- Saudi Arabia

- /

- Professional Services

- /

- SASE:1834

Is Saudi Manpower Solutions Company's (TADAWUL:1834) Recent Price Movement Underpinned By Its Weak Fundamentals?

With its stock down 9.5% over the past three months, it is easy to disregard Saudi Manpower Solutions (TADAWUL:1834). It is possible that the markets have ignored the company's differing financials and decided to lean-in to the negative sentiment. Long-term fundamentals are usually what drive market outcomes, so it's worth paying close attention. Specifically, we decided to study Saudi Manpower Solutions' ROE in this article.

Return on equity or ROE is a key measure used to assess how efficiently a company's management is utilizing the company's capital. Simply put, it is used to assess the profitability of a company in relation to its equity capital.

See our latest analysis for Saudi Manpower Solutions

How Is ROE Calculated?

The formula for return on equity is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Saudi Manpower Solutions is:

25% = ر.س148m ÷ ر.س580m (Based on the trailing twelve months to September 2024).

The 'return' is the profit over the last twelve months. One way to conceptualize this is that for each SAR1 of shareholders' capital it has, the company made SAR0.25 in profit.

What Has ROE Got To Do With Earnings Growth?

So far, we've learned that ROE is a measure of a company's profitability. We now need to evaluate how much profit the company reinvests or "retains" for future growth which then gives us an idea about the growth potential of the company. Assuming everything else remains unchanged, the higher the ROE and profit retention, the higher the growth rate of a company compared to companies that don't necessarily bear these characteristics.

Saudi Manpower Solutions' Earnings Growth And 25% ROE

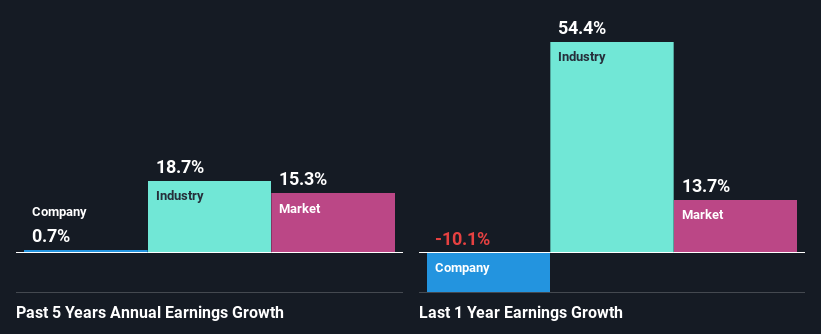

To begin with, Saudi Manpower Solutions seems to have a respectable ROE. And on comparing with the industry, we found that the the average industry ROE is similar at 25%. Despite this, Saudi Manpower Solutions' five year net income growth was quite flat over the past five years. Based on this, we feel that there might be other reasons which haven't been discussed so far in this article that could be hampering the company's growth. For example, it could be that the company has a high payout ratio or the business has allocated capital poorly, for instance.

Next, on comparing with the industry net income growth, we found that Saudi Manpower Solutions' reported growth was lower than the industry growth of 19% over the last few years, which is not something we like to see.

Earnings growth is a huge factor in stock valuation. The investor should try to establish if the expected growth or decline in earnings, whichever the case may be, is priced in. Doing so will help them establish if the stock's future looks promising or ominous. If you're wondering about Saudi Manpower Solutions''s valuation, check out this gauge of its price-to-earnings ratio, as compared to its industry.

Is Saudi Manpower Solutions Efficiently Re-investing Its Profits?

Saudi Manpower Solutions' very high three-year median payout ratio of 108% suggests that the company is paying its shareholders more than what it is earning. The absence in growth is therefore not surprising. Paying a dividend higher than reported profits is not a sustainable move. This is indicative of risk. Our risks dashboard should have the 2 risks we have identified for Saudi Manpower Solutions.

Only recently, Saudi Manpower Solutions started paying a dividend. This means that the management might have concluded that its shareholders prefer dividends over earnings growth.

Summary

Overall, we have mixed feelings about Saudi Manpower Solutions. In spite of the high ROE, the company has failed to see growth in its earnings due to it paying out most of its profits as dividend, with almost nothing left to invest into its own business. Until now, we have only just grazed the surface of the company's past performance by looking at the company's fundamentals. So it may be worth checking this free detailed graph of Saudi Manpower Solutions' past earnings, as well as revenue and cash flows to get a deeper insight into the company's performance.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SASE:1834

Saudi Manpower Solutions

Provides recruitment, manpower, and logistics services and support solutions to workers, government, and private sectors in the Kingdom of Saudi Arabia.

Flawless balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives