- Saudi Arabia

- /

- Insurance

- /

- SASE:8010

The Company for Cooperative Insurance (TADAWUL:8010) Soars 27% But It's A Story Of Risk Vs Reward

Despite an already strong run, The Company for Cooperative Insurance (TADAWUL:8010) shares have been powering on, with a gain of 27% in the last thirty days. The last month tops off a massive increase of 111% in the last year.

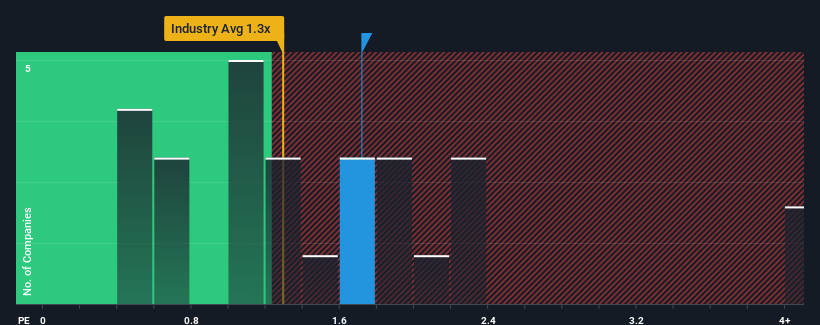

Although its price has surged higher, you could still be forgiven for feeling indifferent about Company for Cooperative Insurance's P/S ratio of 1.7x, since the median price-to-sales (or "P/S") ratio for the Insurance industry in Saudi Arabia is also close to 1.3x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for Company for Cooperative Insurance

What Does Company for Cooperative Insurance's Recent Performance Look Like?

With revenue growth that's superior to most other companies of late, Company for Cooperative Insurance has been doing relatively well. Perhaps the market is expecting this level of performance to taper off, keeping the P/S from soaring. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Company for Cooperative Insurance.Do Revenue Forecasts Match The P/S Ratio?

In order to justify its P/S ratio, Company for Cooperative Insurance would need to produce growth that's similar to the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 50%. The strong recent performance means it was also able to grow revenue by 90% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Shifting to the future, estimates from the three analysts covering the company suggest revenue growth will be highly resilient over the next year growing by 25%. With the rest of the industry predicted to shrink by 0.8%, that would be a fantastic result.

In light of this, it's peculiar that Company for Cooperative Insurance's P/S sits in-line with the majority of other companies. Apparently some shareholders are skeptical of the contrarian forecasts and have been accepting lower selling prices.

The Key Takeaway

Its shares have lifted substantially and now Company for Cooperative Insurance's P/S is back within range of the industry median. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We note that even though Company for Cooperative Insurance trades at a similar P/S as the rest of the industry, it far eclipses them in terms of forecasted revenue growth. We assume that investors are attributing some risk to the company's future revenues, keeping it from trading at a higher P/S. The market could be pricing in the event that tough industry conditions will impact future revenues. It appears some are indeed anticipating revenue instability, because the company's current prospects should normally provide a boost to the share price.

Many other vital risk factors can be found on the company's balance sheet. Take a look at our free balance sheet analysis for Company for Cooperative Insurance with six simple checks on some of these key factors.

If these risks are making you reconsider your opinion on Company for Cooperative Insurance, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SASE:8010

Company for Cooperative Insurance

Provides various insurance and reinsurance solutions for individuals and companies in the Kingdom of Saudi Arabia.

Excellent balance sheet with proven track record.

Market Insights

Community Narratives