- Saudi Arabia

- /

- Insurance

- /

- SASE:8060

Walaa Cooperative Insurance Company (TADAWUL:8060) Might Not Be As Mispriced As It Looks After Plunging 26%

Walaa Cooperative Insurance Company (TADAWUL:8060) shares have had a horrible month, losing 26% after a relatively good period beforehand. Looking at the bigger picture, even after this poor month the stock is up 53% in the last year.

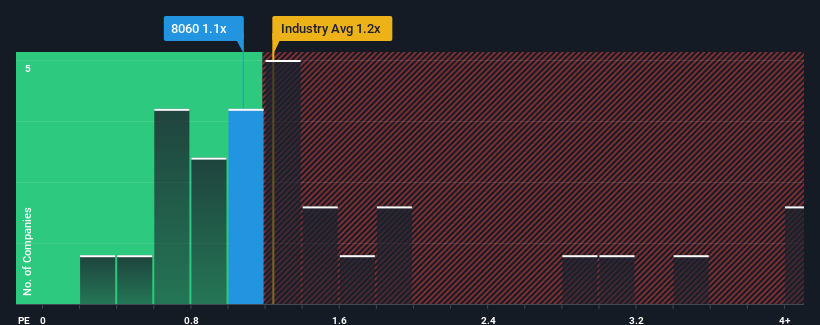

Although its price has dipped substantially, it's still not a stretch to say that Walaa Cooperative Insurance's price-to-sales (or "P/S") ratio of 1.1x right now seems quite "middle-of-the-road" compared to the Insurance industry in Saudi Arabia, where the median P/S ratio is around 1.2x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Check out our latest analysis for Walaa Cooperative Insurance

What Does Walaa Cooperative Insurance's Recent Performance Look Like?

With revenue growth that's inferior to most other companies of late, Walaa Cooperative Insurance has been relatively sluggish. It might be that many expect the uninspiring revenue performance to strengthen positively, which has kept the P/S ratio from falling. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think Walaa Cooperative Insurance's future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The P/S Ratio?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Walaa Cooperative Insurance's to be considered reasonable.

Taking a look back first, we see that the company grew revenue by an impressive 21% last year. The latest three year period has also seen an excellent 119% overall rise in revenue, aided by its short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Looking ahead now, revenue is anticipated to climb by 95% during the coming year according to the lone analyst following the company. With the industry only predicted to deliver 19%, the company is positioned for a stronger revenue result.

With this information, we find it interesting that Walaa Cooperative Insurance is trading at a fairly similar P/S compared to the industry. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Final Word

Following Walaa Cooperative Insurance's share price tumble, its P/S is just clinging on to the industry median P/S. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Despite enticing revenue growth figures that outpace the industry, Walaa Cooperative Insurance's P/S isn't quite what we'd expect. There could be some risks that the market is pricing in, which is preventing the P/S ratio from matching the positive outlook. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

Don't forget that there may be other risks. For instance, we've identified 1 warning sign for Walaa Cooperative Insurance that you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Walaa Cooperative Insurance might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SASE:8060

Walaa Cooperative Insurance

Provides cooperative insurance and reinsurance products and services in the Kingdom of Saudi Arabia.

Flawless balance sheet slight.

Market Insights

Community Narratives