- Saudi Arabia

- /

- Capital Markets

- /

- SASE:4084

Exploring Middle East's Hidden Gems Including 3 Promising Small Caps with Solid Potential

Reviewed by Simply Wall St

The Middle East stock markets have recently shown mixed performance amid global trade tensions, with indices such as Dubai's experiencing declines while Saudi Arabia's saw slight gains. In this environment, identifying promising small-cap stocks requires a focus on companies with strong fundamentals and resilience to external economic pressures, making them potential hidden gems in the region.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Sure Global Tech | NA | 13.90% | 18.91% | ★★★★★★ |

| Nofoth Food Products | NA | 14.41% | 31.88% | ★★★★★★ |

| MOBI Industry | 6.50% | 5.60% | 24.00% | ★★★★★★ |

| Baazeem Trading | 6.93% | -1.88% | -2.38% | ★★★★★★ |

| National Corporation for Tourism and Hotels | 15.77% | -3.48% | -12.95% | ★★★★★★ |

| Amanat Holdings PJSC | 12.00% | 34.39% | -9.61% | ★★★★★☆ |

| Malam - Team | 91.23% | 12.11% | -6.38% | ★★★★★☆ |

| Y.D. More Investments | 72.96% | 29.63% | 29.48% | ★★★★★☆ |

| C. Mer Industries | 114.92% | 13.32% | 73.44% | ★★★★☆☆ |

| Polyram Plastic Industries | 41.71% | 10.42% | 9.94% | ★★★★☆☆ |

We'll examine a selection from our screener results.

East Pipes Integrated Company for Industry (SASE:1321)

Simply Wall St Value Rating: ★★★★★★

Overview: East Pipes Integrated Company for Industry specializes in the manufacturing and sale of iron and steel pipes, tubes, and hollow shapes in Saudi Arabia, with a market capitalization of SAR4.35 billion.

Operations: East Pipes generates revenue primarily from its Machinery - Pumps segment, amounting to SAR2.15 billion.

East Pipes Integrated Company for Industry, a smaller player in the Middle East's industrial sector, has shown remarkable earnings growth of 281% over the past year, outpacing its industry peers by a significant margin. Its net income for the latest quarter reached SAR 112 million, up from SAR 86 million the previous year. The company's interest payments are comfortably covered with an EBIT coverage ratio of 38 times. Despite recent share price volatility, East Pipes is expanding its production capacity with a new line costing SAR 48 million expected to boost output by an additional 100,000 MTs in coming years.

Derayah Financial (SASE:4084)

Simply Wall St Value Rating: ★★★★★★

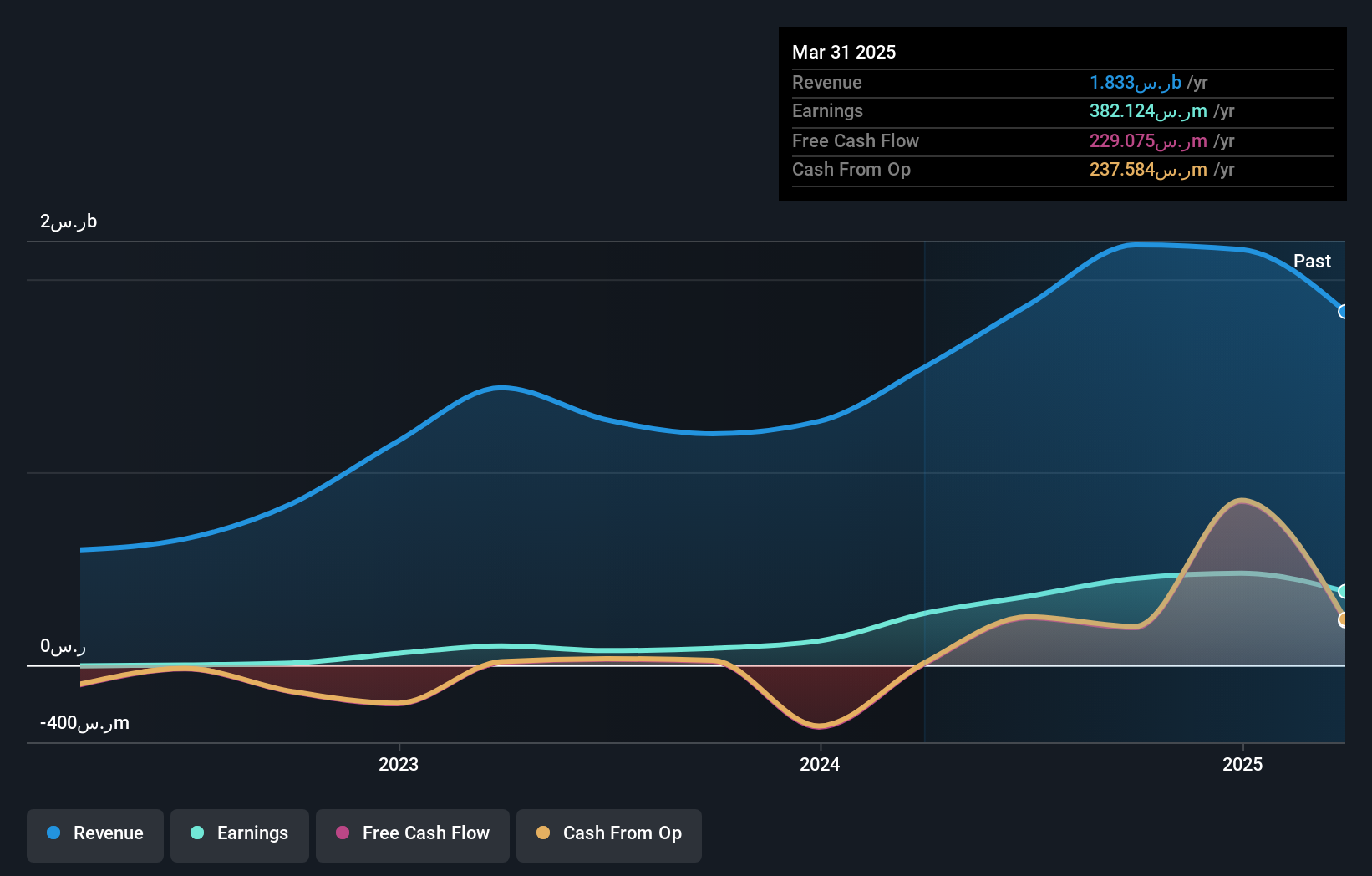

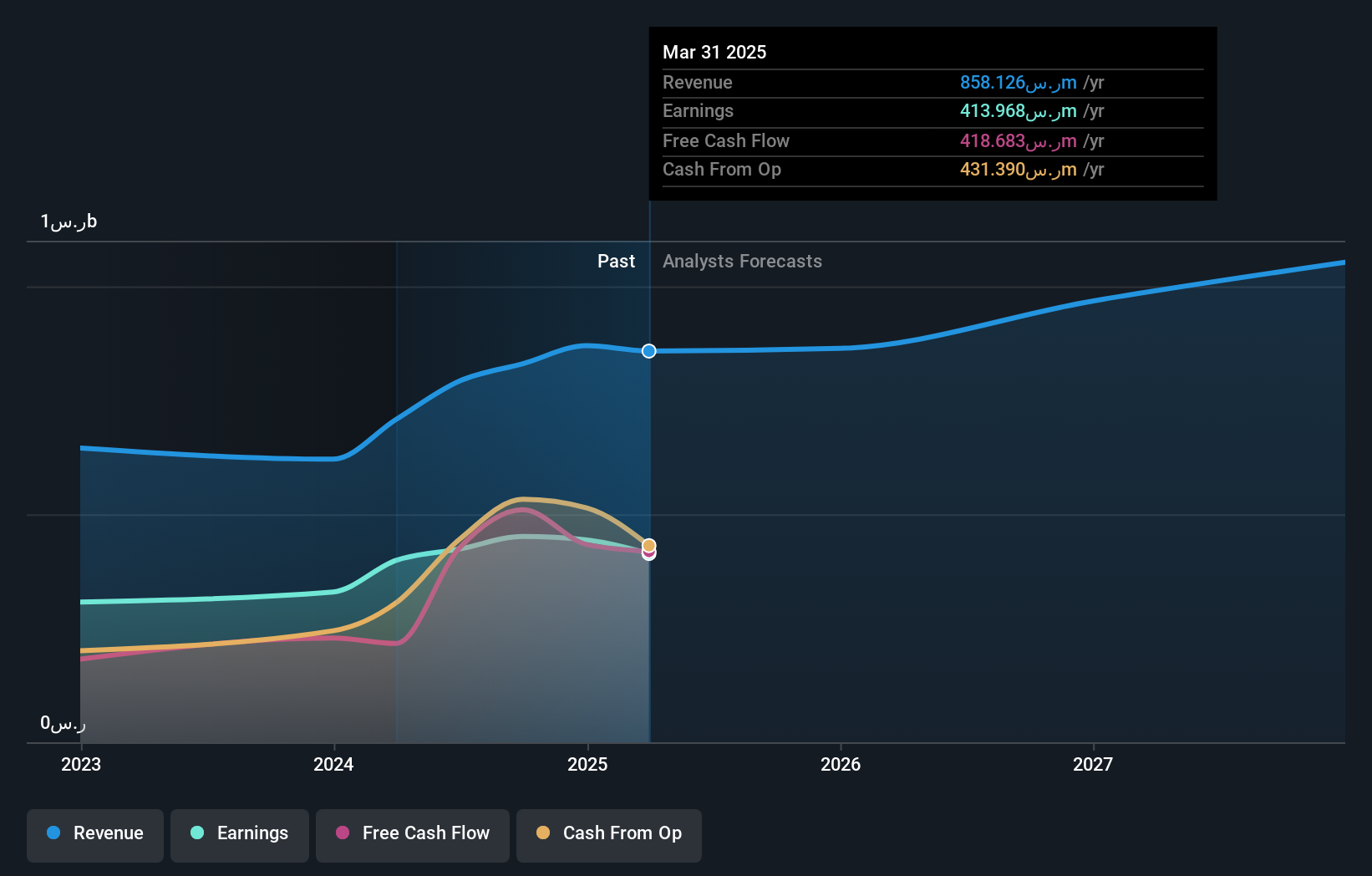

Overview: Derayah Financial Company offers brokerage, advisory, and custody services in Saudi Arabia and internationally, with a market capitalization of SAR7.20 billion.

Operations: The primary revenue streams for Derayah Financial include brokerage services generating SAR689.89 million, asset management contributing SAR144.72 million, and investment activities providing SAR42.06 million. The company's financial performance is significantly driven by its brokerage segment, which accounts for the majority of its income.

Derayah Financial, a promising player in the Middle East financial scene, has showcased impressive growth with earnings rising 34.6% last year, outpacing the industry average of 19.6%. The company reported SAR 443.9 million in net income for 2024, up from SAR 329.7 million the previous year, and completed an IPO raising SAR 1.5 billion at a price of SAR 30 per share. With a price-to-earnings ratio of 16x compared to the SA market's average of 22x and no debt on its books for five years now, Derayah seems well-positioned within its sector despite highly illiquid shares.

- Navigate through the intricacies of Derayah Financial with our comprehensive health report here.

Assess Derayah Financial's past performance with our detailed historical performance reports.

One Software Technologies (TASE:ONE)

Simply Wall St Value Rating: ★★★★★★

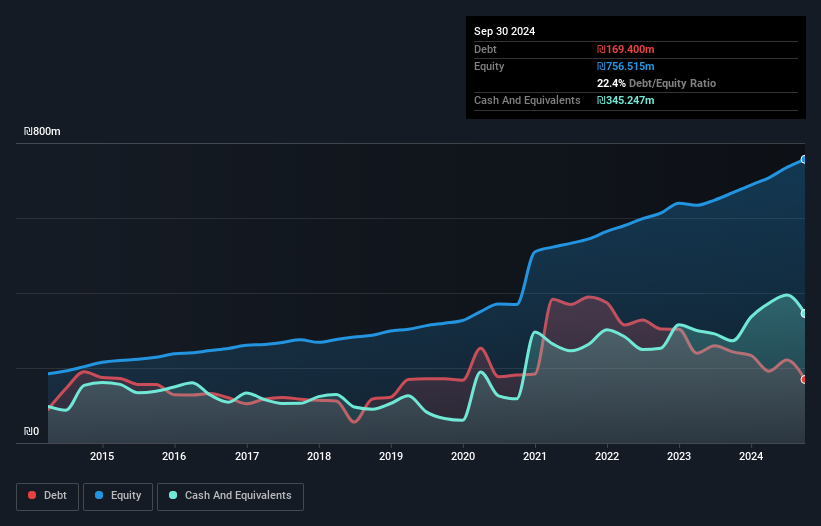

Overview: One Software Technologies Ltd offers a range of software, hardware, and integration services with a market capitalization of approximately ₪5.11 billion.

Operations: One Software Technologies Ltd generates revenue primarily from three segments: Infrastructure and Computing Solutions (₪1.22 billion), Outsourcing of Business Processes and Technological Support Centers (₪316.01 million), and Technological Solutions and Services, Management Consulting, and Value-Added Services (₪2.49 billion). The company's net profit margin is a key financial metric to consider when analyzing its profitability trends over time.

One Software Technologies, a dynamic player in the IT sector, has seen its earnings grow by 26.5% over the past year, outpacing the industry average of 24.5%. The company boasts a strong balance sheet with cash exceeding total debt and a reduced debt-to-equity ratio from 51.2% to 24.8% over five years. Its interest payments are comfortably covered by EBIT at 23.5 times coverage, indicating financial stability. Trading at an attractive valuation of 8.3% below estimated fair value, ONE also reported improved net income of ILS230 million for 2024 compared to ILS182 million the previous year, showcasing robust profitability and growth potential in its market segment.

Taking Advantage

- Delve into our full catalog of 243 Middle Eastern Undiscovered Gems With Strong Fundamentals here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SASE:4084

Derayah Financial

Provides brokerage, advisory, and custody services in the Kingdom of Saudi Arabia and internationally.

Flawless balance sheet with acceptable track record.

Market Insights

Community Narratives