- Saudi Arabia

- /

- Hospitality

- /

- SASE:1810

Recent 3.7% pullback isn't enough to hurt long-term Seera Holding Group (TADAWUL:1810) shareholders, they're still up 24% over 3 years

One simple way to benefit from the stock market is to buy an index fund. But if you pick the right individual stocks, you could make more than that. For example, the Seera Holding Group (TADAWUL:1810) share price is up 24% in the last three years, clearly besting the market decline of around 0.8% (not including dividends).

Although Seera Holding Group has shed ر.س237m from its market cap this week, let's take a look at its longer term fundamental trends and see if they've driven returns.

Check out our latest analysis for Seera Holding Group

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

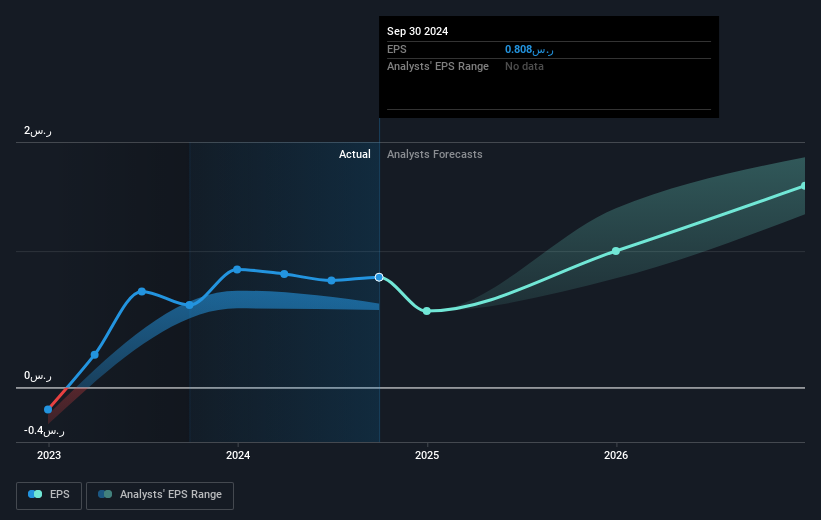

During three years of share price growth, Seera Holding Group moved from a loss to profitability. So we would expect a higher share price over the period.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

It is of course excellent to see how Seera Holding Group has grown profits over the years, but the future is more important for shareholders. This free interactive report on Seera Holding Group's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

We regret to report that Seera Holding Group shareholders are down 7.9% for the year. Unfortunately, that's worse than the broader market decline of 3.2%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. On the bright side, long term shareholders have made money, with a gain of 3% per year over half a decade. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. To that end, you should be aware of the 1 warning sign we've spotted with Seera Holding Group .

If you are like me, then you will not want to miss this free list of undervalued small caps that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Saudi exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SASE:1810

Seera Holding Group

Provides travel and tourism services in the Kingdom of Saudi Arabia, the United Kingdom, Egypt, the United Arab Emirates, Spain, and Kuwait.

Reasonable growth potential and fair value.

Market Insights

Community Narratives