As 2024 draws to a close, global markets have experienced a mixed bag of results, with U.S. indices showing moderate gains despite declining consumer confidence and manufacturing activity. Amid these broader economic shifts, investors continue to seek opportunities that may offer growth potential beyond traditional large-cap stocks. Though the term 'penny stock' might sound like a relic of past trading days, it remains relevant for those looking to explore smaller or newer companies with solid financials that can lead to significant returns. This article will highlight three penny stocks that combine balance sheet strength with potential for outsized gains, offering investors the chance to discover hidden value in quality companies.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.51 | MYR2.54B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.77 | A$140.36M | ★★★★☆☆ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.42 | MYR1.17B | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.90 | MYR298.75M | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$3.92 | HK$43.17B | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.57 | A$65.64M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.86 | HK$545.92M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.976 | £153.96M | ★★★★★★ |

| Stelrad Group (LSE:SRAD) | £1.42 | £180.84M | ★★★★★☆ |

| Secure Trust Bank (LSE:STB) | £3.55 | £67.7M | ★★★★☆☆ |

Click here to see the full list of 5,815 stocks from our Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Al Khaleej Investment P.J.S.C (ADX:KICO)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Al Khaleej Investment P.J.S.C. is a real estate and investment company based in the United Arab Emirates, with a market capitalization of AED498.75 million.

Operations: The company generates revenue primarily from its real estate segment, amounting to AED17.43 million.

Market Cap: AED498.75M

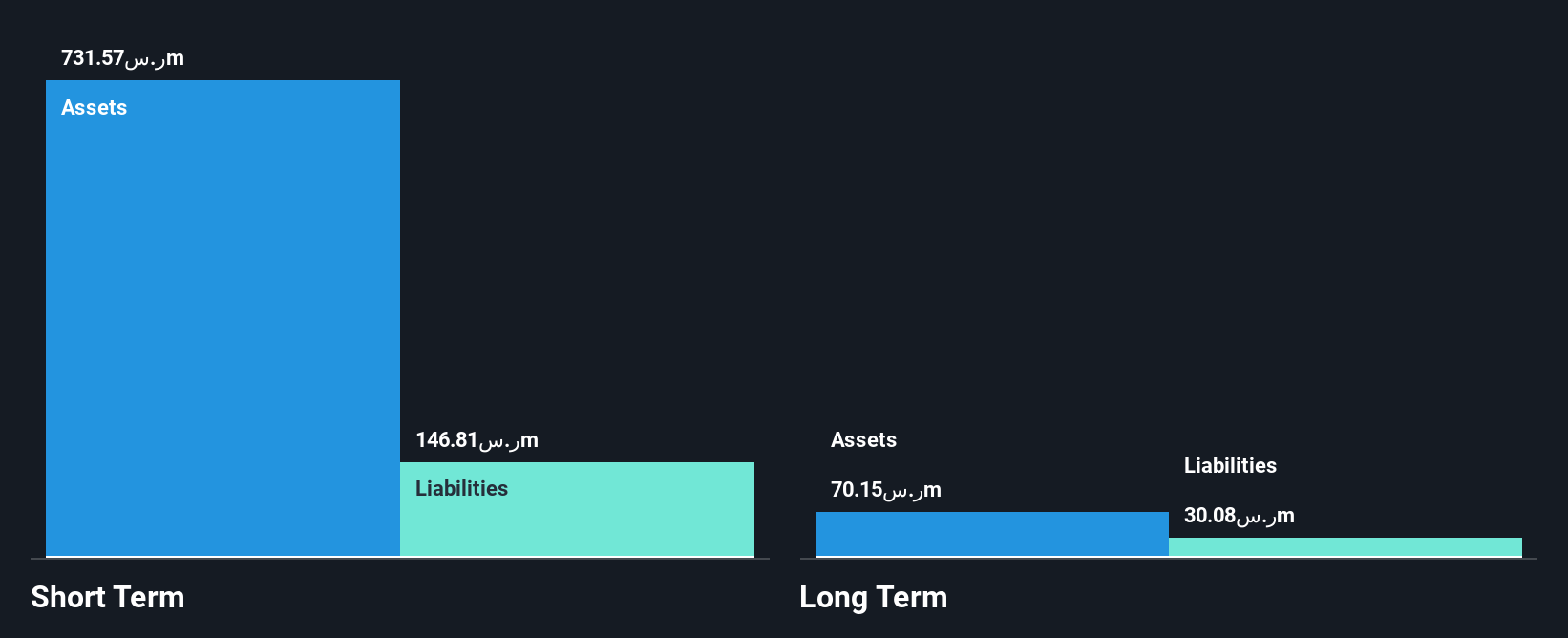

Al Khaleej Investment P.J.S.C. has demonstrated a significant improvement in net income, reporting AED 6.88 million for Q3 2024 compared to AED 2.86 million the previous year, despite having no debt and a low return on equity of 4.2%. The company's short-term assets significantly exceed both its short and long-term liabilities, indicating strong financial stability. However, its earnings growth of 28.2% over the past year lags behind the industry average and is below its five-year average growth rate of 63.6%. Recent results were bolstered by a large one-off gain impacting overall earnings quality.

- Click to explore a detailed breakdown of our findings in Al Khaleej Investment P.J.S.C's financial health report.

- Understand Al Khaleej Investment P.J.S.C's track record by examining our performance history report.

Thob Al Aseel (SASE:4012)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Thob Al Aseel Company engages in the development, import, export, wholesale, and retail of fabrics and readymade clothes with a market cap of SAR1.70 billion.

Operations: The company generates revenue primarily from Thobs, accounting for SAR391.02 million, and Fabrics, contributing SAR120.65 million.

Market Cap: SAR1.7B

Thob Al Aseel Company, with a market cap of SAR1.70 billion, has shown consistent revenue generation primarily from Thobs and Fabrics. Recent earnings for Q3 2024 indicated sales of SAR78.56 million and net income of SAR5.59 million, reflecting modest growth compared to the previous year. The company benefits from being debt-free and has strong short-term asset coverage over liabilities, enhancing financial stability. Despite a low return on equity at 14.4%, profit margins have improved to 16.4%, surpassing last year's figures and industry growth rates, suggesting potential value trading below estimated fair value by 16.8%.

- Navigate through the intricacies of Thob Al Aseel with our comprehensive balance sheet health report here.

- Evaluate Thob Al Aseel's historical performance by accessing our past performance report.

Hong Leong Asia (SGX:H22)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Hong Leong Asia Ltd. is an investment holding company that manufactures and distributes powertrain solutions, building materials, and rigid packaging products across China, Singapore, Malaysia, and internationally with a market cap of SGD706.84 million.

Operations: The company generates revenue primarily from its Powertrain Solutions segment, amounting to SGD3.57 billion, and Building Materials segment, contributing SGD665.81 million.

Market Cap: SGD706.84M

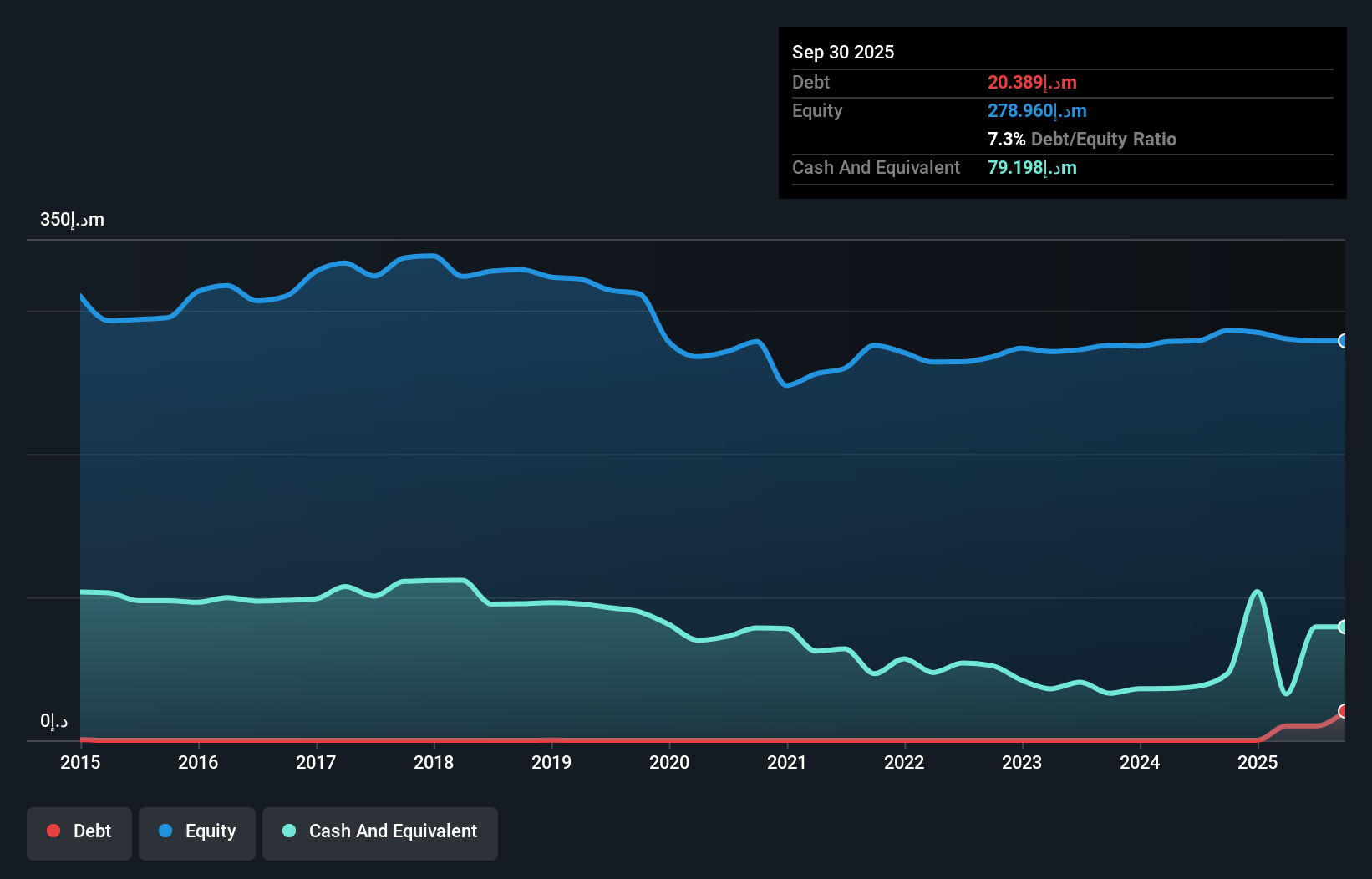

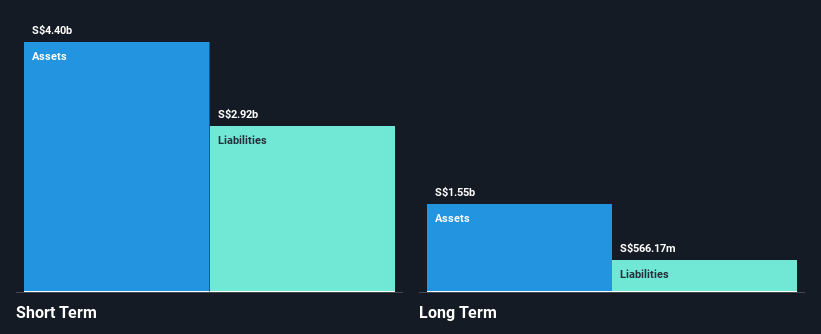

Hong Leong Asia Ltd., with a market cap of S$706.84 million, demonstrates significant revenue streams from its Powertrain Solutions and Building Materials segments. The company is trading at a substantial discount to its estimated fair value, indicating potential undervaluation in the penny stock space. Recent profit growth has been robust, with earnings surging by 94.4% over the past year, outpacing both its historical average and industry benchmarks. Financially sound, it maintains more cash than debt and covers interest payments comfortably through EBIT. The board's recent appointment of Ng Chee Khern suggests strengthened governance focus on sustainability initiatives.

- Get an in-depth perspective on Hong Leong Asia's performance by reading our balance sheet health report here.

- Explore Hong Leong Asia's analyst forecasts in our growth report.

Turning Ideas Into Actions

- Dive into all 5,815 of the Penny Stocks we have identified here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hong Leong Asia might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:H22

Hong Leong Asia

An investment holding company, manufactures and distributes powertrain solutions and related products, building materials, and rigid packaging products in the People’s Republic of China, Singapore, Malaysia, and internationally.

Very undervalued with solid track record.

Market Insights

Community Narratives