- Saudi Arabia

- /

- Healthcare Services

- /

- SASE:4013

Capital Allocation Trends At Dr. Sulaiman Al Habib Medical Services Group (TADAWUL:4013) Aren't Ideal

To find a multi-bagger stock, what are the underlying trends we should look for in a business? In a perfect world, we'd like to see a company investing more capital into its business and ideally the returns earned from that capital are also increasing. If you see this, it typically means it's a company with a great business model and plenty of profitable reinvestment opportunities. However, after briefly looking over the numbers, we don't think Dr. Sulaiman Al Habib Medical Services Group (TADAWUL:4013) has the makings of a multi-bagger going forward, but let's have a look at why that may be.

What is Return On Capital Employed (ROCE)?

For those who don't know, ROCE is a measure of a company's yearly pre-tax profit (its return), relative to the capital employed in the business. The formula for this calculation on Dr. Sulaiman Al Habib Medical Services Group is:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.15 = ر.س1.2b ÷ (ر.س9.9b - ر.س1.9b) (Based on the trailing twelve months to March 2021).

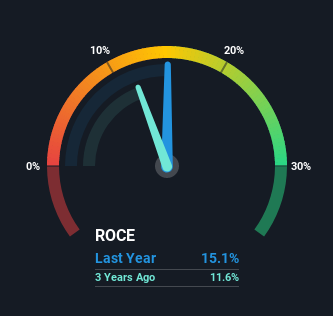

Thus, Dr. Sulaiman Al Habib Medical Services Group has an ROCE of 15%. On its own, that's a standard return, however it's much better than the 8.2% generated by the Healthcare industry.

See our latest analysis for Dr. Sulaiman Al Habib Medical Services Group

In the above chart we have measured Dr. Sulaiman Al Habib Medical Services Group's prior ROCE against its prior performance, but the future is arguably more important. If you'd like, you can check out the forecasts from the analysts covering Dr. Sulaiman Al Habib Medical Services Group here for free.

What The Trend Of ROCE Can Tell Us

When we looked at the ROCE trend at Dr. Sulaiman Al Habib Medical Services Group, we didn't gain much confidence. Over the last five years, returns on capital have decreased to 15% from 26% five years ago. However, given capital employed and revenue have both increased it appears that the business is currently pursuing growth, at the consequence of short term returns. If these investments prove successful, this can bode very well for long term stock performance.

Our Take On Dr. Sulaiman Al Habib Medical Services Group's ROCE

Even though returns on capital have fallen in the short term, we find it promising that revenue and capital employed have both increased for Dr. Sulaiman Al Habib Medical Services Group. And the stock has done incredibly well with a 162% return over the last year, so long term investors are no doubt ecstatic with that result. So while investors seem to be recognizing these promising trends, we would look further into this stock to make sure the other metrics justify the positive view.

If you'd like to know about the risks facing Dr. Sulaiman Al Habib Medical Services Group, we've discovered 2 warning signs that you should be aware of.

If you want to search for solid companies with great earnings, check out this free list of companies with good balance sheets and impressive returns on equity.

If you’re looking to trade a wide range of investments, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SASE:4013

Dr. Sulaiman Al Habib Medical Services Group

Dr. Sulaiman Al Habib Medical Services Group Company establishes, manages, and operates hospitals, general and specialized medical complexes, day surgery centers, and pharmaceutical facilities in Saudi Arabia and internationally.

Reasonable growth potential with acceptable track record.