital Partners with our comprehensive financial health report here.

Vedanta (NSEI:VEDL)

Overview: Vedanta Limited, a diversified natural resources company with a market cap of ₹1.77 trillion, explores, extracts, and processes minerals and oil and gas in India and internationally.

Operations: Vedanta Limited's revenue segments include Power (₹62.54 billion), Copper (₹197.31 billion), Iron Ore (₹83.51 billion), Aluminium (₹499.81 billion), Oil and Gas (₹179.05 billion), and Zinc - International (₹32.06 billion).

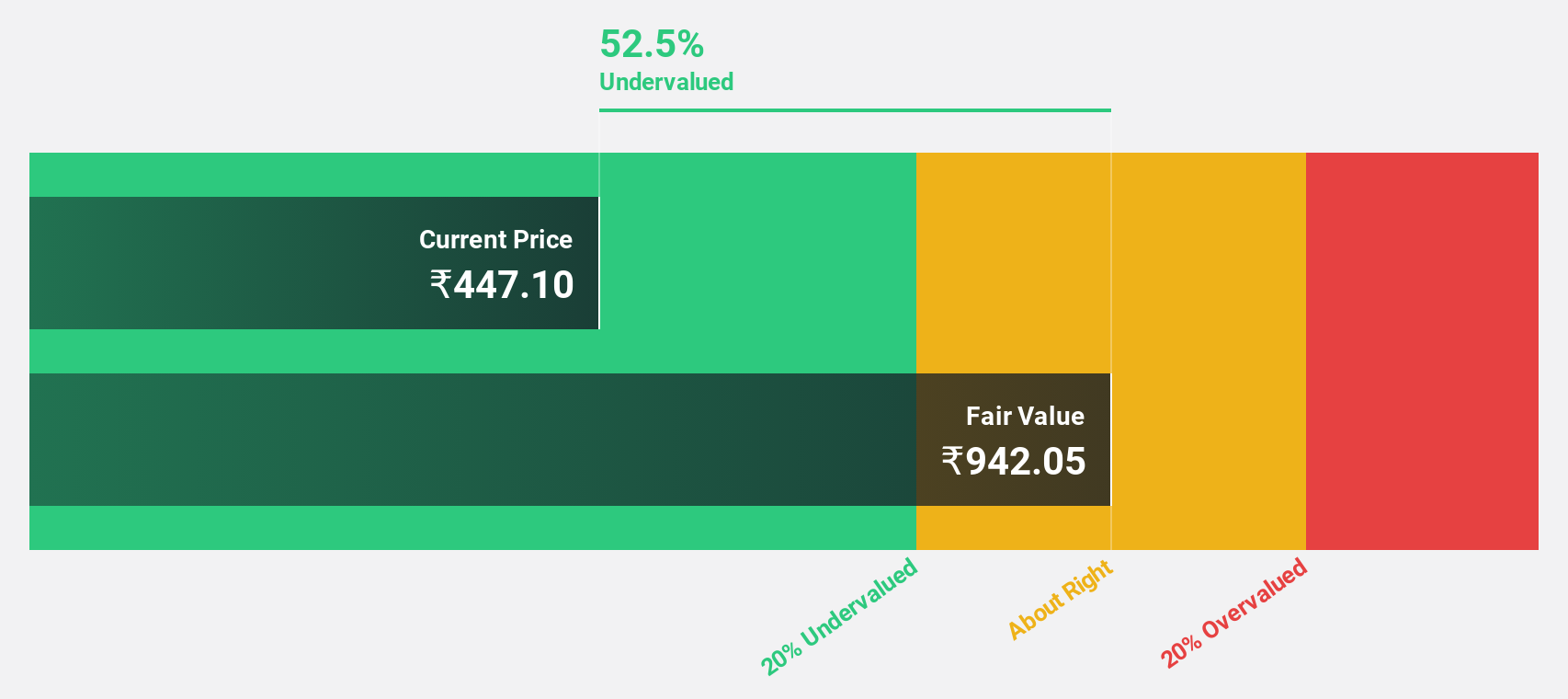

Estimated Discount To Fair Value: 49.3%

Vedanta Limited is trading at ₹470.2, significantly below its estimated fair value of ₹927.25. Despite a high debt level and recent executive changes, the company's earnings are forecast to grow 41.8% annually, outpacing the Indian market's 17.3%. The proposed demerger of key businesses aims to simplify the corporate structure and create independent entities, potentially unlocking further value for investors through direct investment opportunities in pure-play companies linked to India's growth.

- According our earnings growth report, there's an indication that Vedanta might be ready to expand.

- Dive into the specifics of Vedanta here with our thorough financial health report.

Saudi Basic Industries (SASE:2010)

Overview: Saudi Basic Industries Corporation (SABIC) is involved in the global manufacture, marketing, and distribution of chemicals, polymers, plastics, agri-nutrients, and metal products with a market cap of SAR220.20 billion.

Operations: Revenue Segments (in millions of SAR): Agri-Nutrients: SAR10.01 billion, Petrochemicals & Specialties: SAR129.40 billion

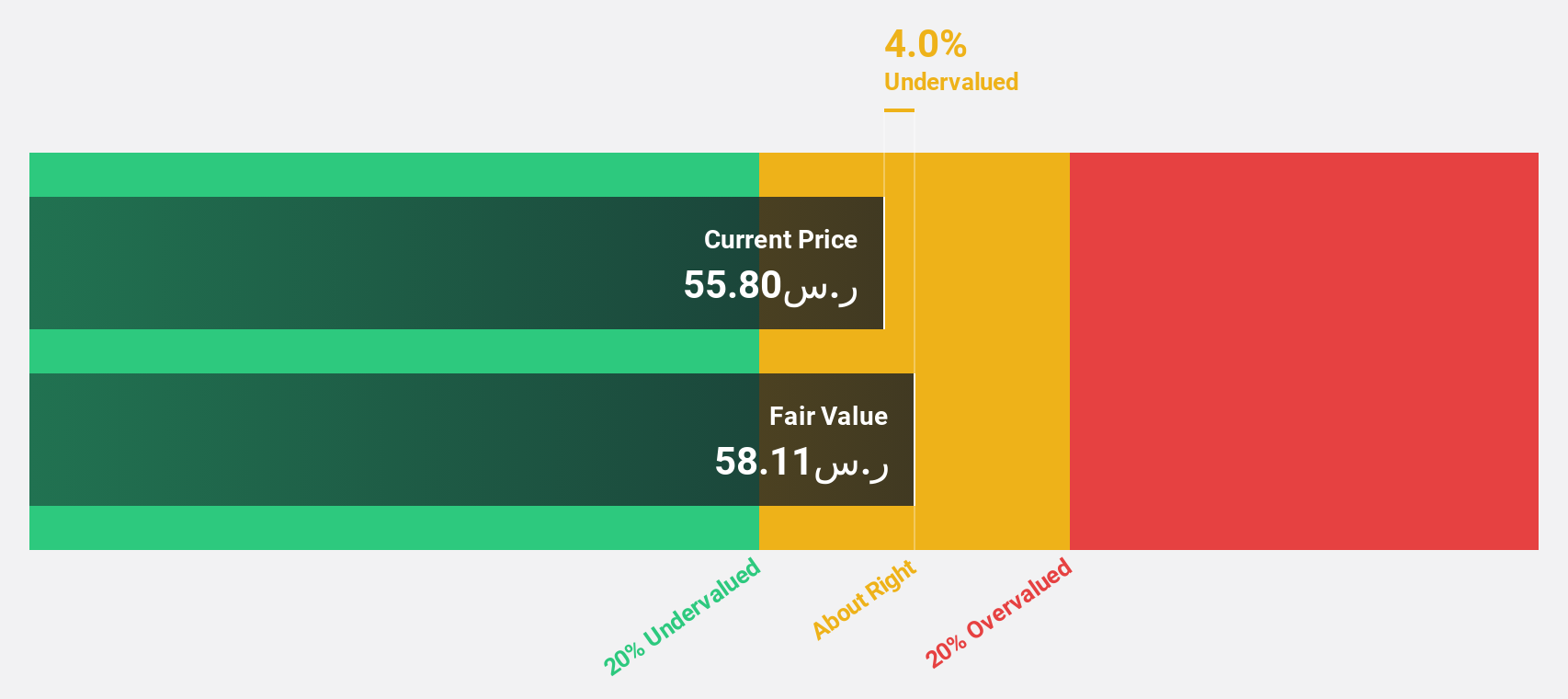

Estimated Discount To Fair Value: 33.2%

Saudi Basic Industries is trading at SAR 73.4, significantly below its estimated fair value of SAR 109.92. Despite a lower net profit margin this year (1.4% vs. 2.8%), the company's earnings are forecast to grow at an impressive annual rate of 48.21%, outpacing the Saudi Arabian market's growth rate of 7.1%. Recent earnings reports show improved net income and basic earnings per share compared to last year, reinforcing its potential as an undervalued stock based on cash flows.

- Upon reviewing our latest growth report, Saudi Basic Industries' projected financial performance appears quite optimistic.

- Get an in-depth perspective on Saudi Basic Industries' balance sheet by reading our health report here.

Seize The Opportunity

- Delve into our full catalog of 933 Undervalued Stocks Based On Cash Flows here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:CVC

CVC Capital Partners

A private equity and venture capital firm specializing in middle market secondaries, infrastructure and credit, management buyouts, leveraged buyouts, growth equity, mature, recapitalizations, strip sales, and spinouts.

High growth potential and slightly overvalued.