- Saudi Arabia

- /

- Insurance

- /

- SASE:8050

Salama Cooperative Insurance Company (TADAWUL:8050) Might Not Be As Mispriced As It Looks After Plunging 26%

To the annoyance of some shareholders, Salama Cooperative Insurance Company (TADAWUL:8050) shares are down a considerable 26% in the last month, which continues a horrid run for the company. The recent drop has obliterated the annual return, with the share price now down 8.5% over that longer period.

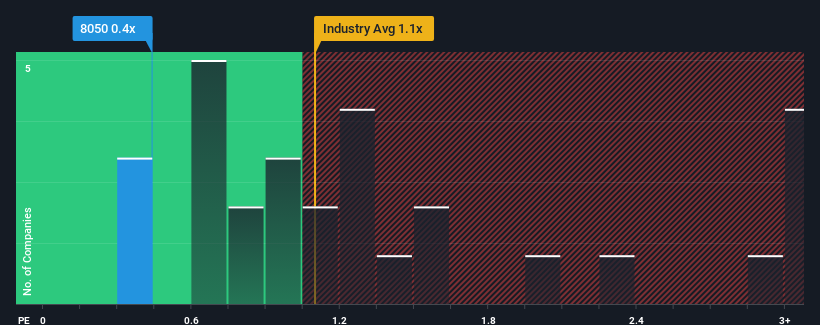

After such a large drop in price, it would be understandable if you think Salama Cooperative Insurance is a stock with good investment prospects with a price-to-sales ratios (or "P/S") of 0.4x, considering almost half the companies in Saudi Arabia's Insurance industry have P/S ratios above 1.1x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

View our latest analysis for Salama Cooperative Insurance

How Has Salama Cooperative Insurance Performed Recently?

For example, consider that Salama Cooperative Insurance's financial performance has been poor lately as its revenue has been in decline. Perhaps the market believes the recent revenue performance isn't good enough to keep up the industry, causing the P/S ratio to suffer. Those who are bullish on Salama Cooperative Insurance will be hoping that this isn't the case so that they can pick up the stock at a lower valuation.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Salama Cooperative Insurance's earnings, revenue and cash flow.Do Revenue Forecasts Match The Low P/S Ratio?

In order to justify its P/S ratio, Salama Cooperative Insurance would need to produce sluggish growth that's trailing the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 2.9%. Still, the latest three year period has seen an excellent 81% overall rise in revenue, in spite of its unsatisfying short-term performance. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Comparing that to the industry, which is predicted to shrink 9.1% in the next 12 months, the company's positive momentum based on recent medium-term revenue results is a bright spot for the moment.

In light of this, it's quite peculiar that Salama Cooperative Insurance's P/S sits below the majority of other companies. It looks like most investors are not convinced at all that the company can maintain its recent positive growth rate in the face of a shrinking broader industry.

The Bottom Line On Salama Cooperative Insurance's P/S

Salama Cooperative Insurance's recently weak share price has pulled its P/S back below other Insurance companies. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Upon analysing the past data, we see it is unexpected that Salama Cooperative Insurance is currently trading at a lower P/S than the rest of the industry given that its revenue growth in the past three-year years is exceeding expectations in a challenging industry. We think potential risks might be placing significant pressure on the P/S ratio and share price. The most obvious risk is that its revenue trajectory may not keep outperforming under these tough industry conditions. While the chance of the share price dropping sharply is fairly remote, investors do seem to be anticipating future revenue instability.

Don't forget that there may be other risks. For instance, we've identified 3 warning signs for Salama Cooperative Insurance that you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SASE:8050

Salama Cooperative Insurance

Provides insurance products and services in the Kingdom of Saudi Arabia, the United Arab Emirates, Bahrain, Alegria, Senegal, Malaysia, and Egypt.

Good value with adequate balance sheet.

Market Insights

Community Narratives