- Saudi Arabia

- /

- Food

- /

- SASE:6050

Shareholders Of Saudi Fisheries (TADAWUL:6050) Have Received 2.2% On Their Investment

While it may not be enough for some shareholders, we think it is good to see the Saudi Fisheries Company (TADAWUL:6050) share price up 13% in a single quarter. But over the last half decade, the stock has not performed well. After all, the share price is down 31% in that time, significantly under-performing the market.

Check out our latest analysis for Saudi Fisheries

Given that Saudi Fisheries didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

Over half a decade Saudi Fisheries reduced its trailing twelve month revenue by 28% for each year. That puts it in an unattractive cohort, to put it mildly. It seems pretty reasonable to us that the share price dipped 6% per year in that time. This loss means the stock shareholders are probably pretty annoyed. Risk averse investors probably wouldn't like this one much.

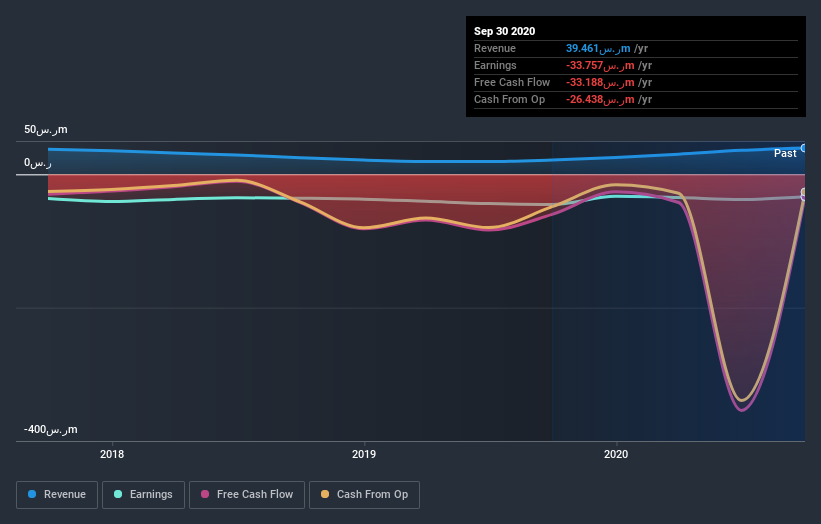

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

What about the Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between Saudi Fisheries' total shareholder return (TSR) and its share price return. Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. We note that Saudi Fisheries' TSR, at 2.2% is higher than its share price return of -31%. When you consider it hasn't been paying a dividend, this data suggests shareholders have benefitted from a spin-off, or had the opportunity to acquire attractively priced shares in a discounted capital raising.

A Different Perspective

It's nice to see that Saudi Fisheries shareholders have received a total shareholder return of 93% over the last year. That gain is better than the annual TSR over five years, which is 0.4%. Therefore it seems like sentiment around the company has been positive lately. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Like risks, for instance. Every company has them, and we've spotted 2 warning signs for Saudi Fisheries (of which 1 is a bit unpleasant!) you should know about.

We will like Saudi Fisheries better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on SA exchanges.

If you decide to trade Saudi Fisheries, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

If you're looking to trade Saudi Fisheries, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About SASE:6050

Saudi Fisheries

Engages in fishing, fish-farming, and other activities in the Kingdom of Saudi Arabia.

Excellent balance sheet low.

Market Insights

Community Narratives