- Netherlands

- /

- Software

- /

- ENXTAM:MTRK

Top Growth Companies With High Insider Ownership On Euronext Amsterdam October 2024

Reviewed by Simply Wall St

Amidst escalating tensions in the Middle East and a cautious European market, the Netherlands' economy has shown resilience, with investors closely watching for signals of growth and stability. As interest rate cuts loom on the horizon due to slowing inflation in the eurozone, identifying growth companies with high insider ownership on Euronext Amsterdam becomes crucial for those seeking potential opportunities. In such an environment, stocks that demonstrate strong insider ownership can be appealing as they often indicate confidence from those closest to the company's operations and strategic direction.

Top 5 Growth Companies With High Insider Ownership In The Netherlands

| Name | Insider Ownership | Earnings Growth |

| Ebusco Holding (ENXTAM:EBUS) | 31% | 107.8% |

| Envipco Holding (ENXTAM:ENVI) | 36.7% | 84% |

| MotorK (ENXTAM:MTRK) | 35.7% | 108.4% |

| Basic-Fit (ENXTAM:BFIT) | 12% | 77.7% |

| CVC Capital Partners (ENXTAM:CVC) | 20.2% | 33.5% |

| PostNL (ENXTAM:PNL) | 35.6% | 36.4% |

Underneath we present a selection of stocks filtered out by our screen.

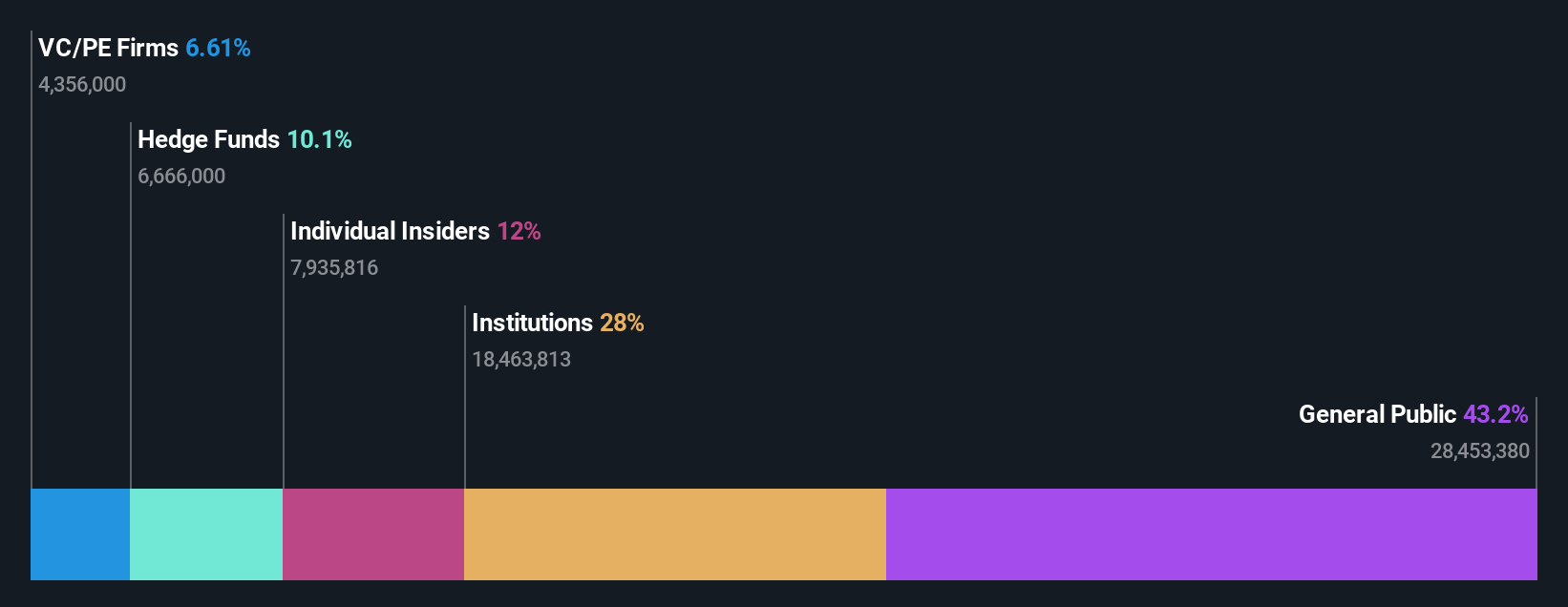

Basic-Fit (ENXTAM:BFIT)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Basic-Fit N.V., along with its subsidiaries, operates fitness clubs and has a market cap of €1.62 billion.

Operations: The company's revenue segments consist of €505.17 million from Benelux and €626.41 million from France, Spain, and Germany.

Insider Ownership: 12%

Basic-Fit shows potential as a growth company with high insider ownership in the Netherlands, despite some challenges. Recent earnings reveal improved profitability, with net income of €4.18 million compared to a prior loss. However, profit margins have decreased from last year. Analysts forecast significant annual earnings growth of 77.68%, yet revenue is expected to grow slower than 20% annually. Investor activism highlights strategic opportunities for value maximization, urging management to consider private equity interest and potential asset sales.

- Navigate through the intricacies of Basic-Fit with our comprehensive analyst estimates report here.

- Our valuation report unveils the possibility Basic-Fit's shares may be trading at a premium.

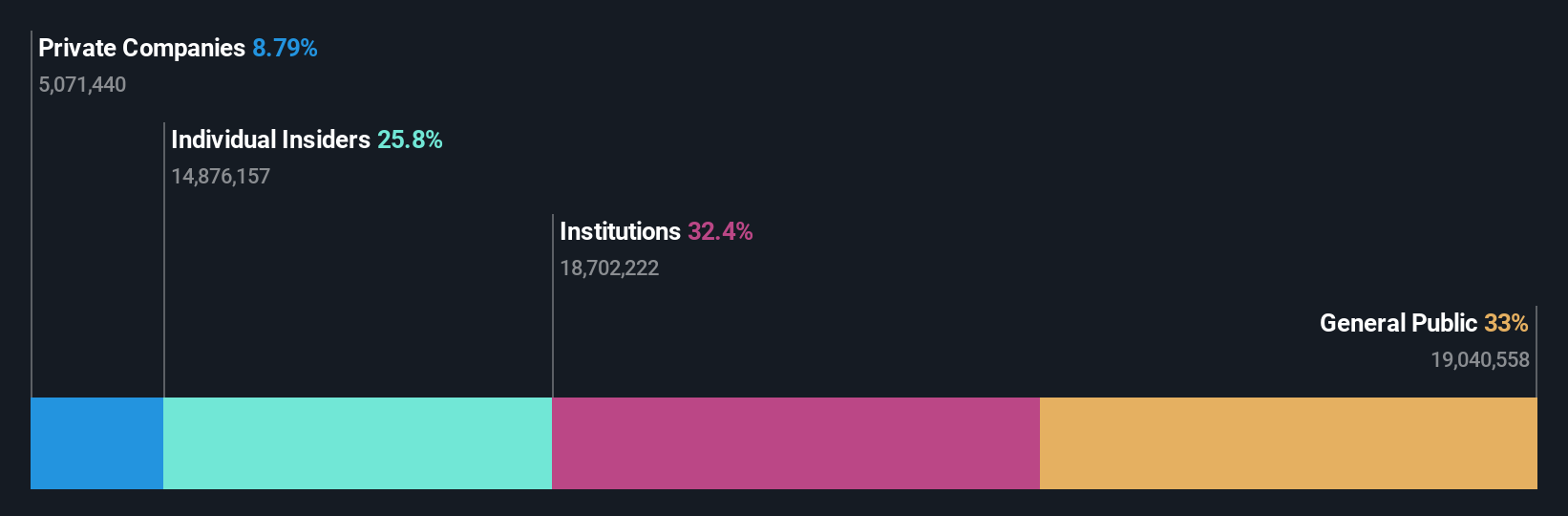

Envipco Holding (ENXTAM:ENVI)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Envipco Holding N.V. is involved in the design, development, manufacturing, assembly, marketing, sales, leasing, and servicing of reverse vending machines for collecting and processing used beverage containers across the Netherlands, North America, and Europe with a market capitalization of approximately €300 million.

Operations: Envipco Holding generates revenue through the design, development, manufacturing, assembly, marketing, sales, leasing, and servicing of reverse vending machines used for collecting and processing beverage containers in the Netherlands, North America, and Europe.

Insider Ownership: 36.7%

Envipco Holding demonstrates growth potential with recent earnings improvements, reporting reduced net losses and increased sales. The company's revenue is forecast to grow at 35.6% annually, outpacing the Dutch market. Despite a highly volatile share price and past shareholder dilution, Envipco's earnings are expected to grow significantly over the next three years. Recent developments include securing a follow-on order in Romania for over 140 Optima RVMs, indicating strong business momentum despite board changes.

- Click here and access our complete growth analysis report to understand the dynamics of Envipco Holding.

- Our expertly prepared valuation report Envipco Holding implies its share price may be too high.

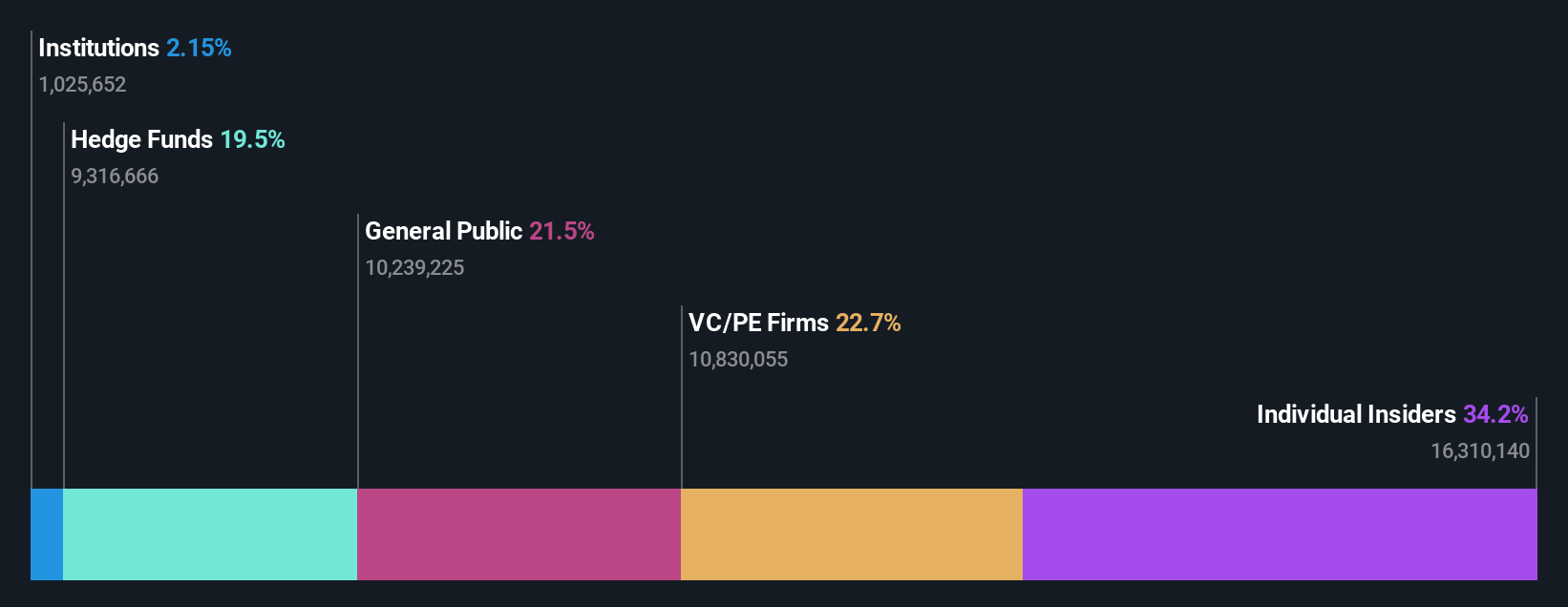

MotorK (ENXTAM:MTRK)

Simply Wall St Growth Rating: ★★★★★☆

Overview: MotorK plc provides software-as-a-service solutions for the automotive retail industry across Italy, Spain, France, Germany, and the Benelux Union with a market cap of €264.71 million.

Operations: The company's revenue is primarily derived from its Software & Programming segment, which generated €42.50 million.

Insider Ownership: 35.7%

MotorK shows strong growth potential with a forecasted revenue increase of 22.1% annually, surpassing the Dutch market's growth rate. Despite past shareholder dilution and less than one year of cash runway, MotorK is expected to become profitable within three years, indicating above-average market profit growth. Recent earnings results show reduced net losses, and the appointment of a new CFO may enhance financial strategy and execution moving forward.

- Get an in-depth perspective on MotorK's performance by reading our analyst estimates report here.

- Insights from our recent valuation report point to the potential overvaluation of MotorK shares in the market.

Next Steps

- Navigate through the entire inventory of 6 Fast Growing Euronext Amsterdam Companies With High Insider Ownership here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:MTRK

MotorK

Provides software-as-a-service for the automotive retail industry in Italy, Spain, France, Germany, and the Benelux Union.

High growth potential with adequate balance sheet.