- Saudi Arabia

- /

- Food

- /

- SASE:6010

Three Undiscovered Gems in Middle East with Strong Potential

Reviewed by Simply Wall St

As most Gulf stock markets gain momentum on the prospects of a U.S. rate cut, investor sentiment in the Middle East has been buoyed by improved economic forecasts and strategic developments across various sectors. In this dynamic environment, identifying stocks with strong fundamentals and growth potential becomes crucial for investors looking to capitalize on emerging opportunities in the region.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Al Wathba National Insurance Company PJSC | 10.97% | 10.37% | 3.14% | ★★★★★★ |

| Sure Global Tech | NA | 10.11% | 15.42% | ★★★★★★ |

| Baazeem Trading | 8.48% | -1.74% | -2.37% | ★★★★★★ |

| Qassim Cement | NA | 0.78% | -14.90% | ★★★★★★ |

| MOBI Industry | 18.09% | 6.66% | 22.02% | ★★★★★★ |

| Saudi Azm for Communication and Information Technology | 3.53% | 16.38% | 21.65% | ★★★★★★ |

| Nofoth Food Products | NA | 15.49% | 26.47% | ★★★★★★ |

| Najran Cement | 14.76% | -3.67% | -26.79% | ★★★★★★ |

| Rotshtein Realestate | 142.50% | 22.29% | 13.79% | ★★★★☆☆ |

| Amir Marketing and Investments in Agriculture | 25.54% | 4.63% | 6.37% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Albaraka Türk Katilim Bankasi (IBSE:ALBRK)

Simply Wall St Value Rating: ★★★★★★

Overview: Albaraka Türk Katilim Bankasi A.S. offers a range of banking products and services in Turkey, with a market capitalization of TRY19.53 billion.

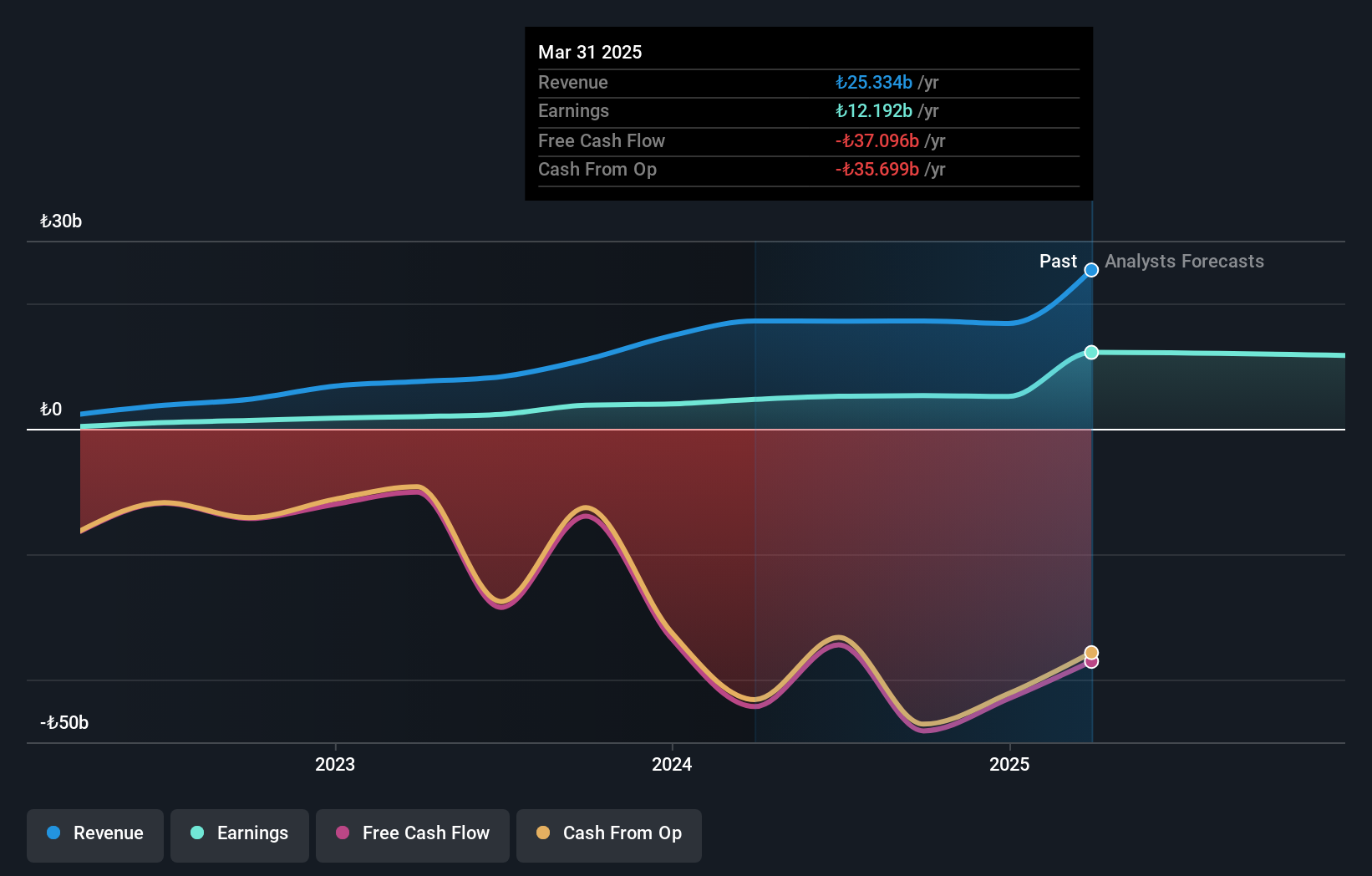

Operations: Albaraka Türk generates revenue primarily from its Commercial and Corporate segment, which contributes TRY36.05 billion, followed by the Treasury segment at TRY22.87 billion and Retail at TRY8.29 billion. The company's financial performance is influenced by these diverse revenue streams across different banking sectors in Turkey.

Albaraka Türk Katilim Bankasi, a notable player in the Middle East's financial landscape, boasts total assets of TRY392.2 billion and equity of TRY22 billion. With deposits at TRY246.2 billion and loans totaling TRY187.8 billion, it demonstrates solid operational scale. The bank maintains an appropriate level of non-performing loans at 1.4% and has a sufficient allowance for bad loans at 163%, reflecting prudent risk management practices. Despite trading at a low price-to-earnings ratio of 1.6x compared to the TR market's 21.6x, earnings are forecasted to decline by an average of 44% annually over the next three years, indicating potential challenges ahead.

Ray Sigorta Anonim Sirketi (IBSE:RAYSG)

Simply Wall St Value Rating: ★★★★★★

Overview: Ray Sigorta Anonim Sirketi operates in the non-life insurance sector in Turkey, with a market capitalization of TRY39.95 billion.

Operations: Ray Sigorta Anonim Sirketi generates revenue primarily from its accident insurance segment, contributing significantly to its revenue streams, followed by fire and transportation segments. The accident insurance segment alone accounts for TRY13.38 billion, indicating its substantial role in the company's revenue model.

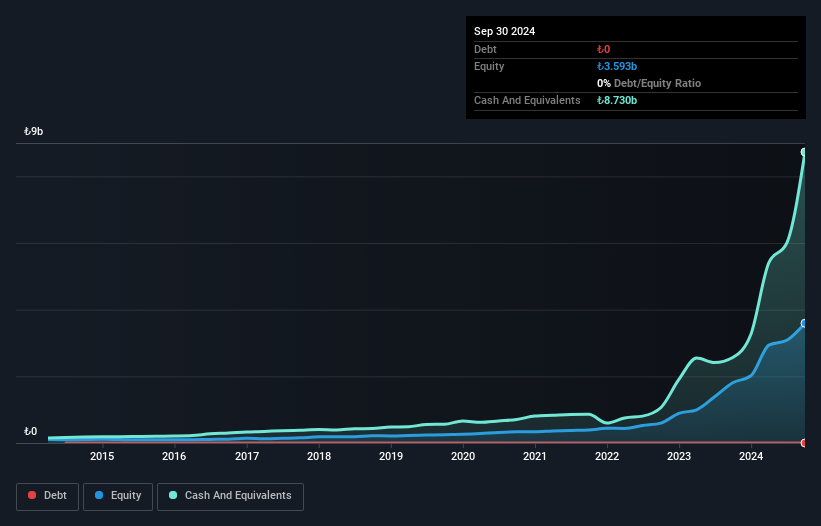

Ray Sigorta Anonim Sirketi, a smaller player in the insurance sector, has shown impressive earnings growth of 101% over the past year, outpacing the industry average of 79.5%. Despite this strong performance, its net profit margin has decreased from 22.5% to 15.3%. The company remains debt-free for the last five years and boasts a price-to-earnings ratio of 12.2x, which is favorable compared to Turkey's market average of 21.6x. Recent earnings reports highlight significant improvements with net income reaching TRY1,309 million in Q2 from TRY152 million last year; however, it was recently dropped from the S&P Global BMI Index.

- Navigate through the intricacies of Ray Sigorta Anonim Sirketi with our comprehensive health report here.

Gain insights into Ray Sigorta Anonim Sirketi's past trends and performance with our Past report.

National Agricultural Development (SASE:6010)

Simply Wall St Value Rating: ★★★★★★

Overview: The National Agricultural Development Company operates in the production of agricultural and livestock products both within Saudi Arabia and internationally, with a market capitalization of SAR6.67 billion.

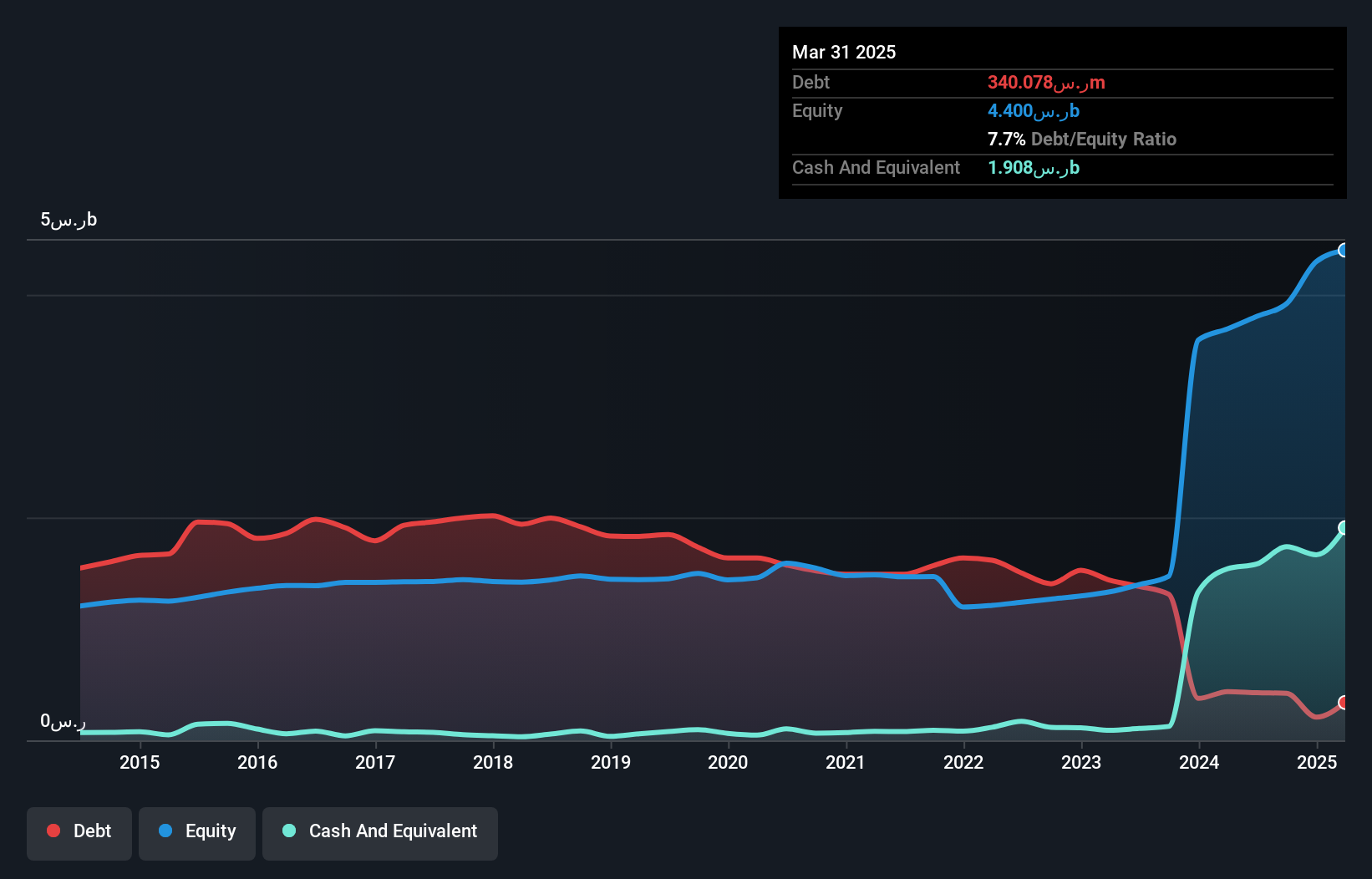

Operations: The company's primary revenue streams include Dairy and Food at SAR3.07 billion, followed by Agriculture at SAR245.54 million, and Protein at SAR242.15 million.

National Agricultural Development Company, a promising player in the Middle East's agricultural sector, reported a solid financial performance with earnings growing by 89% over the past year, outpacing the industry's 4.1%. The company's debt to equity ratio impressively decreased from 98.9% to 6.2% over five years, reflecting prudent financial management. Recent earnings showed sales of SAR 830 million for Q2 and net income of SAR 115 million, slightly up from last year. Despite these gains, future challenges loom with expected earnings declines averaging 9.1% annually over the next three years due to large one-off items impacting results.

Summing It All Up

- Embark on your investment journey to our 207 Middle Eastern Undiscovered Gems With Strong Fundamentals selection here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if National Agricultural Development might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SASE:6010

National Agricultural Development

Engages in the production of agricultural and livestock products in the Kingdom of Saudi Arabia and internationally.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives