Discovering Undiscovered Gems in Middle East Stocks May 2025

Reviewed by Simply Wall St

As the Middle East's stock markets experience mixed performances, with investors eagerly awaiting new catalysts amidst fluctuating oil prices and shifting global trade dynamics, opportunities arise for discerning investors to explore underappreciated sectors. In such an environment, identifying stocks with strong fundamentals and growth potential can be key to uncovering hidden gems within the region's diverse economic landscape.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Kerevitas Gida Sanayi ve Ticaret | 42.60% | 43.79% | 39.15% | ★★★★★★ |

| Izmir Firça Sanayi ve Ticaret Anonim Sirketi | 29.47% | 42.38% | -38.36% | ★★★★★★ |

| MIA Teknoloji Anonim Sirketi | 14.46% | 58.05% | 72.63% | ★★★★★☆ |

| Ege Endüstri ve Ticaret | 19.99% | 43.25% | 22.60% | ★★★★★☆ |

| Alfa Solar Enerji Sanayi ve Ticaret | 38.29% | 5.19% | -13.40% | ★★★★★☆ |

| Birlesim Mühendislik Isitma Sogutma Havalandirma Sanayi ve Ticaret Anonim Sirketi | 44.20% | 44.21% | -32.62% | ★★★★★☆ |

| Sönmez Filament Sentetik Iplik ve Elyaf Sanayi | NA | 53.26% | 26.61% | ★★★★★☆ |

| Bosch Fren Sistemleri Sanayi ve Ticaret | 91.93% | 46.59% | 3.35% | ★★★★★☆ |

| Gür-Sel Turizm Tasimacilik ve Servis Ticaret | 8.11% | 55.10% | 73.88% | ★★★★★☆ |

| National Corporation for Tourism and Hotels | 19.25% | 0.67% | 4.89% | ★★★★☆☆ |

We'll examine a selection from our screener results.

MAIR Group - P.J.S.C (ADX:MAIR)

Simply Wall St Value Rating: ★★★★★★

Overview: MAIR Group - P.J.S.C (ticker: ADX:MAIR) operates in the retail sector through hypermarkets, supermarkets, shopping malls, and more, while also managing retail properties and real estate investments, with a market cap of approximately AED3.48 billion.

Operations: The company generates revenue primarily from its retail operations, which contribute AED1.74 billion, and real estate activities, which add AED207.26 million. The net profit margin is a key metric to watch for trends in profitability over time.

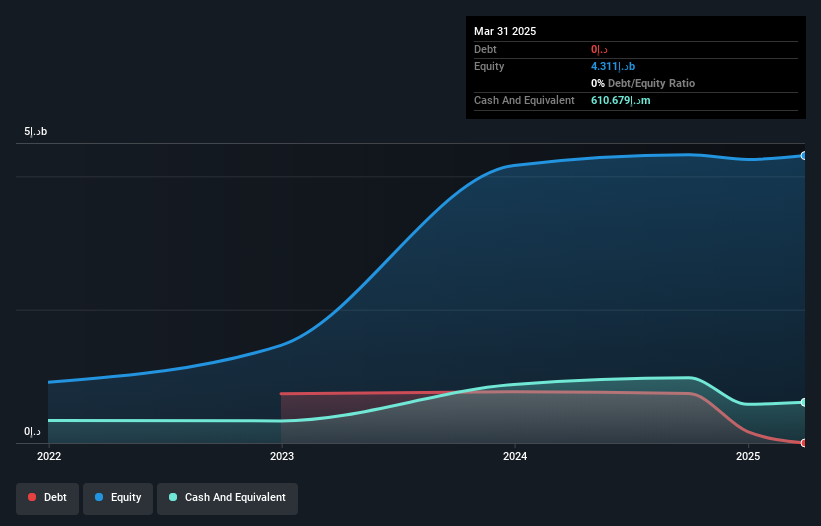

MAIR Group, a debt-free entity, has seen its earnings skyrocket by 127.7% over the past year, outpacing the Consumer Retailing industry’s growth of 2.3%. This impressive surge includes a significant one-off gain of AED30.1 million, impacting recent financial results up to March 2025. Trading at 83% below its estimated fair value suggests potential undervaluation in the market. Recent board changes and dividend affirmations underscore active governance and shareholder returns, with AED135 million approved for distribution as dividends for fiscal year 2024 profits. These factors position MAIR Group as an intriguing prospect within its sector.

- Click here and access our complete health analysis report to understand the dynamics of MAIR Group - P.J.S.C.

Evaluate MAIR Group - P.J.S.C's historical performance by accessing our past performance report.

Miahona (SASE:2084)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Miahona Company Limited operates in the Kingdom of Saudi Arabia, offering water facilities and treatment services, with a market cap of SAR4 billion.

Operations: Miahona generates revenue primarily from water facilities and treatment services. The company has a market cap of SAR4 billion.

Miahona, a notable player in the water utilities sector, has shown impressive growth with its recent earnings report for Q1 2025. The company's sales surged to SAR 175.17 million from SAR 81.6 million the previous year, while net income jumped to SAR 61.43 million from SAR 19.67 million. This growth is further supported by its involvement in a long-term contract for wastewater treatment in Jeddah's Industrial City valued at an estimated SAR 1 billion over 25 years. Despite a high net debt to equity ratio of 48%, Miahona's EBIT covers interest payments well at an impressive rate of 8.1 times, indicating strong operational performance amidst industry challenges and opportunities for future expansion through strategic projects like the Jeddah initiative.

- Get an in-depth perspective on Miahona's performance by reading our health report here.

Understand Miahona's track record by examining our Past report.

Rasan Information Technology (SASE:8313)

Simply Wall St Value Rating: ★★★★★★

Overview: Rasan Information Technology Company is a financial technology firm offering insurance and financial services in Saudi Arabia, with a market capitalization of SAR 6.63 billion.

Operations: Rasan generates revenue primarily from its Tameeni - Motors segment, contributing SAR 217.33 million, followed by Leasing at SAR 133.96 million and Tameeni - Health at SAR 54.74 million.

Rasan Information Technology has been making waves with a robust earnings growth of 116.4% over the past year, outpacing the insurance industry's -15.7%. Despite its small size, it boasts high-quality earnings and remains debt-free, which likely enhances its financial stability. The company reported a net income of SAR 94.73 million for 2024, nearly doubling from SAR 45.95 million in the previous year, while sales climbed to SAR 358.33 million from SAR 256.23 million. However, recent volatility in share price and a follow-on equity offering for an additional 13.3 million shares may affect investor sentiment moving forward.

Summing It All Up

- Embark on your investment journey to our 244 Middle Eastern Undiscovered Gems With Strong Fundamentals selection here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade MAIR Group - P.J.S.C, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ADX:MAIR

MAIR Group - P.J.S.C

Abu Dhabi Co-Operative Society, a retail company, primarily engages in the businesses of operating hypermarkets, supermarkets, shopping malls, retail parks, concept chain stores, franchise operations, retail property management, real estate, and investments.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives