- Saudi Arabia

- /

- Oil and Gas

- /

- SASE:2380

Market Cool On Rabigh Refining and Petrochemical Company's (TADAWUL:2380) Revenues

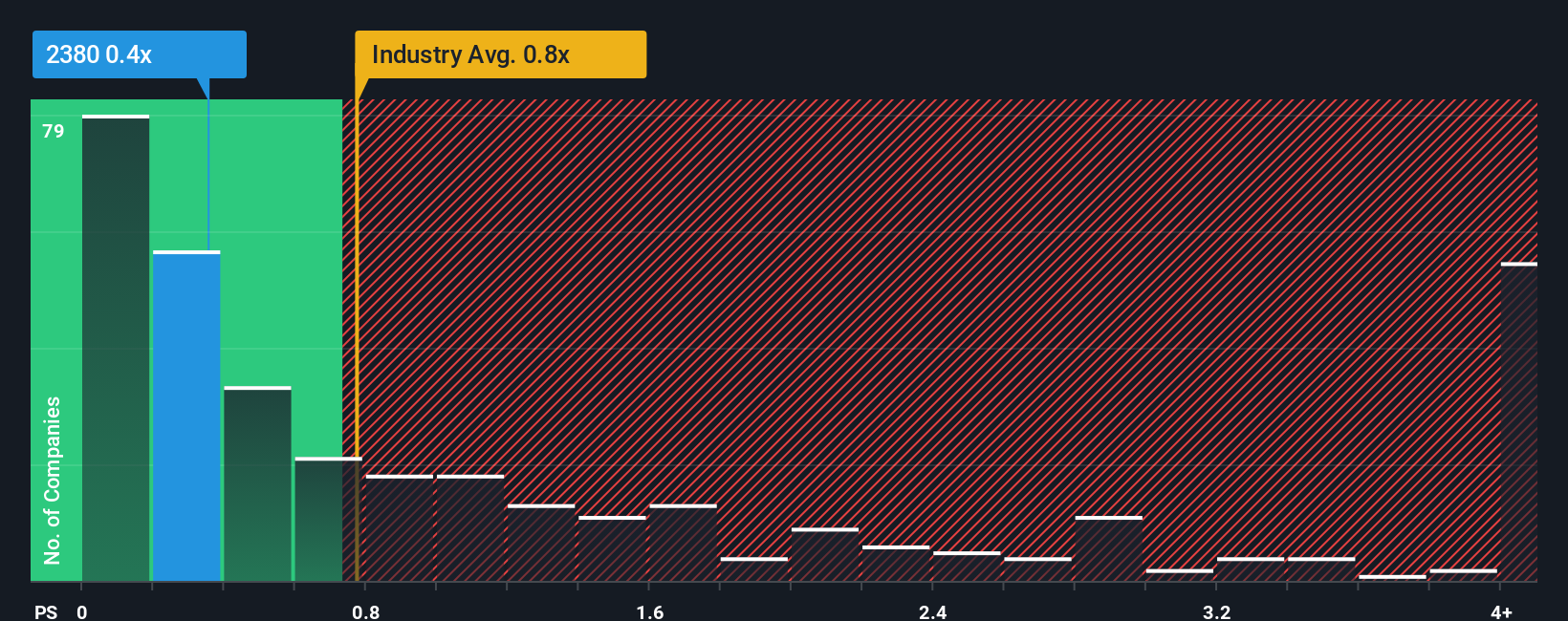

It's not a stretch to say that Rabigh Refining and Petrochemical Company's (TADAWUL:2380) price-to-sales (or "P/S") ratio of 0.4x right now seems quite "middle-of-the-road" for companies in the Oil and Gas industry in Saudi Arabia, where the median P/S ratio is around 0.8x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Check out our latest analysis for Rabigh Refining and Petrochemical

What Does Rabigh Refining and Petrochemical's P/S Mean For Shareholders?

Recent times haven't been great for Rabigh Refining and Petrochemical as its revenue has been falling quicker than most other companies. It might be that many expect the dismal revenue performance to revert back to industry averages soon, which has kept the P/S from falling. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value. Or at the very least, you'd be hoping it doesn't keep underperforming if your plan is to pick up some stock while it's not in favour.

Keen to find out how analysts think Rabigh Refining and Petrochemical's future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The P/S Ratio?

The only time you'd be comfortable seeing a P/S like Rabigh Refining and Petrochemical's is when the company's growth is tracking the industry closely.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 9.9%. The last three years don't look nice either as the company has shrunk revenue by 35% in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Turning to the outlook, the next year should demonstrate some strength in company's business, generating growth of 1.3% as estimated by the only analyst watching the company. This isn't typically strong growth, but with the rest of the industry predicted to shrink by 4.3%, that would be a solid result.

Even though the growth is only slight, it's peculiar that Rabigh Refining and Petrochemical's P/S sits in line with the majority of other companies given the industry is set for a decline. It looks like most investors aren't convinced the company can achieve positive future growth in the face of a shrinking broader industry.

What We Can Learn From Rabigh Refining and Petrochemical's P/S?

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We note that even though Rabigh Refining and Petrochemical trades at a similar P/S as the rest of the industry, it far eclipses them in terms of forecasted revenue growth. We assume that investors are attributing some risk to the company's future revenues, keeping it from trading at a higher P/S. One such risk is that the company may not live up to analysts' revenue trajectories in tough industry conditions. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

Having said that, be aware Rabigh Refining and Petrochemical is showing 1 warning sign in our investment analysis, you should know about.

If these risks are making you reconsider your opinion on Rabigh Refining and Petrochemical, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SASE:2380

Rabigh Refining and Petrochemical

Engages in the development, construction, and operation of an integrated refining and petrochemical complex in the Middle East, the Asia Pacific, and internationally.

Fair value with moderate growth potential.

Market Insights

Community Narratives