- Saudi Arabia

- /

- Insurance

- /

- SASE:8260

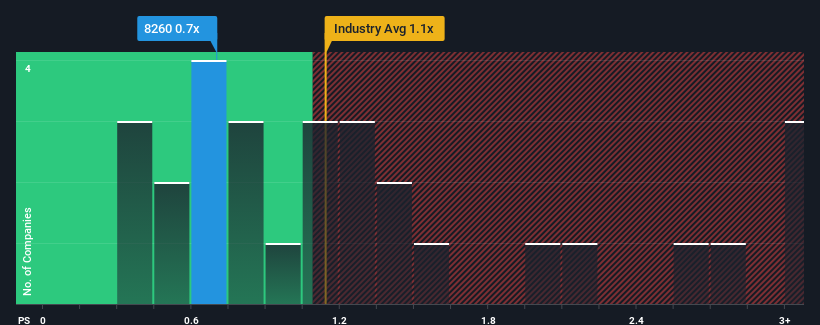

Market Still Lacking Some Conviction On Gulf General Cooperative Insurance Company (TADAWUL:8260)

There wouldn't be many who think Gulf General Cooperative Insurance Company's (TADAWUL:8260) price-to-sales (or "P/S") ratio of 0.7x is worth a mention when the median P/S for the Insurance industry in Saudi Arabia is similar at about 1.1x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Check out our latest analysis for Gulf General Cooperative Insurance

What Does Gulf General Cooperative Insurance's Recent Performance Look Like?

Revenue has risen at a steady rate over the last year for Gulf General Cooperative Insurance, which is generally not a bad outcome. Perhaps the expectation moving forward is that the revenue growth will track in line with the wider industry for the near term, which has kept the P/S subdued. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Gulf General Cooperative Insurance's earnings, revenue and cash flow.How Is Gulf General Cooperative Insurance's Revenue Growth Trending?

In order to justify its P/S ratio, Gulf General Cooperative Insurance would need to produce growth that's similar to the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 3.0%. The latest three year period has also seen an excellent 56% overall rise in revenue, aided somewhat by its short-term performance. So we can start by confirming that the company has done a great job of growing revenues over that time.

In contrast to the company, the rest of the industry is expected to decline by 8.0% over the next year, which puts the company's recent medium-term positive growth rates in a good light for now.

With this information, we find it odd that Gulf General Cooperative Insurance is trading at a fairly similar P/S to the industry. Apparently some shareholders believe the recent performance is at its limits and have been accepting lower selling prices.

The Bottom Line On Gulf General Cooperative Insurance's P/S

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of Gulf General Cooperative Insurance revealed its growing revenue over the medium-term hasn't helped elevate its P/S above that of the industry, which is surprising given the industry is set to shrink. When we see a history of positive growth in a struggling industry, but only an average P/S, we assume potential risks are what might be placing pressure on the P/S ratio. Without the guidance of analysts, perhaps shareholders are feeling uncertain over whether the revenue performance can continue amidst a declining industry outlook. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Gulf General Cooperative Insurance (at least 1 which is a bit unpleasant), and understanding them should be part of your investment process.

If you're unsure about the strength of Gulf General Cooperative Insurance's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SASE:8260

Gulf General Cooperative Insurance

Provides various insurance products for corporates and individuals in the Kingdom of Saudi Arabia.

Excellent balance sheet low.

Market Insights

Community Narratives